Shrinkflation occurs when product sizes decrease while prices remain stable, effectively raising the cost per unit without altering the sticker price. Deflation is characterized by a general decline in prices across the economy, leading to reduced consumer spending and potential economic slowdown. Explore the key differences and economic impacts of shrinkflation and deflation to understand their influence on markets and consumers.

Why it is important

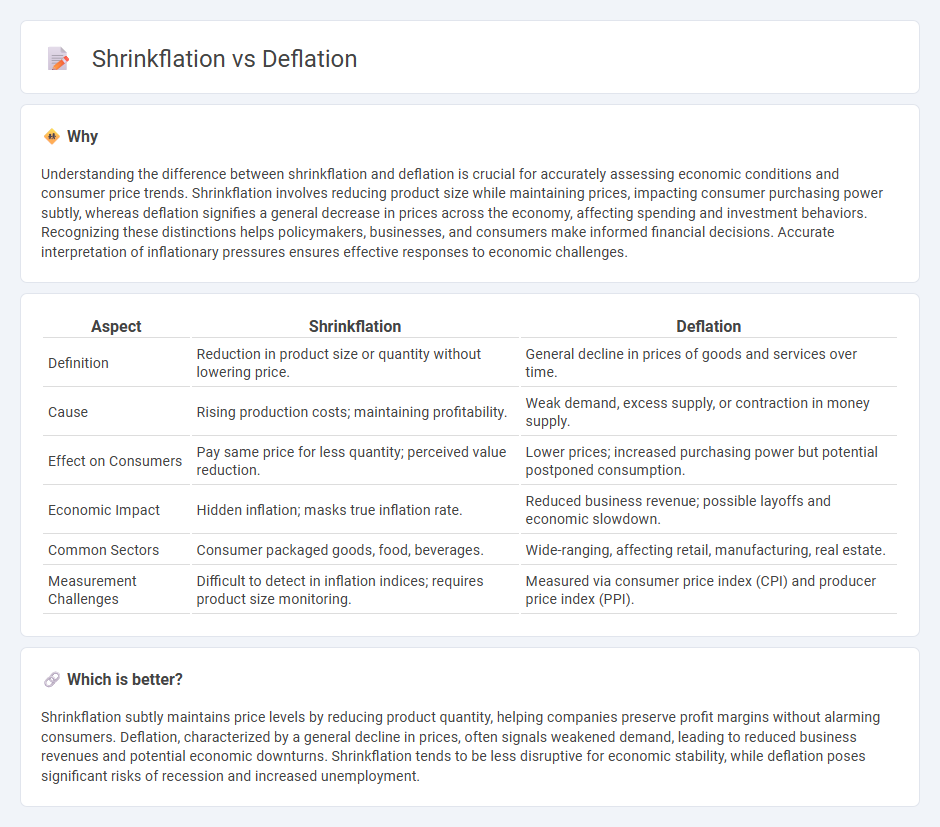

Understanding the difference between shrinkflation and deflation is crucial for accurately assessing economic conditions and consumer price trends. Shrinkflation involves reducing product size while maintaining prices, impacting consumer purchasing power subtly, whereas deflation signifies a general decrease in prices across the economy, affecting spending and investment behaviors. Recognizing these distinctions helps policymakers, businesses, and consumers make informed financial decisions. Accurate interpretation of inflationary pressures ensures effective responses to economic challenges.

Comparison Table

| Aspect | Shrinkflation | Deflation |

|---|---|---|

| Definition | Reduction in product size or quantity without lowering price. | General decline in prices of goods and services over time. |

| Cause | Rising production costs; maintaining profitability. | Weak demand, excess supply, or contraction in money supply. |

| Effect on Consumers | Pay same price for less quantity; perceived value reduction. | Lower prices; increased purchasing power but potential postponed consumption. |

| Economic Impact | Hidden inflation; masks true inflation rate. | Reduced business revenue; possible layoffs and economic slowdown. |

| Common Sectors | Consumer packaged goods, food, beverages. | Wide-ranging, affecting retail, manufacturing, real estate. |

| Measurement Challenges | Difficult to detect in inflation indices; requires product size monitoring. | Measured via consumer price index (CPI) and producer price index (PPI). |

Which is better?

Shrinkflation subtly maintains price levels by reducing product quantity, helping companies preserve profit margins without alarming consumers. Deflation, characterized by a general decline in prices, often signals weakened demand, leading to reduced business revenues and potential economic downturns. Shrinkflation tends to be less disruptive for economic stability, while deflation poses significant risks of recession and increased unemployment.

Connection

Shrinkflation and deflation both impact consumer purchasing power but in contrasting ways; shrinkflation reduces product size while maintaining or increasing price, effectively disguising inflation, whereas deflation involves a general decrease in prices across the economy. Businesses may use shrinkflation to counteract the effects of deflation by preserving profit margins despite falling nominal prices. Understanding this dynamic is crucial for policymakers aiming to stabilize economic growth and maintain consumer confidence.

Key Terms

Price Level

Deflation signifies a persistent decline in the overall price level, causing increased purchasing power and potentially leading to reduced consumer spending and economic slowdown. Shrinkflation involves reducing the size or quantity of a product while maintaining or slightly increasing its price, effectively raising the product's unit cost without altering the headline price level. Explore how these phenomena impact inflation metrics and consumer perception for deeper economic insights.

Purchasing Power

Deflation refers to a general decrease in prices across the economy, increasing consumers' purchasing power by allowing them to buy more goods and services with the same amount of money. Shrinkflation occurs when product sizes or quantities decrease while prices remain constant, effectively reducing purchasing power as consumers receive less value for the same price. Explore how these economic phenomena uniquely impact your spending and financial planning.

Product Size

Deflation refers to the overall decline in prices of goods and services, while shrinkflation specifically targets product size reduction without lowering the price, effectively masking inflation. Companies employ shrinkflation to maintain profit margins by decreasing quantities, such as reducing packet weights or bottle volumes, making consumers pay the same for less. Explore more to understand how shrinkflation affects everyday purchases and consumer perception.

Source and External Links

Deflation - Definition, Causes, Effects, Impact - Deflation is a decrease in the general price level of goods and services, meaning negative inflation, typically caused by a fall in aggregate demand or increase in aggregate supply, and can intensify recessions or lead to deflationary spirals.

Deflation | EBSCO Research Starters - Deflation is characterized by a drop in money or credit supply leading to falling prices, often signaling recession or depression, with severe consequences like job losses, wage cuts, and increased loan defaults.

Deflation - Wikipedia - Deflation happens when the inflation rate falls below zero, causing currency value to increase and often resulting in delayed consumption and investment, leading to reduced economic activity and deflationary spirals.

dowidth.com

dowidth.com