Funflation refers to rising prices in leisure and entertainment sectors while overall inflation remains moderate, contrasting with disinflation, a general slowdown in the rate of inflation across an economy. Understanding these economic trends helps in analyzing consumer spending patterns and monetary policy impacts. Explore more to grasp how funflation and disinflation influence market dynamics and financial decisions.

Why it is important

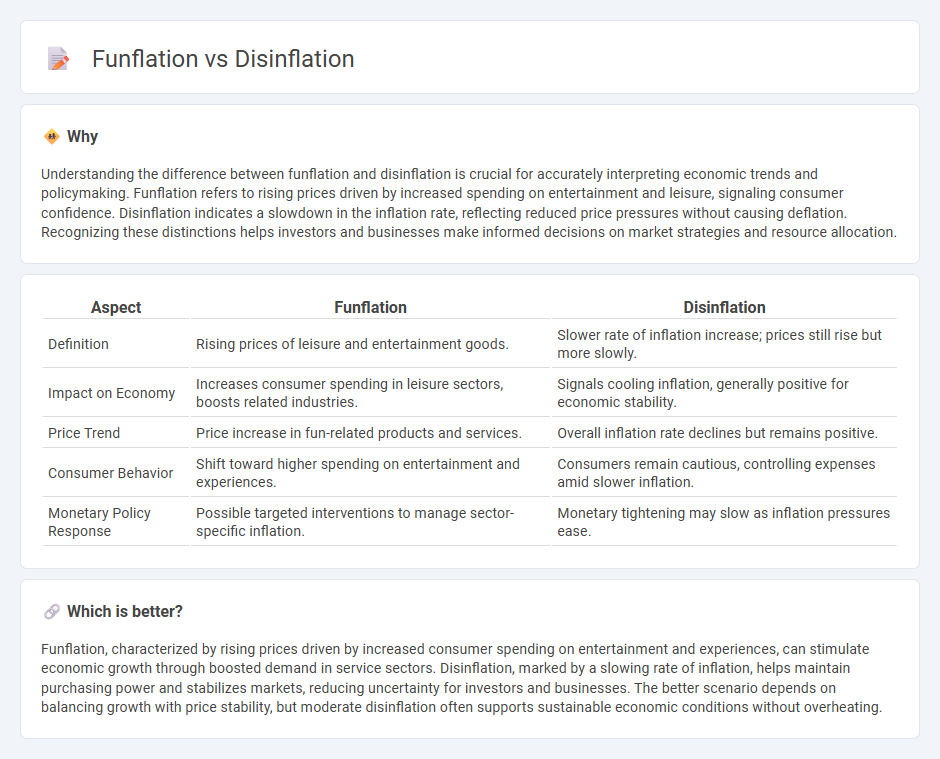

Understanding the difference between funflation and disinflation is crucial for accurately interpreting economic trends and policymaking. Funflation refers to rising prices driven by increased spending on entertainment and leisure, signaling consumer confidence. Disinflation indicates a slowdown in the inflation rate, reflecting reduced price pressures without causing deflation. Recognizing these distinctions helps investors and businesses make informed decisions on market strategies and resource allocation.

Comparison Table

| Aspect | Funflation | Disinflation |

|---|---|---|

| Definition | Rising prices of leisure and entertainment goods. | Slower rate of inflation increase; prices still rise but more slowly. |

| Impact on Economy | Increases consumer spending in leisure sectors, boosts related industries. | Signals cooling inflation, generally positive for economic stability. |

| Price Trend | Price increase in fun-related products and services. | Overall inflation rate declines but remains positive. |

| Consumer Behavior | Shift toward higher spending on entertainment and experiences. | Consumers remain cautious, controlling expenses amid slower inflation. |

| Monetary Policy Response | Possible targeted interventions to manage sector-specific inflation. | Monetary tightening may slow as inflation pressures ease. |

Which is better?

Funflation, characterized by rising prices driven by increased consumer spending on entertainment and experiences, can stimulate economic growth through boosted demand in service sectors. Disinflation, marked by a slowing rate of inflation, helps maintain purchasing power and stabilizes markets, reducing uncertainty for investors and businesses. The better scenario depends on balancing growth with price stability, but moderate disinflation often supports sustainable economic conditions without overheating.

Connection

Funflation and disinflation are connected through their opposing impacts on consumer prices and spending behavior. Funflation refers to the rising costs of leisure and entertainment, driving up overall inflation in those sectors, while disinflation signifies a general slowing of the inflation rate across the broader economy, easing price pressures. The interaction between rising costs in the fun sector and slowing inflation elsewhere highlights shifts in consumer demand and spending priorities within the economy.

Key Terms

Price Stability

Disinflation refers to a slowdown in the rate of inflation, indicating that prices are still rising but at a decreasing pace, which contributes to enhanced price stability in an economy. Funflation, a less common term, describes situations where prices rise while consumer demand and enjoyment increase, often driven by spending on entertainment and leisure activities, impacting overall price levels differently. Explore the nuanced effects of disinflation and funflation on economic policies and market behavior for a deeper understanding.

Consumer Confidence

Disinflation reflects a slowing rate of inflation, often leading to cautious consumer spending due to uncertainty in price stability, while funflation describes rising prices in leisure and entertainment sectors that typically maintain or boost consumer confidence through perceived value and enjoyment. The divergence between these two trends highlights varied consumer attitudes, where essential goods face restrained demand amid disinflation, but discretionary spending in funflation-driven markets remains resilient. Explore deeper insights on how these dynamics influence overall economic outlook and consumer behavior.

Demand Shocks

Disinflation refers to a slowdown in the rate of inflation, often caused by weakened aggregate demand and reduced consumer spending resulting from demand shocks such as economic downturns or financial crises. Funflation, on the other hand, describes rising prices driven by increased consumer demand for leisure and entertainment activities following a period of restricted social interaction, highlighting a unique demand shock in post-pandemic recovery phases. Explore the dynamics and economic implications of demand shocks in disinflation and funflation to deepen your understanding.

Source and External Links

Disinflation - Definition, How It Works, Examples - Disinflation is the slowing down of the inflation rate, meaning prices still rise but at a slower pace, and it differs from deflation, which is negative inflation or falling prices.

Disinflation - Wikipedia - Disinflation refers to a decrease in the rate of inflation, representing a slowdown in the increase of general price levels, and can precede deflation if the rate becomes negative.

Inflation, Disinflation and Deflation: What Do They All Mean? - Disinflation occurs when prices continue to rise but at a reduced rate, contrasting with inflation, which is price rises at an increasing rate, and deflation, which is an actual decline in prices.

dowidth.com

dowidth.com