Supercore inflation excludes volatile food and energy prices, focusing on the most persistent and broad-based price changes, while underlying inflation covers a wider range of goods and services but removes only transitory price shocks. Measuring supercore inflation helps economists identify long-term inflation trends, improving monetary policy decisions by targeting core inflation drivers. Explore how these inflation metrics impact economic forecasting and policy formulation.

Why it is important

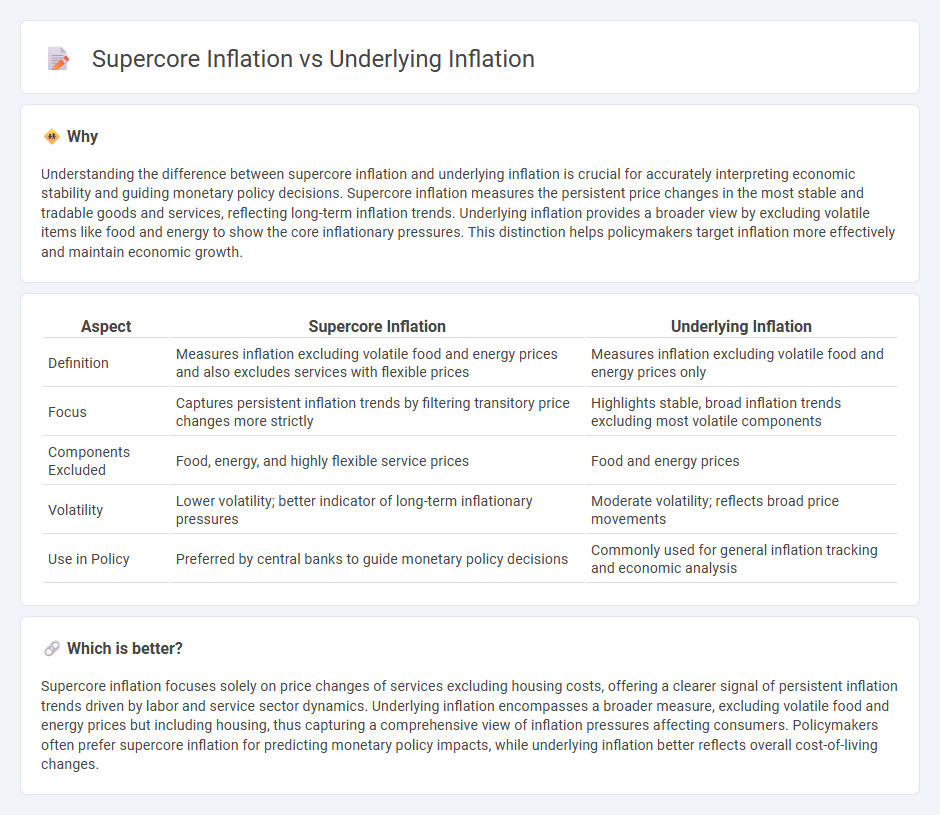

Understanding the difference between supercore inflation and underlying inflation is crucial for accurately interpreting economic stability and guiding monetary policy decisions. Supercore inflation measures the persistent price changes in the most stable and tradable goods and services, reflecting long-term inflation trends. Underlying inflation provides a broader view by excluding volatile items like food and energy to show the core inflationary pressures. This distinction helps policymakers target inflation more effectively and maintain economic growth.

Comparison Table

| Aspect | Supercore Inflation | Underlying Inflation |

|---|---|---|

| Definition | Measures inflation excluding volatile food and energy prices and also excludes services with flexible prices | Measures inflation excluding volatile food and energy prices only |

| Focus | Captures persistent inflation trends by filtering transitory price changes more strictly | Highlights stable, broad inflation trends excluding most volatile components |

| Components Excluded | Food, energy, and highly flexible service prices | Food and energy prices |

| Volatility | Lower volatility; better indicator of long-term inflationary pressures | Moderate volatility; reflects broad price movements |

| Use in Policy | Preferred by central banks to guide monetary policy decisions | Commonly used for general inflation tracking and economic analysis |

Which is better?

Supercore inflation focuses solely on price changes of services excluding housing costs, offering a clearer signal of persistent inflation trends driven by labor and service sector dynamics. Underlying inflation encompasses a broader measure, excluding volatile food and energy prices but including housing, thus capturing a comprehensive view of inflation pressures affecting consumers. Policymakers often prefer supercore inflation for predicting monetary policy impacts, while underlying inflation better reflects overall cost-of-living changes.

Connection

Supercore inflation, which excludes volatile energy and food prices, reflects persistent price changes driven by supply and demand imbalances, while underlying inflation captures the broader, more stable trend by removing short-term shocks. Both measures provide critical insights into inflation dynamics, helping policymakers and economists assess the true inflationary pressures within an economy. Understanding their interaction enhances forecasting accuracy and informs effective monetary policy decisions aimed at stabilizing prices.

Key Terms

Core inflation

Core inflation measures the overall rise in prices excluding volatile food and energy sectors, providing a clearer view of persistent price changes. Underlying inflation focuses on long-term inflation trends by filtering short-term price shocks, while supercore inflation isolates wages and services, closely monitoring labor cost pressures. Explore deeper insights on how these inflation metrics influence economic policy and market decisions.

Volatility

Underlying inflation measures price changes excluding volatile items like food and energy to provide a clearer view of persistent inflation trends. Supercore inflation further refines this by focusing on the most stable components of inflation, such as services less energy, reducing volatility even more effectively. Discover how analyzing these metrics reveals deeper insights into inflation dynamics and economic stability.

Services prices

Underlying inflation excludes volatile food and energy prices, providing a clearer view of persistent price trends, while supercore inflation specifically targets services prices excluding housing rents, reflecting wage pressures more directly. Services prices often drive inflation dynamics since they are less sensitive to short-term shocks and more influenced by labor market conditions. Explore further to understand how these measures impact monetary policy decisions.

Source and External Links

The Fed - Underlying Inflation: Its Measurement and Significance - Underlying inflation is the rate of inflation that would prevail in the absence of economic slack, supply shocks, or idiosyncratic disturbances, and is used as a benchmark for monetary policy.

Defining the rate of underlying inflation - Bureau of Labor Statistics - Underlying inflation is the long-run trend of price levels inherent in the economic structure, as opposed to temporary or shock-induced price changes.

Core inflation - Wikipedia - Core inflation is a measure that excludes volatile items like food and energy to represent the underlying, persistent trend in aggregate price levels.

dowidth.com

dowidth.com