Micro-dosing spending involves small, incremental investments that allow businesses to test market reactions with minimal financial risk, promoting agile growth strategies. Market capitalization represents the total value of a company's outstanding shares, serving as a key indicator of its economic strength and investor confidence. Explore how micro-dosing spending strategies influence market capitalization trends in evolving economic landscapes.

Why it is important

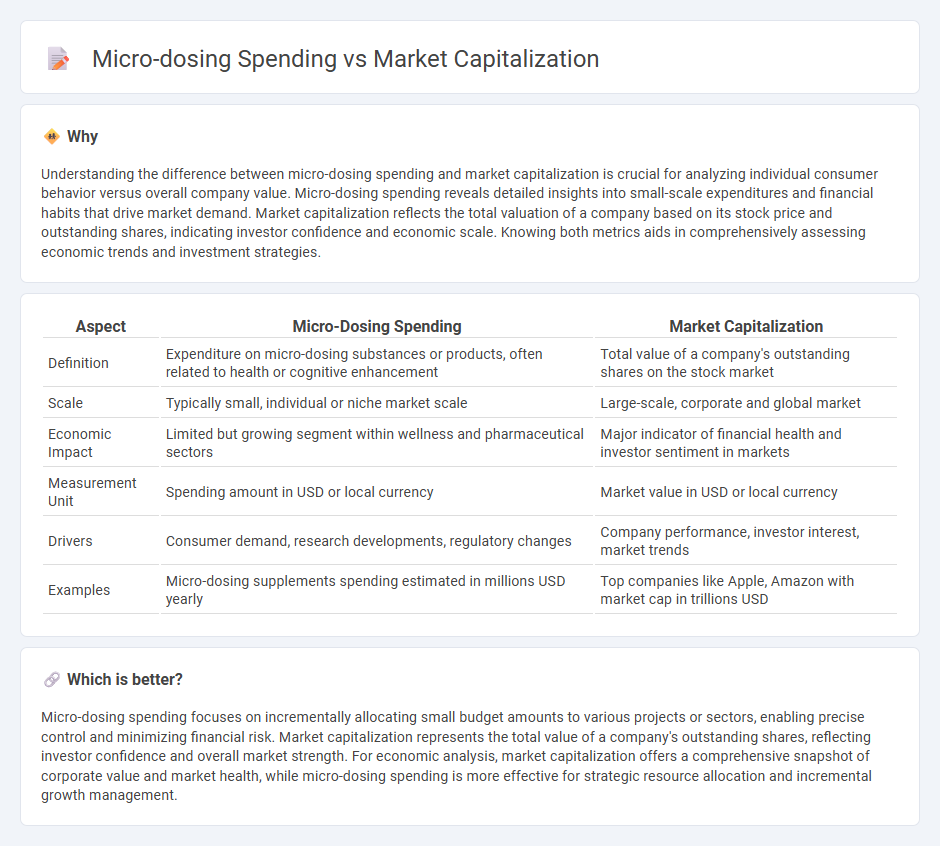

Understanding the difference between micro-dosing spending and market capitalization is crucial for analyzing individual consumer behavior versus overall company value. Micro-dosing spending reveals detailed insights into small-scale expenditures and financial habits that drive market demand. Market capitalization reflects the total valuation of a company based on its stock price and outstanding shares, indicating investor confidence and economic scale. Knowing both metrics aids in comprehensively assessing economic trends and investment strategies.

Comparison Table

| Aspect | Micro-Dosing Spending | Market Capitalization |

|---|---|---|

| Definition | Expenditure on micro-dosing substances or products, often related to health or cognitive enhancement | Total value of a company's outstanding shares on the stock market |

| Scale | Typically small, individual or niche market scale | Large-scale, corporate and global market |

| Economic Impact | Limited but growing segment within wellness and pharmaceutical sectors | Major indicator of financial health and investor sentiment in markets |

| Measurement Unit | Spending amount in USD or local currency | Market value in USD or local currency |

| Drivers | Consumer demand, research developments, regulatory changes | Company performance, investor interest, market trends |

| Examples | Micro-dosing supplements spending estimated in millions USD yearly | Top companies like Apple, Amazon with market cap in trillions USD |

Which is better?

Micro-dosing spending focuses on incrementally allocating small budget amounts to various projects or sectors, enabling precise control and minimizing financial risk. Market capitalization represents the total value of a company's outstanding shares, reflecting investor confidence and overall market strength. For economic analysis, market capitalization offers a comprehensive snapshot of corporate value and market health, while micro-dosing spending is more effective for strategic resource allocation and incremental growth management.

Connection

Micro-dosing spending influences consumer behavior by encouraging incremental purchases that aggregate into significant market demand, directly impacting market capitalization. Small, frequent expenditures generate steady cash flow for companies, boosting investor confidence and increasing stock valuations. This trend shifts traditional economic models by emphasizing the cumulative effect of minor spending patterns on broader market metrics.

Key Terms

Valuation

Market capitalization reflects a company's total equity value, crucial for assessing its financial scale, while micro-dosing spending indicates strategic investment in emerging treatment markets. Biotechnology firms specializing in micro-dosing often experience valuation fluctuations driven by research breakthroughs and regulatory advancements. Explore how these financial indicators interact to shape the future of pharma innovation.

Consumer behavior

Market capitalization reflects the total value of publicly traded companies, influencing consumer confidence and spending power. Micro-dosing, a growing trend in consumer behavior, sees incremental spending shifts toward wellness and niche products, impacting overall market dynamics. Explore how consumer choices in micro-dosing drive broader economic patterns and market valuations.

Purchasing power

Market capitalization reflects the total value of a company's shares, influencing its purchasing power for investments in emerging sectors like micro-dosing. Increased market capitalization enables larger financial allocations towards innovative micro-dosing research and product development, driving growth in this niche market. Discover how market value dynamics impact spending strategies in micro-dosing.

Source and External Links

Market Cap: What It Is, Why It's Important and How to Calculate - Market capitalization is the total value of a company's publicly traded shares, calculated by multiplying the current share price by the total number of shares outstanding, and is used to categorize companies by size and assess their risk and growth potential.

Market Capitalization - Definition, How to Calculate - Market capitalization represents the most recent market value of a company's outstanding shares, determined by multiplying the current share price by the number of shares outstanding, and is a key metric for comparing company sizes within industries.

What is market cap and how do you calculate it? - Fidelity Investments - Market cap is the total dollar value of a company's outstanding shares of stock, calculated simply as the number of outstanding shares multiplied by the current price per share, providing insight into a company's market value for investment decisions.

dowidth.com

dowidth.com