Neobanks leverage advanced digital platforms to streamline banking services, offering personalized financial solutions with lower operational costs compared to traditional insurance companies. Insurance firms are increasingly integrating insurtech innovations to enhance risk assessment and customer engagement but often face regulatory complexities and legacy system challenges. Discover how the evolving interplay between neobanks and insurance companies is reshaping the financial ecosystem.

Why it is important

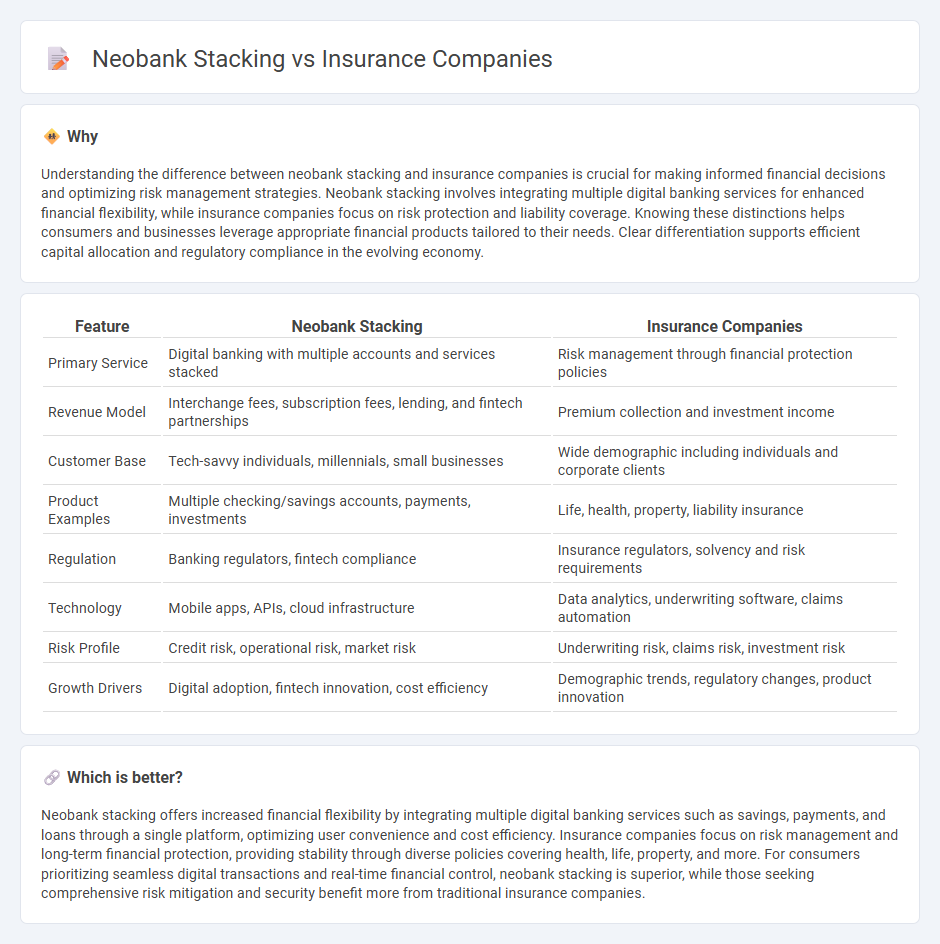

Understanding the difference between neobank stacking and insurance companies is crucial for making informed financial decisions and optimizing risk management strategies. Neobank stacking involves integrating multiple digital banking services for enhanced financial flexibility, while insurance companies focus on risk protection and liability coverage. Knowing these distinctions helps consumers and businesses leverage appropriate financial products tailored to their needs. Clear differentiation supports efficient capital allocation and regulatory compliance in the evolving economy.

Comparison Table

| Feature | Neobank Stacking | Insurance Companies |

|---|---|---|

| Primary Service | Digital banking with multiple accounts and services stacked | Risk management through financial protection policies |

| Revenue Model | Interchange fees, subscription fees, lending, and fintech partnerships | Premium collection and investment income |

| Customer Base | Tech-savvy individuals, millennials, small businesses | Wide demographic including individuals and corporate clients |

| Product Examples | Multiple checking/savings accounts, payments, investments | Life, health, property, liability insurance |

| Regulation | Banking regulators, fintech compliance | Insurance regulators, solvency and risk requirements |

| Technology | Mobile apps, APIs, cloud infrastructure | Data analytics, underwriting software, claims automation |

| Risk Profile | Credit risk, operational risk, market risk | Underwriting risk, claims risk, investment risk |

| Growth Drivers | Digital adoption, fintech innovation, cost efficiency | Demographic trends, regulatory changes, product innovation |

Which is better?

Neobank stacking offers increased financial flexibility by integrating multiple digital banking services such as savings, payments, and loans through a single platform, optimizing user convenience and cost efficiency. Insurance companies focus on risk management and long-term financial protection, providing stability through diverse policies covering health, life, property, and more. For consumers prioritizing seamless digital transactions and real-time financial control, neobank stacking is superior, while those seeking comprehensive risk mitigation and security benefit more from traditional insurance companies.

Connection

Neobank stacking leverages digital banking platforms to offer integrated financial services, including tailored insurance products, enhancing customer experience and retention. Insurance companies collaborate with neobanks to access real-time financial data, enabling personalized risk assessment and dynamic pricing models. This synergy drives innovation in fintech, streamlines operations, and expands market reach for both sectors in the evolving financial ecosystem.

Key Terms

Risk Management

Insurance companies leverage extensive actuarial data and regulatory frameworks to enhance risk management, employing predictive analytics to mitigate policyholder risks effectively. Neobanks integrate advanced AI algorithms with real-time transaction monitoring to identify fraud and credit risks promptly, fostering agile financial decision-making. Explore the intricate risk management strategies that differentiate insurance firms and neobanks in handling evolving financial threats.

Digital Banking

Insurance companies are increasingly integrating digital banking features to enhance customer experience and streamline financial services. Neobanks specialize in digital banking by offering seamless, user-friendly platforms with real-time transactions and personalized financial tools. Discover more about how the convergence of insurance and neobanking is reshaping the future of digital financial services.

Regulatory Compliance

Insurance companies face stringent regulatory compliance requirements including solvency margins, risk management, and consumer protection laws, often resulting in complex and rigid operational structures. Neobanks leverage advanced fintech solutions and agile compliance technologies such as RegTech to streamline adherence to anti-money laundering (AML), Know Your Customer (KYC), and data privacy regulations while enhancing customer experience. Explore the evolving landscape of regulatory compliance to understand how these entities strategically navigate legal frameworks.

Source and External Links

List of United States insurance companies - Provides a comprehensive list of major health insurance companies in the U.S., including Aetna, Blue Cross, and Kaiser Permanente.

Progressive Insurance - Offers customized auto insurance, motorcycle insurance, and bundling options for property insurance to provide extensive coverage.

Nationwide Insurance - Provides a wide range of insurance and financial services, including auto, homeowners, life, and business insurance.

dowidth.com

dowidth.com