Digital asset custody involves specialized technology solutions designed to securely store cryptocurrencies and blockchain-based assets, utilizing cold wallets and multi-signature protocols. Trust company custody offers traditional fiduciary management with regulatory oversight and legal protections for a broader range of financial assets, including digital holdings. Explore the key differences and benefits of each approach to determine the best fit for your asset protection needs.

Why it is important

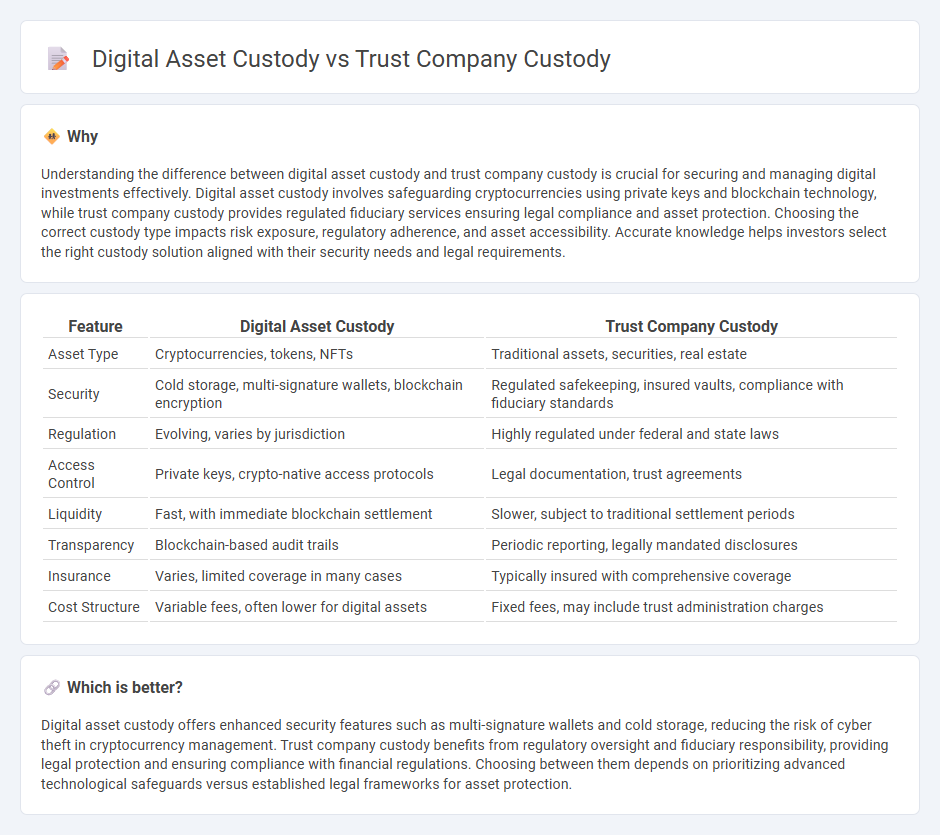

Understanding the difference between digital asset custody and trust company custody is crucial for securing and managing digital investments effectively. Digital asset custody involves safeguarding cryptocurrencies using private keys and blockchain technology, while trust company custody provides regulated fiduciary services ensuring legal compliance and asset protection. Choosing the correct custody type impacts risk exposure, regulatory adherence, and asset accessibility. Accurate knowledge helps investors select the right custody solution aligned with their security needs and legal requirements.

Comparison Table

| Feature | Digital Asset Custody | Trust Company Custody |

|---|---|---|

| Asset Type | Cryptocurrencies, tokens, NFTs | Traditional assets, securities, real estate |

| Security | Cold storage, multi-signature wallets, blockchain encryption | Regulated safekeeping, insured vaults, compliance with fiduciary standards |

| Regulation | Evolving, varies by jurisdiction | Highly regulated under federal and state laws |

| Access Control | Private keys, crypto-native access protocols | Legal documentation, trust agreements |

| Liquidity | Fast, with immediate blockchain settlement | Slower, subject to traditional settlement periods |

| Transparency | Blockchain-based audit trails | Periodic reporting, legally mandated disclosures |

| Insurance | Varies, limited coverage in many cases | Typically insured with comprehensive coverage |

| Cost Structure | Variable fees, often lower for digital assets | Fixed fees, may include trust administration charges |

Which is better?

Digital asset custody offers enhanced security features such as multi-signature wallets and cold storage, reducing the risk of cyber theft in cryptocurrency management. Trust company custody benefits from regulatory oversight and fiduciary responsibility, providing legal protection and ensuring compliance with financial regulations. Choosing between them depends on prioritizing advanced technological safeguards versus established legal frameworks for asset protection.

Connection

Digital asset custody and trust company custody intersect through secure asset management frameworks designed to protect client holdings. Trust companies incorporate advanced cryptographic technology and regulatory compliance protocols to safeguard digital assets, ensuring legal ownership and fiduciary responsibility. This integration enhances transparency, risk mitigation, and asset accessibility within the evolving financial ecosystem.

Key Terms

Fiduciary responsibility

Trust company custody involves regulated fiduciary responsibility, ensuring clients' assets are managed with a legal duty of care, loyalty, and prudence under state laws such as the Uniform Trust Code. Digital asset custody in blockchain environments requires specialized security protocols, including multi-signature wallets and cold storage, to safeguard cryptographic keys but may lack standardized fiduciary frameworks. Explore the nuances of fiduciary responsibilities in digital versus traditional trust company custody for informed asset protection strategies.

Cold storage

Trust company custody typically utilizes insured cold storage solutions, prioritizing regulatory compliance and secure, offline asset protection with multi-signature access controls. Digital asset custody often involves decentralized cold storage methods like hardware wallets or air-gapped devices, emphasizing cryptographic security and user control without intermediaries. Explore the differences in custody models to determine the best fit for your asset security needs.

Regulatory compliance

Trust company custody involves regulated financial institutions adhering to stringent compliance standards under federal and state laws, ensuring asset protection through established fiduciary responsibilities. Digital asset custody requires specialized frameworks to meet evolving regulatory guidelines, including AML/KYC protocols and cybersecurity mandates tailored to blockchain and cryptocurrency transactions. Explore how these distinct approaches address regulatory challenges in safeguarding assets.

Source and External Links

Trust & Custody Services | First State Trust - First State Trust acts as a directed corporate trustee and custodian for various institutional clients, offering comprehensive fiduciary management, custody services including domestic and global custody, specialized accounting and reporting, and escrow transaction administration.

Trust & Custody Services - Ascensus - Ascensus provides integrated trust and custodial services tailored to both qualified and nonqualified employee benefit plans, focusing on asset protection, plan administration, disbursement services, and abandoned plan termination solutions.

Custody | SEI U.S. - SEI Private Trust Company offers custody services emphasizing asset segregation by keeping client money separate from firm assets, integrated technology for accountability, and robust cybersecurity to safeguard client assets.

dowidth.com

dowidth.com