Synthetic risk transfer allows financial institutions to manage credit risk by using derivatives to transfer specific risk exposures without selling the underlying assets. Total return swaps involve exchanging the total economic performance of a reference asset, including income and capital gains, between two parties, providing synthetic exposure and risk management. Explore how these instruments enhance portfolio efficiency and risk mitigation strategies.

Why it is important

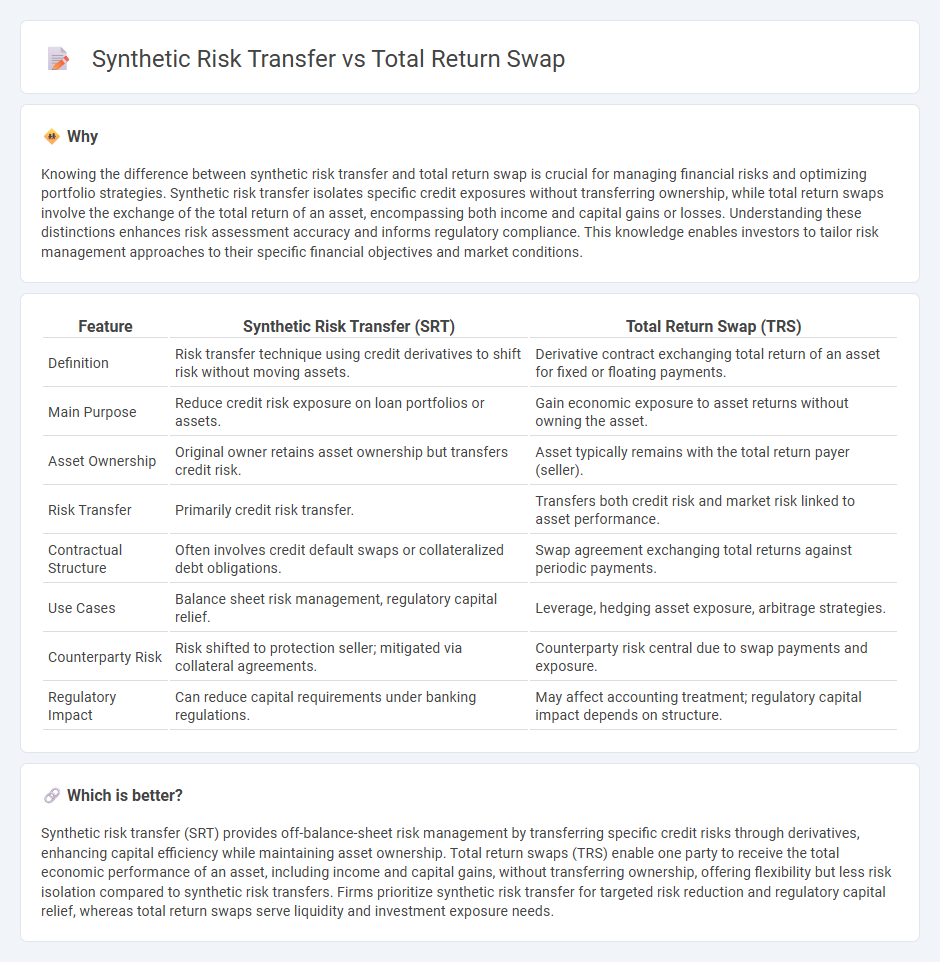

Knowing the difference between synthetic risk transfer and total return swap is crucial for managing financial risks and optimizing portfolio strategies. Synthetic risk transfer isolates specific credit exposures without transferring ownership, while total return swaps involve the exchange of the total return of an asset, encompassing both income and capital gains or losses. Understanding these distinctions enhances risk assessment accuracy and informs regulatory compliance. This knowledge enables investors to tailor risk management approaches to their specific financial objectives and market conditions.

Comparison Table

| Feature | Synthetic Risk Transfer (SRT) | Total Return Swap (TRS) |

|---|---|---|

| Definition | Risk transfer technique using credit derivatives to shift risk without moving assets. | Derivative contract exchanging total return of an asset for fixed or floating payments. |

| Main Purpose | Reduce credit risk exposure on loan portfolios or assets. | Gain economic exposure to asset returns without owning the asset. |

| Asset Ownership | Original owner retains asset ownership but transfers credit risk. | Asset typically remains with the total return payer (seller). |

| Risk Transfer | Primarily credit risk transfer. | Transfers both credit risk and market risk linked to asset performance. |

| Contractual Structure | Often involves credit default swaps or collateralized debt obligations. | Swap agreement exchanging total returns against periodic payments. |

| Use Cases | Balance sheet risk management, regulatory capital relief. | Leverage, hedging asset exposure, arbitrage strategies. |

| Counterparty Risk | Risk shifted to protection seller; mitigated via collateral agreements. | Counterparty risk central due to swap payments and exposure. |

| Regulatory Impact | Can reduce capital requirements under banking regulations. | May affect accounting treatment; regulatory capital impact depends on structure. |

Which is better?

Synthetic risk transfer (SRT) provides off-balance-sheet risk management by transferring specific credit risks through derivatives, enhancing capital efficiency while maintaining asset ownership. Total return swaps (TRS) enable one party to receive the total economic performance of an asset, including income and capital gains, without transferring ownership, offering flexibility but less risk isolation compared to synthetic risk transfers. Firms prioritize synthetic risk transfer for targeted risk reduction and regulatory capital relief, whereas total return swaps serve liquidity and investment exposure needs.

Connection

Synthetic risk transfer (SRT) and total return swaps (TRS) are interconnected financial instruments used to manage and redistribute risk without the need for outright asset sales. SRT involves transferring credit risk through derivatives, often employing TRS contracts where one party receives the total return of an asset while the other assumes the associated risks. This mechanism enhances balance sheet efficiency by allowing institutions to hedge exposure and optimize capital allocation.

Key Terms

Swap Agreement

Total Return Swap (TRS) and Synthetic Risk Transfer (SRT) differ primarily in structure and risk allocation under the Swap Agreement. A TRS involves the transfer of total economic performance, including income and capital gains or losses, from the reference asset, while the counterparty assumes full credit risk, making it a direct exposure swap. Examining detailed Swap Agreement clauses reveals how counterparties manage credit exposure and risk transfer; explore these differences further to optimize your financial strategy.

Credit Risk

Total return swaps (TRS) and synthetic risk transfer (SRT) both enable credit risk management by transferring exposure without physical asset sale. TRS involves exchange of total return on reference asset against floating payments, effectively passing credit risk to the swap counterparty. Explore deeper insights on credit risk nuances in TRS versus synthetic risk transfer for strategic credit risk optimization.

Synthetic Exposure

Synthetic exposure in total return swaps (TRS) involves transferring the economic performance of an asset without transferring legal ownership, enabling efficient capital management and risk hedging. Synthetic risk transfer (SRT) structures use derivatives and off-balance-sheet instruments to isolate and transfer credit risk, often improving regulatory capital relief. Explore how synthetic exposure nuances differ between TRS and SRT to optimize financial strategies and regulatory compliance.

Source and External Links

Total Return Swap - Overview, Structure, Benefits - A Total Return Swap (TRS) is a contract between two parties exchanging the total return from an underlying asset, where one party pays based on a set rate and the other party pays the total return including any income and capital gains, allowing exposure to the asset without ownership.

Total return swap - Wikipedia - A TRS transfers both credit and market risk of an underlying asset between parties, enabling one to benefit from asset returns without owning it, commonly used by hedge funds and financial institutions to manage leverage and exposure.

Total return swap (TRS) | Practical Law - Westlaw - A TRS is a derivative contract replicating the cash flows of an investment in an asset, with parties exchanging payments based on appreciation or depreciation of the underlying asset's value over time.

dowidth.com

dowidth.com