Dollarization occurs when a country adopts a foreign currency, typically the US dollar, as its official medium of exchange, eliminating its own national currency to stabilize inflation and increase investor confidence. Currency board arrangements maintain a domestic currency fully backed by foreign reserves, ensuring fixed exchange rates and monetary discipline while allowing the government to retain control over issuing currency. Explore the detailed economic implications and examples of dollarization and currency boards to better understand their impact on national economies.

Why it is important

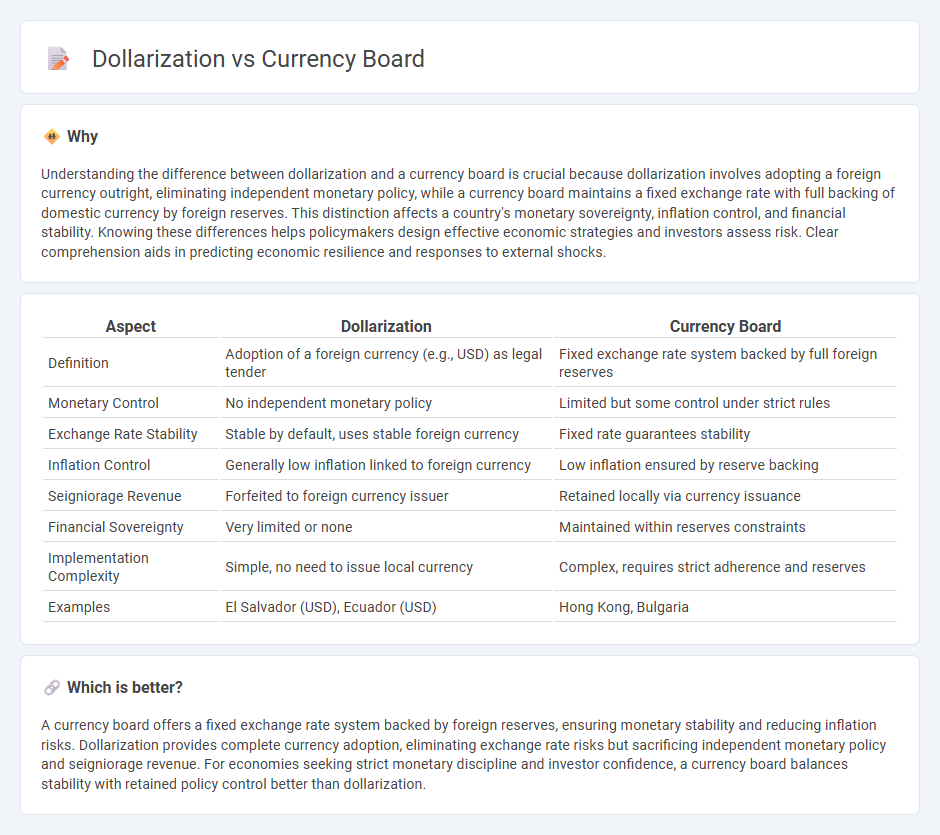

Understanding the difference between dollarization and a currency board is crucial because dollarization involves adopting a foreign currency outright, eliminating independent monetary policy, while a currency board maintains a fixed exchange rate with full backing of domestic currency by foreign reserves. This distinction affects a country's monetary sovereignty, inflation control, and financial stability. Knowing these differences helps policymakers design effective economic strategies and investors assess risk. Clear comprehension aids in predicting economic resilience and responses to external shocks.

Comparison Table

| Aspect | Dollarization | Currency Board |

|---|---|---|

| Definition | Adoption of a foreign currency (e.g., USD) as legal tender | Fixed exchange rate system backed by full foreign reserves |

| Monetary Control | No independent monetary policy | Limited but some control under strict rules |

| Exchange Rate Stability | Stable by default, uses stable foreign currency | Fixed rate guarantees stability |

| Inflation Control | Generally low inflation linked to foreign currency | Low inflation ensured by reserve backing |

| Seigniorage Revenue | Forfeited to foreign currency issuer | Retained locally via currency issuance |

| Financial Sovereignty | Very limited or none | Maintained within reserves constraints |

| Implementation Complexity | Simple, no need to issue local currency | Complex, requires strict adherence and reserves |

| Examples | El Salvador (USD), Ecuador (USD) | Hong Kong, Bulgaria |

Which is better?

A currency board offers a fixed exchange rate system backed by foreign reserves, ensuring monetary stability and reducing inflation risks. Dollarization provides complete currency adoption, eliminating exchange rate risks but sacrificing independent monetary policy and seigniorage revenue. For economies seeking strict monetary discipline and investor confidence, a currency board balances stability with retained policy control better than dollarization.

Connection

Dollarization and currency boards both involve fixed exchange rate systems where a country's currency value is pegged to a foreign currency, often the US dollar, to stabilize the economy and control inflation. Dollarization occurs when a country adopts a foreign currency as legal tender, while a currency board issues a domestic currency fully backed by foreign reserves, maintaining a fixed parity. Both mechanisms reduce exchange rate volatility and build investor confidence by anchoring monetary policy to a stable external standard.

Key Terms

Monetary Policy Independence

Currency boards maintain limited monetary policy independence by pegging the domestic currency to a foreign anchor, ensuring strict control over money supply and exchange rates but restricting discretionary policy actions. Dollarization involves adopting a foreign currency outright, resulting in zero monetary policy autonomy, as the country must follow the monetary policy of the currency issuer. Explore the full implications of currency boards and dollarization on economic stability and sovereignty.

Exchange Rate Regime

A currency board maintains a fixed exchange rate by backing domestic currency with foreign reserves, ensuring stability and automatic convertibility without discretionary monetary policy. Dollarization means adopting a foreign currency, typically the US dollar, as legal tender, eliminating exchange rate risk but sacrificing independent monetary control entirely. Explore the nuances of these exchange rate regimes to understand their impacts on economic stability and policy flexibility.

Foreign Reserves

Currency boards maintain a fixed exchange rate by holding foreign reserves equal to or exceeding domestic currency in circulation, ensuring full convertibility and monetary stability. Dollarization involves adopting a foreign currency, often the US dollar, which eliminates currency risk but surrenders control over monetary policy and depends entirely on the foreign currency's reserves. Explore deeper insights into the impacts on foreign reserves in currency board systems versus dollarized economies.

Source and External Links

Currency board - A currency board is a monetary authority that maintains a fixed exchange rate with a foreign currency by holding sufficient foreign reserves to fully back the domestic currency in circulation.

Currency Boards for Developing Countries - A currency board issues notes and coins only if it has corresponding reserves (typically 100% or more) in a stable foreign currency or commodity, with no discretionary control over the money supply, and remits any profits beyond expenses and reserve requirements to the government.

Currency Boards - Unlike central banks, currency boards operate as rule-bound institutions without discretionary monetary policy, requiring immediate convertibility of domestic currency into a foreign anchor currency at a fixed rate.

dowidth.com

dowidth.com