Supercore inflation measures the rising prices of goods and services excluding volatile food and energy costs, reflecting persistent underlying inflation trends in the economy. Wage inflation tracks the increase in workers' earnings, which influences consumer spending power and overall price levels. Explore the intricate dynamics between supercore inflation and wage inflation to understand their impact on economic growth.

Why it is important

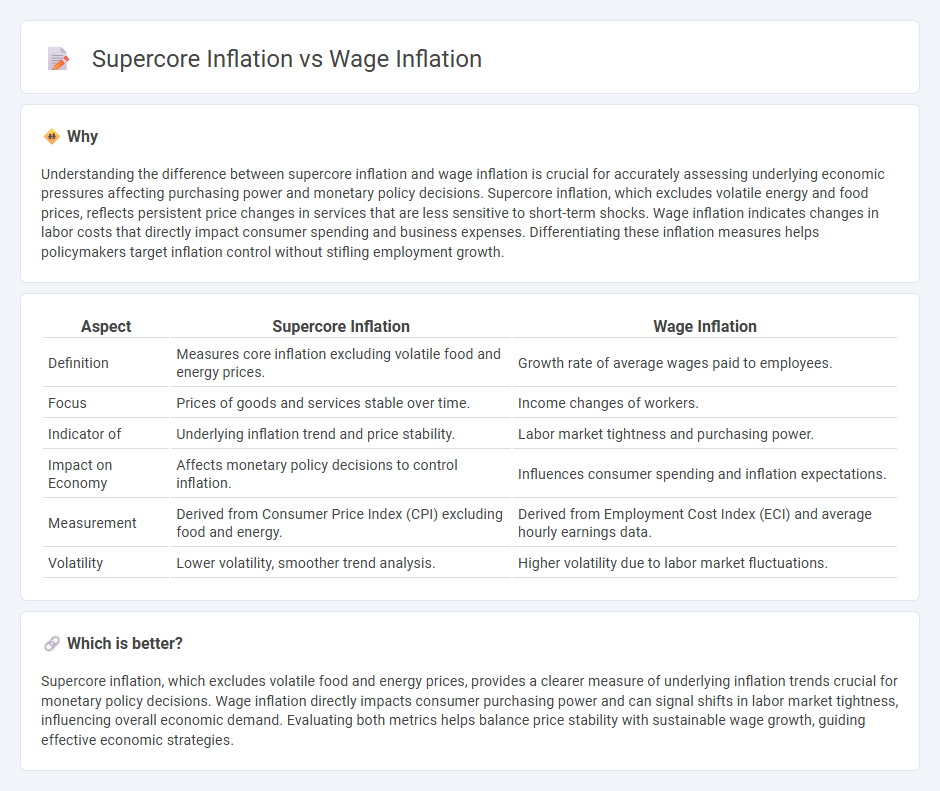

Understanding the difference between supercore inflation and wage inflation is crucial for accurately assessing underlying economic pressures affecting purchasing power and monetary policy decisions. Supercore inflation, which excludes volatile energy and food prices, reflects persistent price changes in services that are less sensitive to short-term shocks. Wage inflation indicates changes in labor costs that directly impact consumer spending and business expenses. Differentiating these inflation measures helps policymakers target inflation control without stifling employment growth.

Comparison Table

| Aspect | Supercore Inflation | Wage Inflation |

|---|---|---|

| Definition | Measures core inflation excluding volatile food and energy prices. | Growth rate of average wages paid to employees. |

| Focus | Prices of goods and services stable over time. | Income changes of workers. |

| Indicator of | Underlying inflation trend and price stability. | Labor market tightness and purchasing power. |

| Impact on Economy | Affects monetary policy decisions to control inflation. | Influences consumer spending and inflation expectations. |

| Measurement | Derived from Consumer Price Index (CPI) excluding food and energy. | Derived from Employment Cost Index (ECI) and average hourly earnings data. |

| Volatility | Lower volatility, smoother trend analysis. | Higher volatility due to labor market fluctuations. |

Which is better?

Supercore inflation, which excludes volatile food and energy prices, provides a clearer measure of underlying inflation trends crucial for monetary policy decisions. Wage inflation directly impacts consumer purchasing power and can signal shifts in labor market tightness, influencing overall economic demand. Evaluating both metrics helps balance price stability with sustainable wage growth, guiding effective economic strategies.

Connection

Supercore inflation, which excludes volatile food and energy prices, directly influences wage inflation as rising costs in core services drive workers to demand higher wages to maintain purchasing power. Wage inflation, in turn, can reinforce supercore inflation by increasing production costs that businesses pass on to consumers, creating a wage-price spiral. Understanding this interconnection is crucial for policymakers targeting sustainable economic growth and controlling inflationary pressures.

Key Terms

Labor Costs

Wage inflation directly impacts labor costs as rising wages increase expenses for employers, influencing overall production costs and pricing strategies. Supercore inflation, which excludes volatile food and energy prices, highlights persistent inflation pressures primarily driven by sustained wage growth and tight labor markets. Explore in-depth analysis of how these inflation measures uniquely affect economic policies and business decisions.

Core Services (Ex-Housing)

Wage inflation directly impacts labor costs across sectors, driving up prices in core services excluding housing, such as healthcare and education, where labor intensity is high. Supercore inflation measures persistent price increases in these services less volatile and more sensitive to wage trends, providing a clearer indicator of underlying inflation pressures. Explore the dynamics between wage growth and supercore inflation to understand future policy implications and economic stability.

Price Stability

Wage inflation reflects rising labor costs that drive consumer spending and influence overall inflation trends, while supercore inflation excludes volatile food and energy prices to reveal underlying price pressures critical for assessing monetary policy. Central banks prioritize supercore inflation metrics to maintain price stability and guide interest rate decisions, balancing wage growth impacts without overstating transient price spikes. Explore deeper insights on how wage and supercore inflation interplay shapes economic stability and policy strategies.

Source and External Links

Are wages keeping up with inflation? - From June 2024 to June 2025 in the United States, average wages grew 0.7 percentage points faster than inflation, with nominal wages increasing by 3.4% while inflation was 2.7%, indicating workers' purchasing power improved during this period.

Wage growth vs inflation U.S. 2025 - Although inflation peaked at 9.1% in 2022, wage growth has generally outpaced inflation since 2023, with wages growing 4.3% and inflation at 2.4% in March 2025; however, minimum wage increases have lagged productivity gains over the years, affecting low-wage workers.

Strong wage growth for low-wage workers bucks the historic trend - Between 2019 and 2024, despite inflation increasing 21.3%, the lowest-wage workers saw the strongest real wage growth, with a 15.3% increase at the 10th percentile wage, reflecting a faster growth rate for low-wage workers than for higher wage groups.

dowidth.com

dowidth.com