Tax loss harvesting involves selling investments at a loss to offset capital gains taxes, enhancing portfolio efficiency and reducing tax liability. Donor-advised funds allow charitable giving with immediate tax deductions while enabling grant distributions over time, offering strategic philanthropic flexibility. Explore the benefits and strategies of tax loss harvesting versus donor-advised funds to optimize your financial planning.

Why it is important

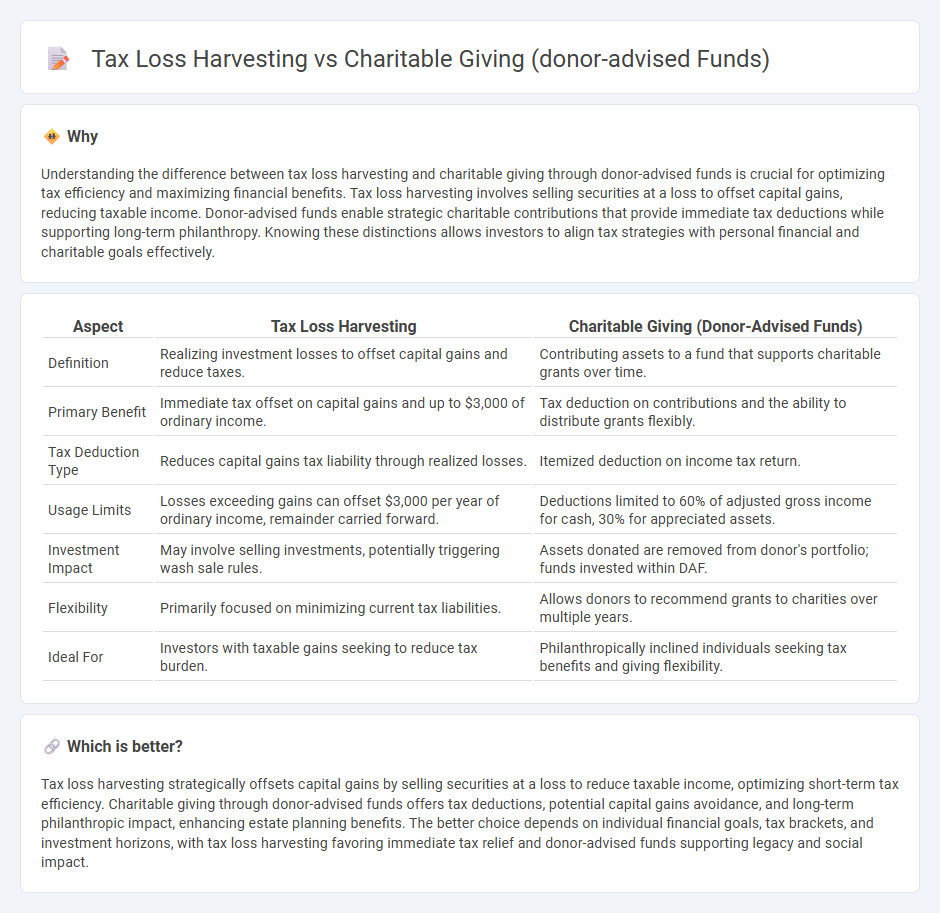

Understanding the difference between tax loss harvesting and charitable giving through donor-advised funds is crucial for optimizing tax efficiency and maximizing financial benefits. Tax loss harvesting involves selling securities at a loss to offset capital gains, reducing taxable income. Donor-advised funds enable strategic charitable contributions that provide immediate tax deductions while supporting long-term philanthropy. Knowing these distinctions allows investors to align tax strategies with personal financial and charitable goals effectively.

Comparison Table

| Aspect | Tax Loss Harvesting | Charitable Giving (Donor-Advised Funds) |

|---|---|---|

| Definition | Realizing investment losses to offset capital gains and reduce taxes. | Contributing assets to a fund that supports charitable grants over time. |

| Primary Benefit | Immediate tax offset on capital gains and up to $3,000 of ordinary income. | Tax deduction on contributions and the ability to distribute grants flexibly. |

| Tax Deduction Type | Reduces capital gains tax liability through realized losses. | Itemized deduction on income tax return. |

| Usage Limits | Losses exceeding gains can offset $3,000 per year of ordinary income, remainder carried forward. | Deductions limited to 60% of adjusted gross income for cash, 30% for appreciated assets. |

| Investment Impact | May involve selling investments, potentially triggering wash sale rules. | Assets donated are removed from donor's portfolio; funds invested within DAF. |

| Flexibility | Primarily focused on minimizing current tax liabilities. | Allows donors to recommend grants to charities over multiple years. |

| Ideal For | Investors with taxable gains seeking to reduce tax burden. | Philanthropically inclined individuals seeking tax benefits and giving flexibility. |

Which is better?

Tax loss harvesting strategically offsets capital gains by selling securities at a loss to reduce taxable income, optimizing short-term tax efficiency. Charitable giving through donor-advised funds offers tax deductions, potential capital gains avoidance, and long-term philanthropic impact, enhancing estate planning benefits. The better choice depends on individual financial goals, tax brackets, and investment horizons, with tax loss harvesting favoring immediate tax relief and donor-advised funds supporting legacy and social impact.

Connection

Tax loss harvesting strategically realizes investment losses to offset capital gains, optimizing tax liabilities. Charitable giving through donor-advised funds allows donors to contribute appreciated assets, receiving immediate tax deductions while enabling tax-efficient portfolio rebalancing. Combining these approaches enhances tax efficiency by reducing taxable income and maximizing philanthropic impact.

Key Terms

Qualified Charitable Contribution

Qualified Charitable Contributions (QCCs) made through donor-advised funds offer immediate tax deductions while enabling strategic philanthropic impact, contrasting with tax loss harvesting, which primarily minimizes capital gains taxes by offsetting investment losses. QCCs allow taxpayers to donate appreciated assets directly, avoiding capital gains taxes and maximizing charitable impact, whereas tax loss harvesting focuses on tax efficiency within investment portfolios without direct contributions to charity. Explore how combining QCCs and tax loss harvesting can optimize both philanthropic goals and tax strategies.

Cost Basis

Donor-advised funds optimize charitable giving by allowing donors to contribute appreciated assets, effectively bypassing capital gains taxes and establishing a higher cost basis with the fund. Tax loss harvesting involves selling investments at a loss to offset capital gains, which resets the cost basis to a lower value, minimizing immediate tax liability but potentially limiting future tax benefits. Explore how strategic use of cost basis adjustments through donor-advised funds and tax loss harvesting can maximize your financial efficiency.

Capital Gains

Donor-advised funds enable charitable giving by allowing donors to contribute appreciated assets, avoiding immediate capital gains taxes and maximizing tax benefits. Tax loss harvesting involves selling securities at a loss to offset capital gains, thereby reducing taxable income in the current tax year. Explore detailed strategies on how donor-advised funds and tax loss harvesting optimize capital gains tax management to enhance your investment portfolio.

Source and External Links

Differences Between Donor-Advised Funds & Charitable Trusts - A donor-advised fund (DAF) is a charitable investment account managed by a sponsoring charity that offers donors immediate tax benefits and the ability to recommend grants to charities over time while the fund grows in value.

What is a Donor-Advised Fund (DAF)? - National Philanthropic Trust - DAFs enable donors to contribute to a public charity, get an immediate tax deduction, and then recommend grants to charities over time, making them a flexible, popular vehicle for philanthropy in the U.S.

What is a Donor-Advised Fund? - Fidelity Charitable - Donor-advised funds are tax-advantageous charitable investment accounts where donors contribute assets to receive an immediate tax deduction and then recommend grants to IRS-qualified public charities whenever they choose.

dowidth.com

dowidth.com