A living wage ensures workers earn enough to meet basic needs, while wage indexation adjusts salaries according to inflation rates to maintain purchasing power. These mechanisms impact economic stability, labor market dynamics, and social equity by influencing consumer spending and poverty levels. Explore how living wage policies and wage indexation interact to shape economic resilience and worker wellbeing.

Why it is important

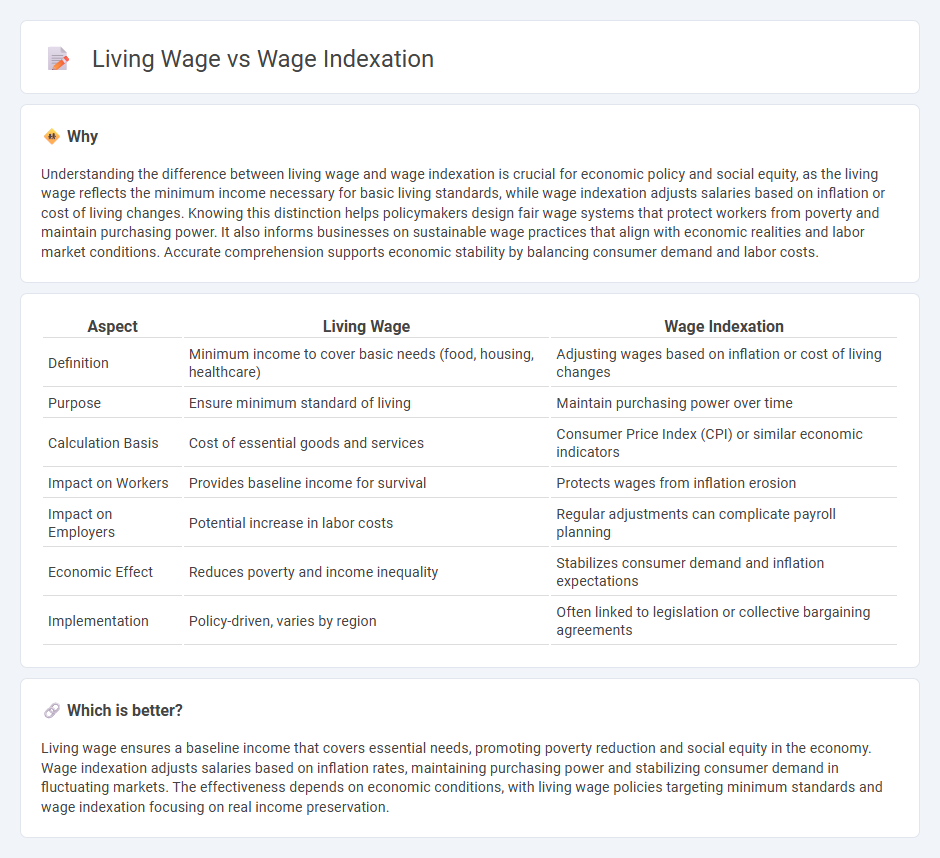

Understanding the difference between living wage and wage indexation is crucial for economic policy and social equity, as the living wage reflects the minimum income necessary for basic living standards, while wage indexation adjusts salaries based on inflation or cost of living changes. Knowing this distinction helps policymakers design fair wage systems that protect workers from poverty and maintain purchasing power. It also informs businesses on sustainable wage practices that align with economic realities and labor market conditions. Accurate comprehension supports economic stability by balancing consumer demand and labor costs.

Comparison Table

| Aspect | Living Wage | Wage Indexation |

|---|---|---|

| Definition | Minimum income to cover basic needs (food, housing, healthcare) | Adjusting wages based on inflation or cost of living changes |

| Purpose | Ensure minimum standard of living | Maintain purchasing power over time |

| Calculation Basis | Cost of essential goods and services | Consumer Price Index (CPI) or similar economic indicators |

| Impact on Workers | Provides baseline income for survival | Protects wages from inflation erosion |

| Impact on Employers | Potential increase in labor costs | Regular adjustments can complicate payroll planning |

| Economic Effect | Reduces poverty and income inequality | Stabilizes consumer demand and inflation expectations |

| Implementation | Policy-driven, varies by region | Often linked to legislation or collective bargaining agreements |

Which is better?

Living wage ensures a baseline income that covers essential needs, promoting poverty reduction and social equity in the economy. Wage indexation adjusts salaries based on inflation rates, maintaining purchasing power and stabilizing consumer demand in fluctuating markets. The effectiveness depends on economic conditions, with living wage policies targeting minimum standards and wage indexation focusing on real income preservation.

Connection

Living wage ensures workers earn income that meets basic needs, directly influencing wage indexation mechanisms that adjust salaries based on cost-of-living changes. Wage indexation uses inflation rates and living wage benchmarks to maintain purchasing power and reduce income inequality. Effective linkage between living wage policies and wage indexation supports economic stability and consumer spending.

Key Terms

Inflation

Wage indexation directly adjusts salaries based on inflation rates to maintain workers' purchasing power amid rising consumer prices, ensuring income stability in volatile markets. In contrast, a living wage is a fixed annual minimum income that guarantees basic needs regardless of inflation fluctuations, often lagging behind real-time cost-of-living changes. Explore the impact of inflation on wage policies and learn how each approach addresses economic challenges.

Cost of living

Wage indexation adjusts salaries based on inflation rates to maintain purchasing power as reflected in consumer price indexes, directly linking wages to the cost of living fluctuations. Living wage calculations consider essential expenses such as housing, food, transportation, and healthcare, aiming to provide workers with income sufficient to cover basic needs and ensure a decent standard of living. Explore the impact of these mechanisms on economic stability and worker well-being to understand how wage policies address cost of living challenges.

Collective bargaining

Collective bargaining plays a critical role in aligning wage indexation with the living wage by ensuring negotiated salary adjustments reflect inflation and cost of living changes. Effective negotiations enable workers to secure fair wages that maintain purchasing power and address economic fluctuations. Explore how collective bargaining strategies can optimize wage indexation to support sustainable living wages.

Source and External Links

Indexation - Wikipedia - Wage indexation is a technique that adjusts wages based on a price index to maintain purchasing power against inflation; while aimed at transferring inflation risk and managing inflation expectations, economists have mixed views on its success and recommend indexation more during high inflation periods and deindexation when inflation moderates.

Wage indexation mechanisms in euro area countries - Several European countries have formal wage indexation clauses, particularly in the public sector, where wages are automatically adjusted based on past inflation rates to avoid second-round inflation effects, with mechanisms and coverage differing by country and sector.

Endogenous wage indexation and aggregate shocks - The degree of wage indexation critically affects macroeconomic fluctuations and inflation dynamics, as higher wage indexation amplifies inflationary shocks through feedback between wages and prices, leading to potentially higher social costs and requiring stronger policy responses to control inflation.

dowidth.com

dowidth.com