Loss harvesting involves strategically selling investments at a loss to offset capital gains and reduce tax liability, while charitable giving allows donors to support causes and potentially receive tax deductions. Both strategies can optimize financial outcomes by leveraging tax benefits tailored to individual circumstances. Discover how combining loss harvesting with charitable giving can enhance your tax planning and philanthropy goals.

Why it is important

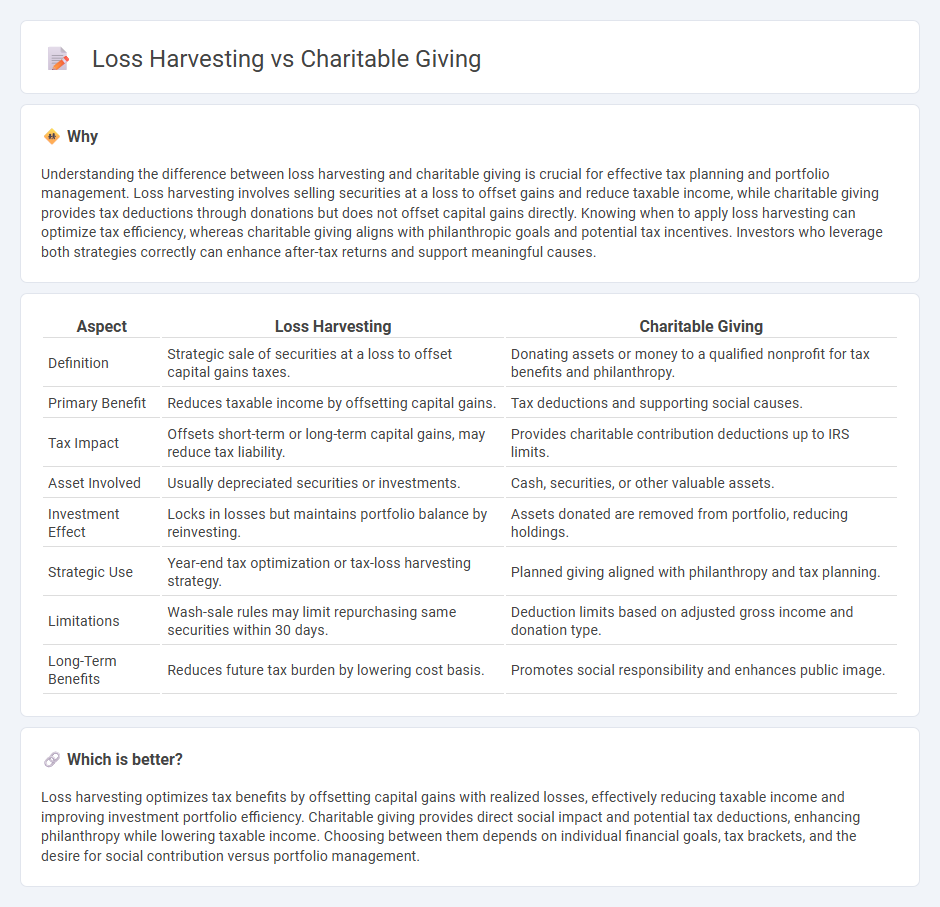

Understanding the difference between loss harvesting and charitable giving is crucial for effective tax planning and portfolio management. Loss harvesting involves selling securities at a loss to offset gains and reduce taxable income, while charitable giving provides tax deductions through donations but does not offset capital gains directly. Knowing when to apply loss harvesting can optimize tax efficiency, whereas charitable giving aligns with philanthropic goals and potential tax incentives. Investors who leverage both strategies correctly can enhance after-tax returns and support meaningful causes.

Comparison Table

| Aspect | Loss Harvesting | Charitable Giving |

|---|---|---|

| Definition | Strategic sale of securities at a loss to offset capital gains taxes. | Donating assets or money to a qualified nonprofit for tax benefits and philanthropy. |

| Primary Benefit | Reduces taxable income by offsetting capital gains. | Tax deductions and supporting social causes. |

| Tax Impact | Offsets short-term or long-term capital gains, may reduce tax liability. | Provides charitable contribution deductions up to IRS limits. |

| Asset Involved | Usually depreciated securities or investments. | Cash, securities, or other valuable assets. |

| Investment Effect | Locks in losses but maintains portfolio balance by reinvesting. | Assets donated are removed from portfolio, reducing holdings. |

| Strategic Use | Year-end tax optimization or tax-loss harvesting strategy. | Planned giving aligned with philanthropy and tax planning. |

| Limitations | Wash-sale rules may limit repurchasing same securities within 30 days. | Deduction limits based on adjusted gross income and donation type. |

| Long-Term Benefits | Reduces future tax burden by lowering cost basis. | Promotes social responsibility and enhances public image. |

Which is better?

Loss harvesting optimizes tax benefits by offsetting capital gains with realized losses, effectively reducing taxable income and improving investment portfolio efficiency. Charitable giving provides direct social impact and potential tax deductions, enhancing philanthropy while lowering taxable income. Choosing between them depends on individual financial goals, tax brackets, and the desire for social contribution versus portfolio management.

Connection

Loss harvesting in finance involves selling securities at a loss to offset capital gains, reducing taxable income. Charitable giving can complement this strategy by donating appreciated assets, maximizing tax deductions while supporting philanthropic causes. Combining loss harvesting with charitable contributions enhances tax efficiency and optimizes portfolio management.

Key Terms

Tax Deduction

Charitable giving allows taxpayers to claim deductions for donations made to qualified organizations, lowering taxable income and potentially reducing overall tax liability. Loss harvesting involves selling securities at a loss to offset capital gains, which can also provide tax benefits by decreasing taxable income. Explore detailed strategies to maximize your tax deductions through charitable giving and loss harvesting.

Capital Gains

Charitable giving allows investors to donate appreciated assets directly to a qualified nonprofit, avoiding capital gains taxes and receiving a charitable deduction, effectively reducing taxable income. Loss harvesting involves selling investments at a loss to offset realized capital gains, thereby minimizing current tax liability and optimizing portfolio tax efficiency. Explore detailed strategies to maximize tax benefits while supporting your financial goals.

Fair Market Value

Charitable giving allows donors to deduct the fair market value of appreciated assets, maximizing tax benefits while supporting nonprofit causes. Loss harvesting involves selling securities at a loss to offset capital gains, leveraging the asset's current market value to reduce tax liability. Explore the nuances of fair market value in both strategies to optimize your tax planning and philanthropic impact.

Source and External Links

What is Charitable Giving? - NPT UK - Charitable giving involves donating money, time, or goods to create positive change and support community well-being regardless of wealth or status.

Charitable Planning Guide - In the U.S., charitable giving is a longstanding tradition with Americans donating over $400 billion annually, benefiting both recipients and donors through tax advantages and personal fulfillment.

Charitable Giving Coalition - The Charitable Giving Coalition advocates for preserving and expanding the charitable tax deduction which incentivizes donations crucial to community services and nonprofit support.

dowidth.com

dowidth.com