Liability Driven Investing (LDI) focuses on managing assets to meet specific future liabilities, often used by pension funds to ensure obligations are met, while Benchmarked Investing targets outperforming a market index through asset allocation aligned with benchmark composition. LDI emphasizes risk mitigation and cash flow matching, prioritizing the reduction of funding gaps, whereas benchmarked investing seeks alpha through relative performance against a predefined standard. Discover more about how these strategies impact portfolio construction and risk management.

Why it is important

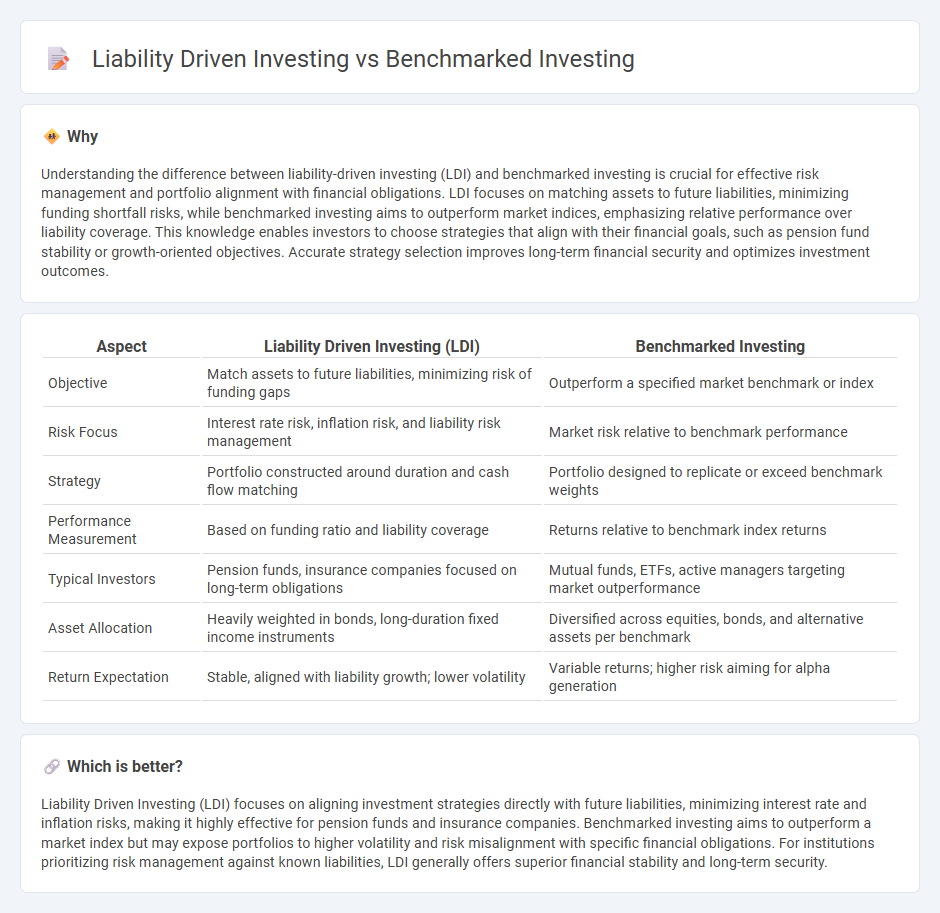

Understanding the difference between liability-driven investing (LDI) and benchmarked investing is crucial for effective risk management and portfolio alignment with financial obligations. LDI focuses on matching assets to future liabilities, minimizing funding shortfall risks, while benchmarked investing aims to outperform market indices, emphasizing relative performance over liability coverage. This knowledge enables investors to choose strategies that align with their financial goals, such as pension fund stability or growth-oriented objectives. Accurate strategy selection improves long-term financial security and optimizes investment outcomes.

Comparison Table

| Aspect | Liability Driven Investing (LDI) | Benchmarked Investing |

|---|---|---|

| Objective | Match assets to future liabilities, minimizing risk of funding gaps | Outperform a specified market benchmark or index |

| Risk Focus | Interest rate risk, inflation risk, and liability risk management | Market risk relative to benchmark performance |

| Strategy | Portfolio constructed around duration and cash flow matching | Portfolio designed to replicate or exceed benchmark weights |

| Performance Measurement | Based on funding ratio and liability coverage | Returns relative to benchmark index returns |

| Typical Investors | Pension funds, insurance companies focused on long-term obligations | Mutual funds, ETFs, active managers targeting market outperformance |

| Asset Allocation | Heavily weighted in bonds, long-duration fixed income instruments | Diversified across equities, bonds, and alternative assets per benchmark |

| Return Expectation | Stable, aligned with liability growth; lower volatility | Variable returns; higher risk aiming for alpha generation |

Which is better?

Liability Driven Investing (LDI) focuses on aligning investment strategies directly with future liabilities, minimizing interest rate and inflation risks, making it highly effective for pension funds and insurance companies. Benchmarked investing aims to outperform a market index but may expose portfolios to higher volatility and risk misalignment with specific financial obligations. For institutions prioritizing risk management against known liabilities, LDI generally offers superior financial stability and long-term security.

Connection

Liability-driven investing (LDI) focuses on aligning asset portfolios with future financial obligations to manage risk and ensure liquidity, often using benchmarks tied to liability profiles. Benchmarked investing provides a performance yardstick by comparing portfolio returns against relevant indices, enabling investors to gauge the effectiveness of their LDI strategies. The integration of LDI with benchmarked investing enhances risk management by ensuring that investment decisions are systematically measured against liability-based benchmarks tailored to specific financial commitments.

Key Terms

Benchmark Index

Benchmark investing revolves around replicating or outperforming a specified benchmark index, such as the S&P 500 or MSCI World, to measure portfolio performance against a market standard. Liability-driven investing (LDI) prioritizes aligning assets with present and future liabilities, focusing on cash flow matching and risk reduction rather than index tracking. Explore further to understand which strategy aligns best with your financial goals and risk tolerance.

Liabilities Matching

Liability Driven Investing (LDI) prioritizes aligning asset strategies directly with an investor's future liabilities, reducing funding gaps and interest rate risk. Benchmarked investing, in contrast, focuses on outperforming a market index without specifically addressing future obligations. Explore how LDI's liability matching mechanisms optimize portfolio resilience for pension funds and insurance companies.

Tracking Error

Benchmarking investing primarily aims to replicate or outperform a specific index, focusing on minimizing tracking error to the benchmark, which ensures portfolio returns closely mirror the targeted index performance. Liability Driven Investing (LDI) emphasizes aligning asset returns with future liabilities, thereby managing tracking error relative to the liabilities rather than a market index. Explore the nuances between benchmarked investing and LDI strategies to optimize your portfolio's risk-return profile.

Source and External Links

Escaping the Benchmark Trap: A Guide for Smarter Investing - Benchmarked investing focuses on outperforming a market index, but this can lead to irrational decisions and misallocation of capital by prioritizing relative performance over absolute returns and risk management.

Playing the Benchmarking Game With Allan Roth - Benchmarking in investing involves comparing portfolio returns to broad, low-fee indices that include US equities, international equities, bonds, real estate, and private equity to objectively measure performance while factoring in risk differences.

Get Off the Bench: A Look at Benchmarks - Benchmarked investing uses market indexes like the S&P 500 to evaluate investment performance, helping investors determine if their returns are outperforming, matching, or lagging a relevant index.

dowidth.com

dowidth.com