De-risking involves reducing exposure to high-risk investments or markets to protect assets and ensure financial stability. Rebalancing focuses on adjusting the portfolio allocation to maintain a desired risk-reward balance and capture growth opportunities. Explore how these strategies can optimize your investment approach and safeguard your economic interests.

Why it is important

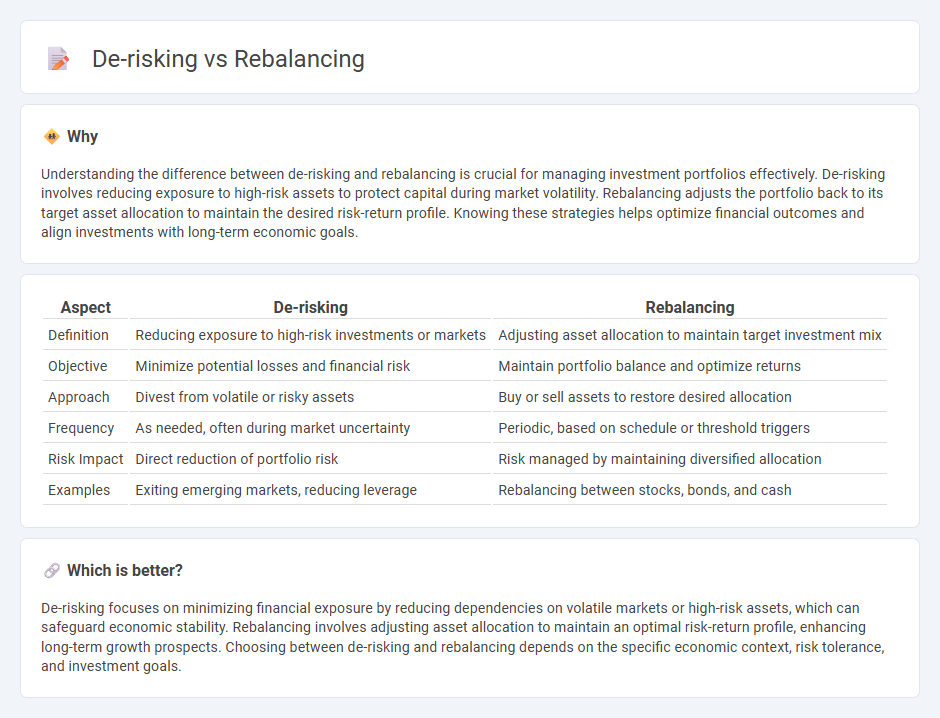

Understanding the difference between de-risking and rebalancing is crucial for managing investment portfolios effectively. De-risking involves reducing exposure to high-risk assets to protect capital during market volatility. Rebalancing adjusts the portfolio back to its target asset allocation to maintain the desired risk-return profile. Knowing these strategies helps optimize financial outcomes and align investments with long-term economic goals.

Comparison Table

| Aspect | De-risking | Rebalancing |

|---|---|---|

| Definition | Reducing exposure to high-risk investments or markets | Adjusting asset allocation to maintain target investment mix |

| Objective | Minimize potential losses and financial risk | Maintain portfolio balance and optimize returns |

| Approach | Divest from volatile or risky assets | Buy or sell assets to restore desired allocation |

| Frequency | As needed, often during market uncertainty | Periodic, based on schedule or threshold triggers |

| Risk Impact | Direct reduction of portfolio risk | Risk managed by maintaining diversified allocation |

| Examples | Exiting emerging markets, reducing leverage | Rebalancing between stocks, bonds, and cash |

Which is better?

De-risking focuses on minimizing financial exposure by reducing dependencies on volatile markets or high-risk assets, which can safeguard economic stability. Rebalancing involves adjusting asset allocation to maintain an optimal risk-return profile, enhancing long-term growth prospects. Choosing between de-risking and rebalancing depends on the specific economic context, risk tolerance, and investment goals.

Connection

De-risking in the economy involves reducing exposure to financial or operational risks, while rebalancing adjusts asset allocations to maintain an optimal risk-return profile. These strategies work together as rebalancing helps implement de-risking by shifting investments away from high-risk sectors toward more stable assets. Effective integration of de-risking and rebalancing enhances portfolio resilience and long-term economic stability.

Key Terms

Asset Allocation

Rebalancing involves periodically adjusting the proportions of assets in a portfolio to maintain a target allocation, optimizing risk and return based on market fluctuations. De-risking focuses on reducing exposure to high-risk assets, often by increasing allocations to safer investments like bonds or cash equivalents as investors approach financial goals or market uncertainty rises. Explore deeper insights on how strategic asset allocation furthers portfolio stability and growth potential.

Portfolio Diversification

Portfolio diversification enhances investment stability by spreading assets across different sectors and risk levels. Rebalancing maintains the desired asset allocation, ensuring consistent exposure to growth opportunities while controlling risk. Explore effective strategies to balance growth and security in your portfolio.

Risk Tolerance

Rebalancing involves adjusting portfolio allocations to maintain a desired risk level aligned with an investor's risk tolerance, ensuring consistent exposure to targeted asset classes. De-risking focuses on gradually reducing overall portfolio risk, often by shifting investments from volatile assets like equities to safer options such as bonds or cash equivalents, particularly as investors approach retirement or financial goals. Explore how these strategies can be tailored to optimize your investment risk profile and achieve long-term financial stability.

Source and External Links

Rebalancing - Bogleheads - Rebalancing involves adjusting a portfolio that has drifted from its target asset allocation by transferring funds from higher-performing to lower-performing asset classes to maintain risk levels and adhere to investment strategy.

What is Portfolio Rebalancing and Why Should You Care? - E*Trade - Portfolio rebalancing consists of selling some assets and buying others to realign the portfolio with its target allocation, helping manage risk and meet investing goals especially during market volatility.

Rebalancing in Action | Charles Schwab - Rebalancing keeps the portfolio's target allocation consistent over time by adjusting holdings when price movements cause shifts in the weights of different asset classes.

dowidth.com

dowidth.com