Polycrisis refers to multiple, simultaneous economic disruptions that compound financial instability, while a fiscal cliff describes a sudden, severe budgetary shortfall caused by expiring tax cuts and mandatory spending increases. Understanding these phenomena is critical for assessing risks in national and global economic policies. Explore detailed analyses to grasp their implications for market stability and fiscal strategy.

Why it is important

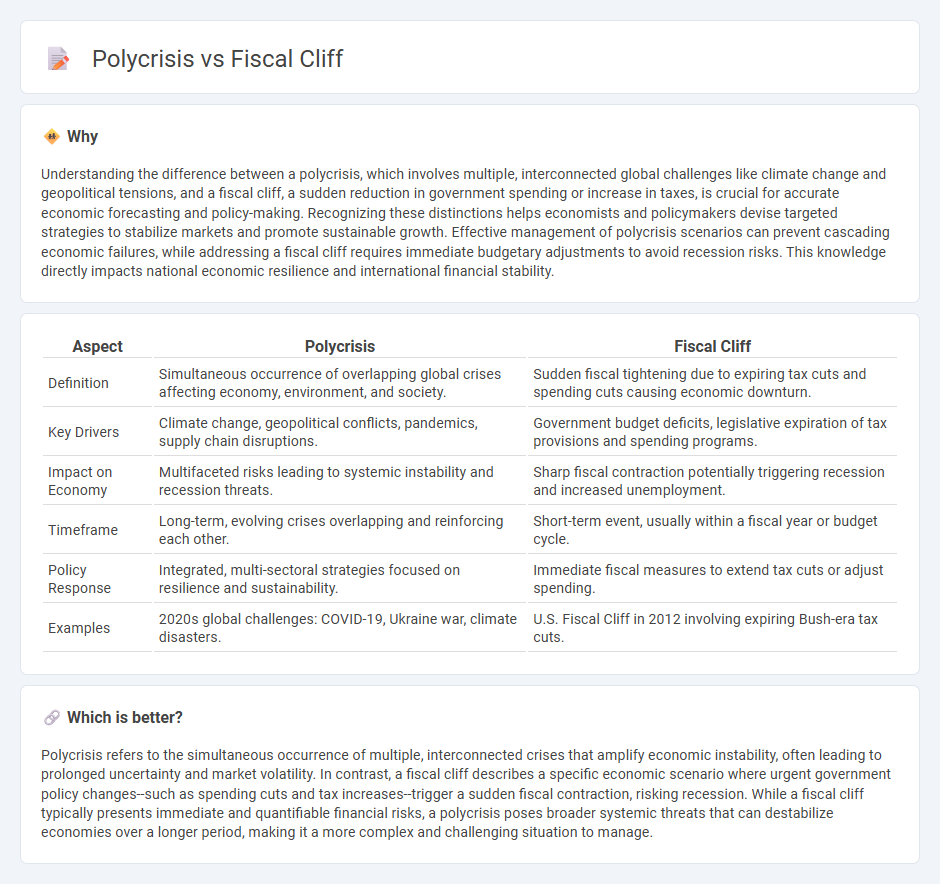

Understanding the difference between a polycrisis, which involves multiple, interconnected global challenges like climate change and geopolitical tensions, and a fiscal cliff, a sudden reduction in government spending or increase in taxes, is crucial for accurate economic forecasting and policy-making. Recognizing these distinctions helps economists and policymakers devise targeted strategies to stabilize markets and promote sustainable growth. Effective management of polycrisis scenarios can prevent cascading economic failures, while addressing a fiscal cliff requires immediate budgetary adjustments to avoid recession risks. This knowledge directly impacts national economic resilience and international financial stability.

Comparison Table

| Aspect | Polycrisis | Fiscal Cliff |

|---|---|---|

| Definition | Simultaneous occurrence of overlapping global crises affecting economy, environment, and society. | Sudden fiscal tightening due to expiring tax cuts and spending cuts causing economic downturn. |

| Key Drivers | Climate change, geopolitical conflicts, pandemics, supply chain disruptions. | Government budget deficits, legislative expiration of tax provisions and spending programs. |

| Impact on Economy | Multifaceted risks leading to systemic instability and recession threats. | Sharp fiscal contraction potentially triggering recession and increased unemployment. |

| Timeframe | Long-term, evolving crises overlapping and reinforcing each other. | Short-term event, usually within a fiscal year or budget cycle. |

| Policy Response | Integrated, multi-sectoral strategies focused on resilience and sustainability. | Immediate fiscal measures to extend tax cuts or adjust spending. |

| Examples | 2020s global challenges: COVID-19, Ukraine war, climate disasters. | U.S. Fiscal Cliff in 2012 involving expiring Bush-era tax cuts. |

Which is better?

Polycrisis refers to the simultaneous occurrence of multiple, interconnected crises that amplify economic instability, often leading to prolonged uncertainty and market volatility. In contrast, a fiscal cliff describes a specific economic scenario where urgent government policy changes--such as spending cuts and tax increases--trigger a sudden fiscal contraction, risking recession. While a fiscal cliff typically presents immediate and quantifiable financial risks, a polycrisis poses broader systemic threats that can destabilize economies over a longer period, making it a more complex and challenging situation to manage.

Connection

Polycrisis, characterized by simultaneous global challenges such as inflation, geopolitical tensions, and supply chain disruptions, exacerbates the risk of a fiscal cliff by straining government budgets and limiting fiscal policy flexibility. Countries facing polycrisis may confront sharp reductions in public spending or increased taxation as debt levels become unsustainable, intensifying economic contraction. This interconnected dynamic threatens economic stability by amplifying financial vulnerabilities and undermining recovery prospects worldwide.

Key Terms

Government Spending

Fiscal cliff refers to a situation where a government faces simultaneous expiring tax cuts and across-the-board government spending cuts, resulting in a sudden reduction in budget deficits and economic slowdown. Polycrisis describes a complex, interconnected set of crises, including government overspending, inflation, and debt, leading to systemic risks that are harder to resolve abruptly. Explore deeper into government spending dynamics to understand how fiscal cliff triggers differ fundamentally from polycrisis scenarios.

Economic Shock

The fiscal cliff refers to a set of expiring tax cuts and automatic spending cuts that triggered a sudden economic shock by reducing government spending and increasing taxes, potentially leading to recession. Polycrisis describes the simultaneous occurrence of multiple interconnected crises, such as economic downturns, geopolitical tensions, and climate change, amplifying systemic vulnerabilities and compounding financial shocks. Explore deeper insights into how economic shocks manifest differently in fiscal cliffs versus polycrises and their global implications.

Policy Response

Fiscal cliff scenarios demand immediate, targeted policy responses including spending cuts and tax adjustments to stabilize the economy and avoid recession risks. Polycrisis situations require comprehensive, multifaceted policy strategies that address interconnected economic, social, and environmental challenges simultaneously to build systemic resilience. Explore in-depth analyses of policy frameworks designed to navigate these complex crises effectively.

Source and External Links

What Is the Fiscal Cliff? | Council on Foreign Relations - The fiscal cliff refers to the bundle of major U.S. federal tax increases and spending cuts that were scheduled to take effect at the end of 2012, potentially slashing the federal budget deficit by hundreds of billions but risking a double-dip recession if not addressed.

The Fiscal Cliff Crisis and the Real Economic Crisis in the United States - The 2013 fiscal cliff involved the expiration of Bush-era tax cuts, the end of a temporary payroll tax cut, and the start of $110 billion in spending cuts, which together threatened to push the U.S. economy back into recession if not averted by Congressional action.

United States fiscal cliff - Wikipedia - The fiscal cliff was the simultaneous enactment of laws in January 2013 increasing taxes and cutting spending, which was projected to reduce the federal deficit but also risk causing a mild recession and higher unemployment before eventual economic recovery.

dowidth.com

dowidth.com