Locavesting focuses on channeling local investments directly into nearby businesses and projects, fostering community growth and economic resilience, while traditional bank lending often involves larger institutions providing loans based on broader financial criteria. Locavesting offers personalized investment opportunities and potential higher local impact, contrasting with the standardized risk assessments and collateral requirements typical of bank loans. Explore further to understand which financing method aligns best with your economic goals and community values.

Why it is important

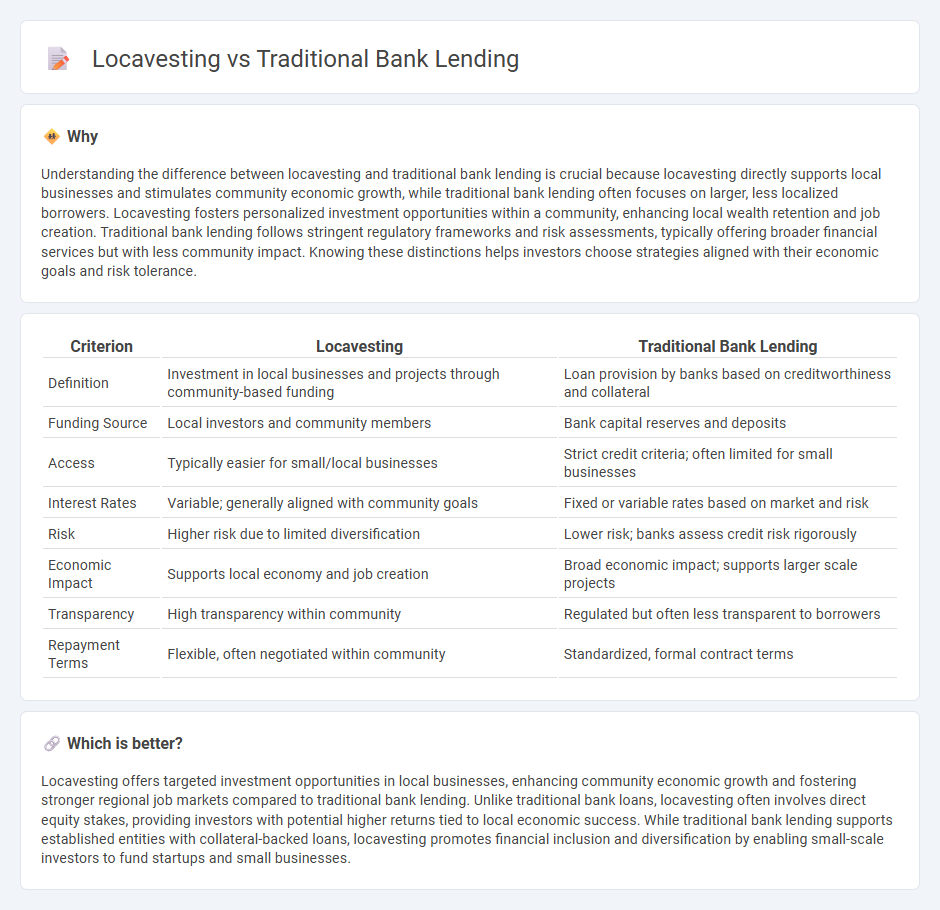

Understanding the difference between locavesting and traditional bank lending is crucial because locavesting directly supports local businesses and stimulates community economic growth, while traditional bank lending often focuses on larger, less localized borrowers. Locavesting fosters personalized investment opportunities within a community, enhancing local wealth retention and job creation. Traditional bank lending follows stringent regulatory frameworks and risk assessments, typically offering broader financial services but with less community impact. Knowing these distinctions helps investors choose strategies aligned with their economic goals and risk tolerance.

Comparison Table

| Criterion | Locavesting | Traditional Bank Lending |

|---|---|---|

| Definition | Investment in local businesses and projects through community-based funding | Loan provision by banks based on creditworthiness and collateral |

| Funding Source | Local investors and community members | Bank capital reserves and deposits |

| Access | Typically easier for small/local businesses | Strict credit criteria; often limited for small businesses |

| Interest Rates | Variable; generally aligned with community goals | Fixed or variable rates based on market and risk |

| Risk | Higher risk due to limited diversification | Lower risk; banks assess credit risk rigorously |

| Economic Impact | Supports local economy and job creation | Broad economic impact; supports larger scale projects |

| Transparency | High transparency within community | Regulated but often less transparent to borrowers |

| Repayment Terms | Flexible, often negotiated within community | Standardized, formal contract terms |

Which is better?

Locavesting offers targeted investment opportunities in local businesses, enhancing community economic growth and fostering stronger regional job markets compared to traditional bank lending. Unlike traditional bank loans, locavesting often involves direct equity stakes, providing investors with potential higher returns tied to local economic success. While traditional bank lending supports established entities with collateral-backed loans, locavesting promotes financial inclusion and diversification by enabling small-scale investors to fund startups and small businesses.

Connection

Locavesting bridges local economies by channeling investments directly into community-based projects, complementing traditional bank lending that provides broader financial support through established credit systems. Both methods stimulate economic growth, with locavesting enhancing regional development while traditional bank lending sustains larger-scale business operations and infrastructure. The synergy between localized investment and conventional financing drives diversified capital flow, fostering resilient and inclusive economic ecosystems.

Key Terms

Credit Risk

Traditional bank lending involves assessing credit risk through rigorous credit scoring, collateral evaluation, and financial history analysis to minimize defaults. Locavesting, focusing on local investments, mitigates credit risk by leveraging community familiarity and stronger social accountability, often leading to more personalized risk assessment. Explore how credit risk frameworks differ significantly between these financing models to optimize your investment strategy.

Community Investment

Traditional bank lending often relies on stringent credit assessments and centralized decision-making processes, which can limit access for small local businesses. Locavesting fosters community investment by enabling residents to directly fund local enterprises, promoting economic growth and social impact within neighborhoods. Discover how locavesting transforms community investment and supports local prosperity.

Decentralization

Traditional bank lending relies on centralized institutions that control credit allocation and assess borrower risk through standardized procedures, often leading to limited access and slower approval processes. Locavesting promotes decentralization by enabling local investors to directly fund small businesses and projects within their communities, reducing intermediaries and fostering transparent, trust-based financial relationships. Explore how decentralization through locavesting can transform local economies and democratize access to capital.

Source and External Links

P2P Lending vs. Traditional Lending - Experian - Traditional lending involves banks and credit unions directly providing loans to borrowers, with financing sourced from the institution's own capital.

Direct Lending vs. Traditional Bank Loans - Private Equity Bro - The process includes submitting financial statements, a credit assessment, and structured loan terms, with banks adhering to strict regulatory and risk standards.

Traditional Bank vs. Alternative Lender - Kapitus - Traditional banks generally offer lower interest rates, face-to-face service, and a full suite of financial products, making them a one-stop solution for many business needs.

dowidth.com

dowidth.com