Living wage policies ensure workers earn enough to cover basic living costs, directly targeting income insufficiency and reducing poverty. Universal basic income (UBI) provides all citizens with a regular, unconditional sum of money, aiming to alleviate economic inequality and boost financial security. Explore deeper comparisons of living wage and UBI to understand their impacts on economic stability and social welfare.

Why it is important

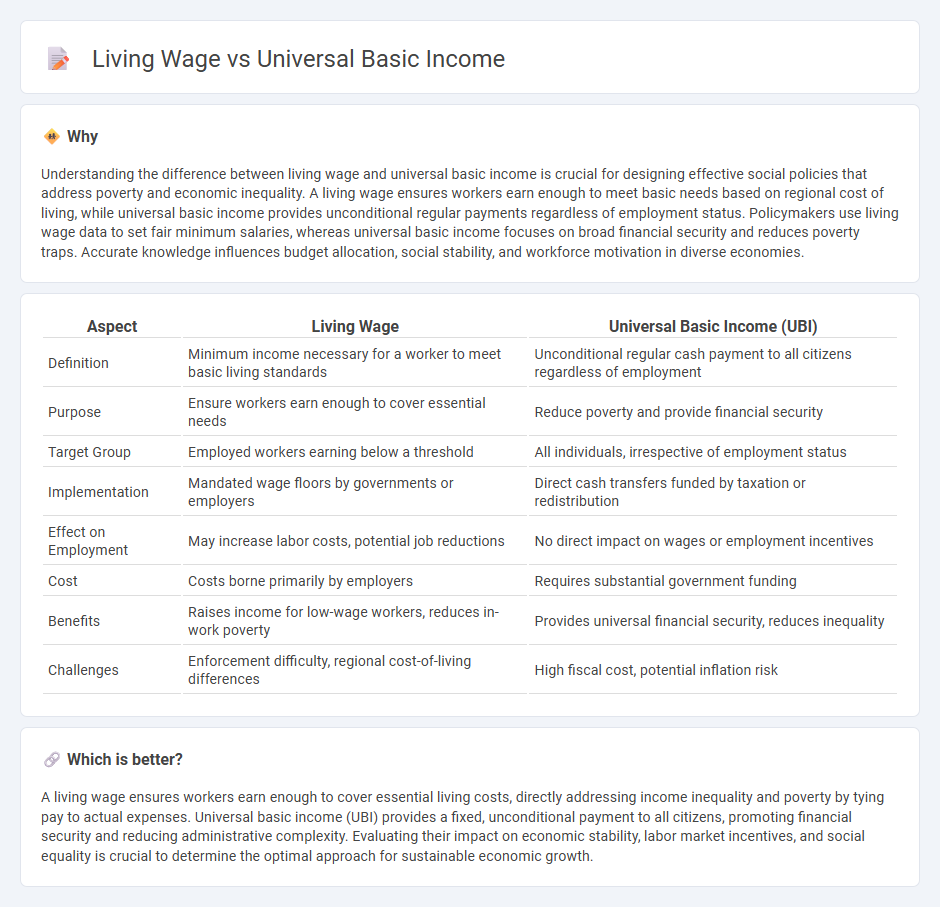

Understanding the difference between living wage and universal basic income is crucial for designing effective social policies that address poverty and economic inequality. A living wage ensures workers earn enough to meet basic needs based on regional cost of living, while universal basic income provides unconditional regular payments regardless of employment status. Policymakers use living wage data to set fair minimum salaries, whereas universal basic income focuses on broad financial security and reduces poverty traps. Accurate knowledge influences budget allocation, social stability, and workforce motivation in diverse economies.

Comparison Table

| Aspect | Living Wage | Universal Basic Income (UBI) |

|---|---|---|

| Definition | Minimum income necessary for a worker to meet basic living standards | Unconditional regular cash payment to all citizens regardless of employment |

| Purpose | Ensure workers earn enough to cover essential needs | Reduce poverty and provide financial security |

| Target Group | Employed workers earning below a threshold | All individuals, irrespective of employment status |

| Implementation | Mandated wage floors by governments or employers | Direct cash transfers funded by taxation or redistribution |

| Effect on Employment | May increase labor costs, potential job reductions | No direct impact on wages or employment incentives |

| Cost | Costs borne primarily by employers | Requires substantial government funding |

| Benefits | Raises income for low-wage workers, reduces in-work poverty | Provides universal financial security, reduces inequality |

| Challenges | Enforcement difficulty, regional cost-of-living differences | High fiscal cost, potential inflation risk |

Which is better?

A living wage ensures workers earn enough to cover essential living costs, directly addressing income inequality and poverty by tying pay to actual expenses. Universal basic income (UBI) provides a fixed, unconditional payment to all citizens, promoting financial security and reducing administrative complexity. Evaluating their impact on economic stability, labor market incentives, and social equality is crucial to determine the optimal approach for sustainable economic growth.

Connection

Living wage and Universal Basic Income (UBI) are connected as both address income security by ensuring individuals can meet basic living costs; a living wage sets a minimum income from employment, while UBI provides unconditional regular payments regardless of work status. Policies promoting a living wage aim to reduce poverty through fair wages, whereas UBI supplements income to cover essentials, potentially reducing income inequality and economic insecurity. Combining living wage standards with UBI could create a comprehensive social safety net, supporting economic stability and increasing consumer spending power.

Key Terms

Income Security

Universal basic income (UBI) guarantees a fixed income for all citizens regardless of employment status, ensuring consistent income security by reducing poverty and income volatility. Living wage policies mandate a minimum wage level based on the cost of living, providing income security tied to employment but susceptible to job market fluctuations. Explore how UBI and living wage approaches differently impact long-term income security and economic stability.

Wage Floor

Universal basic income (UBI) guarantees a fixed income to all citizens regardless of employment status, setting a baseline for financial security, while a living wage sets a wage floor ensuring workers earn enough to cover basic living expenses based on local cost of living. The living wage directly targets income disparities by mandating employer-paid wages above minimum legal requirements, promoting labor market fairness. Explore further insights on how these policies impact economic equality and workforce dynamics.

Social Welfare

Universal basic income (UBI) provides a fixed amount of money to all citizens regardless of employment status, aiming to reduce poverty and economic inequality. A living wage ensures workers earn enough to meet basic living expenses, directly linking income to employment and promoting labor market participation. Explore the differences between UBI and living wage policies to understand their impacts on social welfare systems.

Source and External Links

Does universal basic income work? These countries are finding out. - England is the latest country to pilot universal basic income (UBI), with a north London and northeast England experiment providing $2,013 monthly for two years to 30 residents, as UBI has been shown to reduce poverty but remains untested on a national scale.

Universal Basic Income in the United States and Advanced Countries - A true UBI would be extremely expensive to implement nationally--for example, $12,000 per year for all US adults would cost about $3 trillion annually, nearly 75% of current federal spending, requiring major tax hikes or cuts to existing programs.

Universal basic income - Evidence suggests UBI-type programs can improve financial stability and health without significantly reducing labor supply, but more research is needed on the effects of large-scale, long-term UBI.

dowidth.com

dowidth.com