Micro-dosing spending involves incremental budget increases to control inflation while stimulating growth, contrasting with deficit financing where governments cover expenditures by borrowing, often leading to increased national debt. This approach can enhance fiscal discipline and reduce financial risks associated with large-scale deficit spending. Explore further to understand how micro-dosing spending impacts economic stability and public finance management.

Why it is important

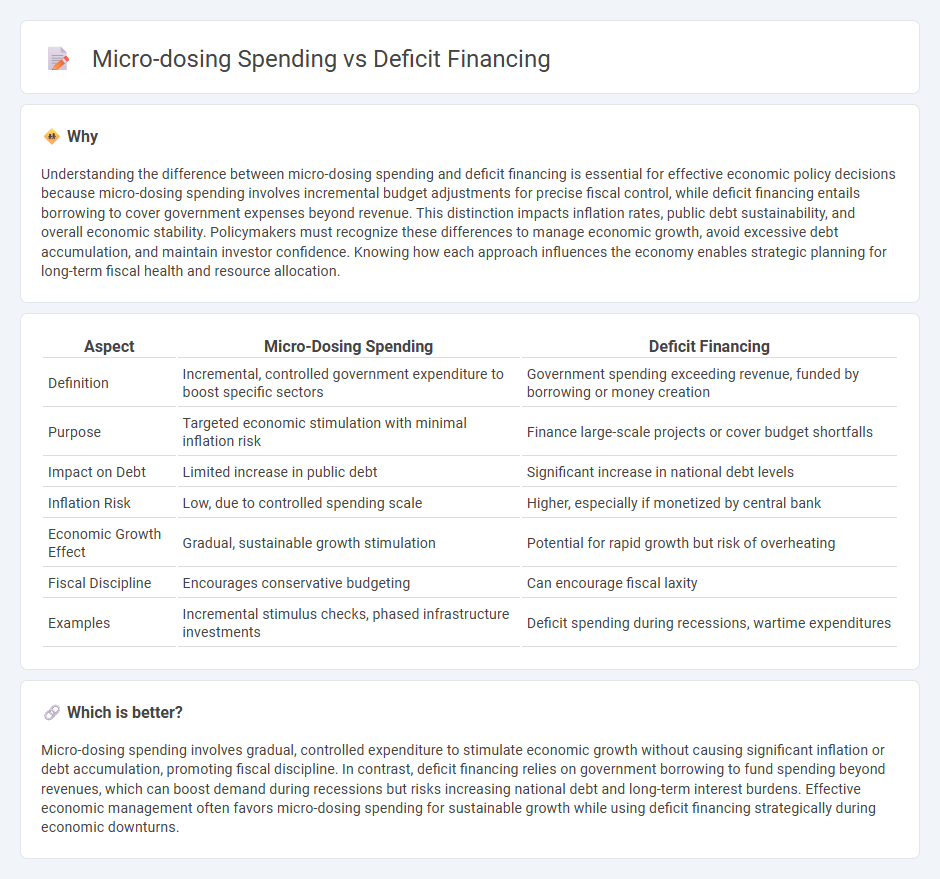

Understanding the difference between micro-dosing spending and deficit financing is essential for effective economic policy decisions because micro-dosing spending involves incremental budget adjustments for precise fiscal control, while deficit financing entails borrowing to cover government expenses beyond revenue. This distinction impacts inflation rates, public debt sustainability, and overall economic stability. Policymakers must recognize these differences to manage economic growth, avoid excessive debt accumulation, and maintain investor confidence. Knowing how each approach influences the economy enables strategic planning for long-term fiscal health and resource allocation.

Comparison Table

| Aspect | Micro-Dosing Spending | Deficit Financing |

|---|---|---|

| Definition | Incremental, controlled government expenditure to boost specific sectors | Government spending exceeding revenue, funded by borrowing or money creation |

| Purpose | Targeted economic stimulation with minimal inflation risk | Finance large-scale projects or cover budget shortfalls |

| Impact on Debt | Limited increase in public debt | Significant increase in national debt levels |

| Inflation Risk | Low, due to controlled spending scale | Higher, especially if monetized by central bank |

| Economic Growth Effect | Gradual, sustainable growth stimulation | Potential for rapid growth but risk of overheating |

| Fiscal Discipline | Encourages conservative budgeting | Can encourage fiscal laxity |

| Examples | Incremental stimulus checks, phased infrastructure investments | Deficit spending during recessions, wartime expenditures |

Which is better?

Micro-dosing spending involves gradual, controlled expenditure to stimulate economic growth without causing significant inflation or debt accumulation, promoting fiscal discipline. In contrast, deficit financing relies on government borrowing to fund spending beyond revenues, which can boost demand during recessions but risks increasing national debt and long-term interest burdens. Effective economic management often favors micro-dosing spending for sustainable growth while using deficit financing strategically during economic downturns.

Connection

Micro-dosing spending involves small, incremental government expenditures aimed at stimulating economic activity without large upfront costs. Deficit financing occurs when a government funds these expenditures by borrowing, increasing public debt. The connection lies in using deficit financing to sustain micro-dosing spending strategies, balancing immediate economic stimulus with long-term fiscal responsibility.

Key Terms

Fiscal Deficit

Deficit financing increases the fiscal deficit by borrowing or printing money to cover government expenditures exceeding revenues, potentially leading to inflation and debt accumulation. Micro-dosing spending involves targeted, small-scale investments designed to optimize budget efficiency without significantly widening the fiscal deficit. Explore how balancing these approaches can sustainably manage the fiscal deficit while promoting economic growth.

Aggregate Demand

Deficit financing increases aggregate demand by injecting government spending beyond revenues, stimulating economic growth through higher public expenditure. Micro-dosing spending targets smaller, frequent fiscal injections aimed at gradually influencing consumption and investment behaviors without causing significant budget imbalances. Explore how these fiscal strategies differently impact aggregate demand and economic stability.

Marginal Utility

Deficit financing often leads to increased government spending that may yield diminishing marginal utility if not allocated efficiently, whereas micro-dosing spending targets small, incremental investments designed to maximize marginal utility through optimized resource distribution. In economic contexts, marginal utility measures the added benefit derived from each additional unit of spending, making the precision of micro-dosing more effective in enhancing overall welfare compared to broad deficit spending. Explore how strategic micro-dosing can revolutionize public finance by improving economic outcomes with controlled marginal utility.

Source and External Links

Deficit Financing: Types, Objectives, Advantages, and FAQs - Vedantu - Deficit financing is when government spending exceeds revenue, often funded by printing money or borrowing; it's used to finance extraordinary expenses, stimulate the economy, and fund development projects, but can cause inflation if unchecked.

What is deficit financing and why is it necessary in some countries? - Economic Times - Deficit financing is crucial for governments, especially in developing countries, to fund growth and infrastructure when tax revenues are insufficient, but excessive deficit financing risks inflation and economic instability.

Deficit spending - Wikipedia - Deficit spending occurs when expenditures exceed revenues, increasing government debt and potentially impacting interest rates and private investment, with crowded-out effects especially near full employment, but it has also helped fund periods of economic growth historically.

dowidth.com

dowidth.com