Zombie companies, characterized by their inability to generate sufficient profits to cover debt servicing, drain economic resources and impede market efficiency. Value stocks, identified by low price-to-earnings ratios and strong fundamentals, offer investors opportunities for long-term returns by focusing on undervalued assets with growth potential. Explore the dynamics between zombie companies and value stocks to enhance your investment strategy and economic understanding.

Why it is important

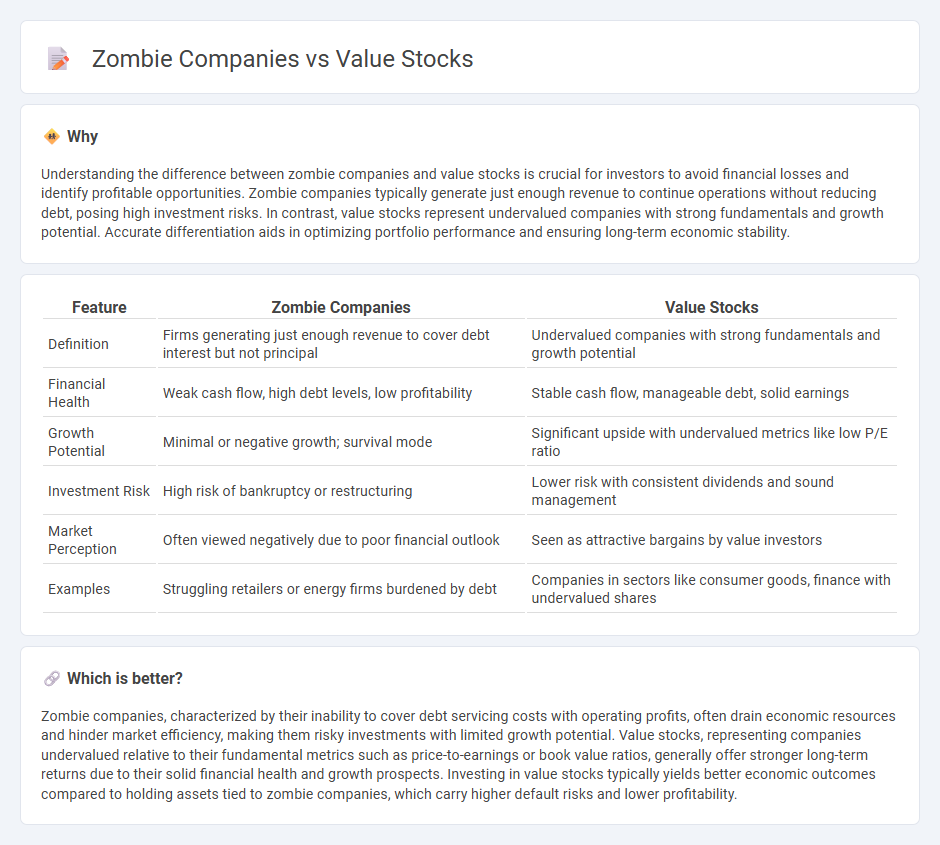

Understanding the difference between zombie companies and value stocks is crucial for investors to avoid financial losses and identify profitable opportunities. Zombie companies typically generate just enough revenue to continue operations without reducing debt, posing high investment risks. In contrast, value stocks represent undervalued companies with strong fundamentals and growth potential. Accurate differentiation aids in optimizing portfolio performance and ensuring long-term economic stability.

Comparison Table

| Feature | Zombie Companies | Value Stocks |

|---|---|---|

| Definition | Firms generating just enough revenue to cover debt interest but not principal | Undervalued companies with strong fundamentals and growth potential |

| Financial Health | Weak cash flow, high debt levels, low profitability | Stable cash flow, manageable debt, solid earnings |

| Growth Potential | Minimal or negative growth; survival mode | Significant upside with undervalued metrics like low P/E ratio |

| Investment Risk | High risk of bankruptcy or restructuring | Lower risk with consistent dividends and sound management |

| Market Perception | Often viewed negatively due to poor financial outlook | Seen as attractive bargains by value investors |

| Examples | Struggling retailers or energy firms burdened by debt | Companies in sectors like consumer goods, finance with undervalued shares |

Which is better?

Zombie companies, characterized by their inability to cover debt servicing costs with operating profits, often drain economic resources and hinder market efficiency, making them risky investments with limited growth potential. Value stocks, representing companies undervalued relative to their fundamental metrics such as price-to-earnings or book value ratios, generally offer stronger long-term returns due to their solid financial health and growth prospects. Investing in value stocks typically yields better economic outcomes compared to holding assets tied to zombie companies, which carry higher default risks and lower profitability.

Connection

Zombie companies, typically defined as firms that generate just enough revenue to continue operating without growing or reducing debt, directly impact the performance of value stocks by distorting market valuations. These companies often weigh down value stock indexes since they usually carry high debt levels and low profitability, reducing overall sector returns and investor confidence. The prevalence of zombie companies signals economic inefficiencies, causing investors to reevaluate the intrinsic value of traditional value stocks versus more resilient growth-oriented equities.

Key Terms

Fundamentals

Value stocks are characterized by strong fundamentals such as solid earnings, low price-to-earnings ratios, and robust cash flow, indicating financial health and growth potential. Zombie companies, on the other hand, struggle with weak fundamentals, often relying on debt refinancing and generating insufficient earnings to cover interest payments, leading to stagnant or declining performance. Explore deeper insights into fundamental analysis to differentiate between sustainable investments and risky holdings.

Profitability

Value stocks exhibit consistent profitability through strong earnings, stable cash flows, and robust return on equity, making them attractive for long-term investment. In contrast, zombie companies struggle with sustained losses, insufficient cash generation, and poor debt servicing ability, risking insolvency despite appearing undervalued. Explore the detailed profitability metrics to distinguish true value stocks from financially distressed zombie companies.

Debt

Value stocks typically exhibit manageable debt levels with strong cash flow supporting their financial stability, distinguishing them from zombie companies that are burdened by excessive debt and depend on continuous borrowing to meet interest obligations. Zombie companies often face declining revenue and profitability, making debt servicing increasingly unsustainable, whereas value stocks demonstrate healthier leverage ratios and robust earnings. Explore further to understand debt's critical role in differentiating investment quality between value stocks and zombie firms.

Source and External Links

Value Stock Investments: Build a Durable Portfolio | Charles Schwab - Value stocks are shares of companies trading below their intrinsic value, identified using fundamental metrics like future earnings, balance sheet health, and cash flow, with the expectation that their price will eventually rise to match true worth.

The 10 Best Companies to Invest in Now | Morningstar - Examples of current value stocks include Constellation Brands (trading 35% below fair value) and GSK (33% below fair value), both identified through a comparison of market price to estimated intrinsic value.

Value investing - Wikipedia - Value investing, pioneered by Benjamin Graham and David Dodd, involves buying stocks priced below their intrinsic value as determined by fundamental analysis, emphasizing a "margin of safety" and a long-term perspective.

dowidth.com

dowidth.com