De-dollarization refers to the process where countries reduce their reliance on the US dollar for trade and reserves, favoring their national currencies or alternatives. Euroization occurs when nations adopt the euro alongside or instead of their domestic currency to stabilize inflation and enhance economic integration with the Eurozone. Explore the impacts and trends of these monetary shifts to understand their influence on global economic stability.

Why it is important

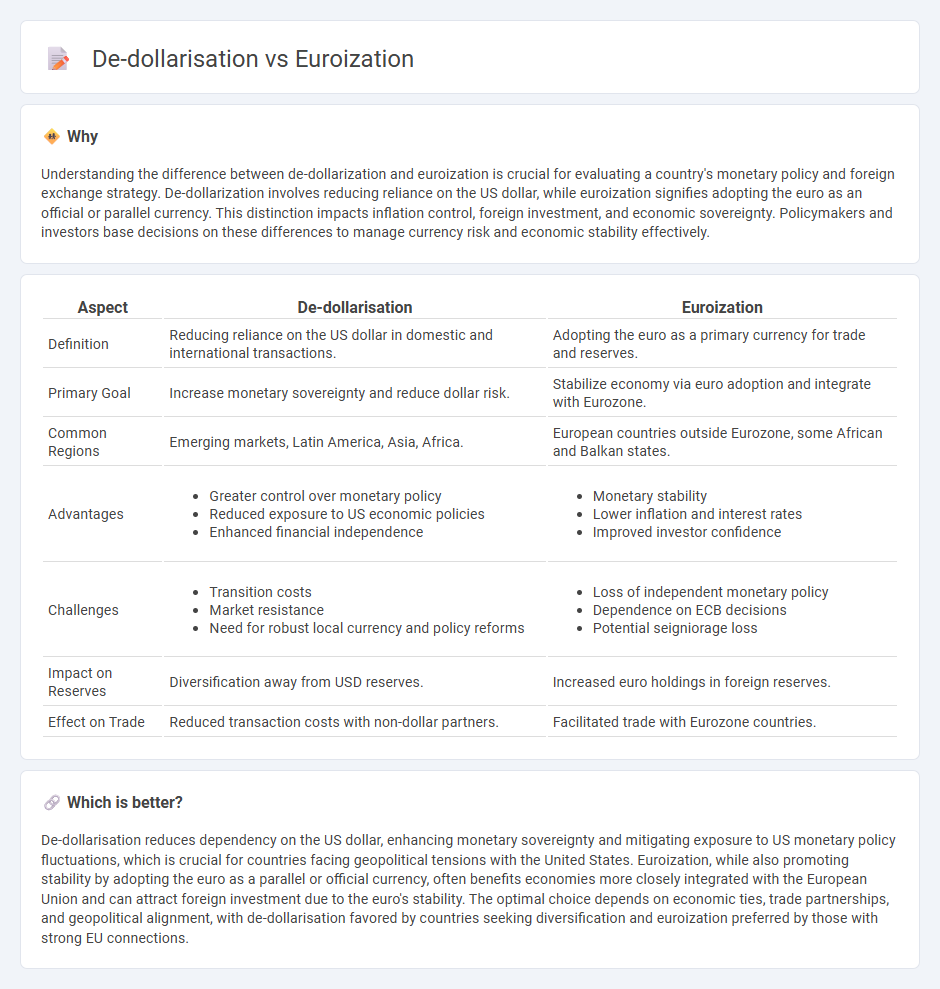

Understanding the difference between de-dollarization and euroization is crucial for evaluating a country's monetary policy and foreign exchange strategy. De-dollarization involves reducing reliance on the US dollar, while euroization signifies adopting the euro as an official or parallel currency. This distinction impacts inflation control, foreign investment, and economic sovereignty. Policymakers and investors base decisions on these differences to manage currency risk and economic stability effectively.

Comparison Table

| Aspect | De-dollarisation | Euroization |

|---|---|---|

| Definition | Reducing reliance on the US dollar in domestic and international transactions. | Adopting the euro as a primary currency for trade and reserves. |

| Primary Goal | Increase monetary sovereignty and reduce dollar risk. | Stabilize economy via euro adoption and integrate with Eurozone. |

| Common Regions | Emerging markets, Latin America, Asia, Africa. | European countries outside Eurozone, some African and Balkan states. |

| Advantages |

|

|

| Challenges |

|

|

| Impact on Reserves | Diversification away from USD reserves. | Increased euro holdings in foreign reserves. |

| Effect on Trade | Reduced transaction costs with non-dollar partners. | Facilitated trade with Eurozone countries. |

Which is better?

De-dollarisation reduces dependency on the US dollar, enhancing monetary sovereignty and mitigating exposure to US monetary policy fluctuations, which is crucial for countries facing geopolitical tensions with the United States. Euroization, while also promoting stability by adopting the euro as a parallel or official currency, often benefits economies more closely integrated with the European Union and can attract foreign investment due to the euro's stability. The optimal choice depends on economic ties, trade partnerships, and geopolitical alignment, with de-dollarisation favored by countries seeking diversification and euroization preferred by those with strong EU connections.

Connection

De-dollarisation and euroization both involve shifting a country's reliance away from the US dollar toward alternative currencies like the euro, affecting global financial stability and monetary policy. Countries practicing de-dollarisation reduce dollar-denominated debt and reserves, while euroization increases the euro's use in domestic transactions and savings. This interconnected trend reshapes international trade patterns and influences currency exchange rates, impacting economic sovereignty and inflation control.

Key Terms

Currency Substitution

Currency substitution occurs when residents of a country use a foreign currency alongside or instead of the domestic currency for transactions and savings, impacting monetary policy effectiveness. Euroization refers specifically to the adoption of the euro as the foreign currency, while de-dollarization involves reducing reliance on the US dollar in favor of alternative currencies or the local currency. Explore the dynamics and implications of currency substitution to understand the strategic shifts in global monetary ecosystems.

Monetary Sovereignty

Euroization refers to a country's adoption of the euro as its official currency or parallel legal tender, enhancing monetary stability but often limiting independent monetary policy. De-dollarisation involves reducing reliance on the US dollar in international trade and finance to regain monetary sovereignty and mitigate external economic influence. Explore how nations balance monetary sovereignty through euroization and de-dollarisation strategies.

Exchange Rate Regime

Euroization involves adopting the euro as the official currency or using it extensively in domestic transactions, leading to a fixed or highly stable exchange rate regime that reduces currency risk and inflation volatility. In contrast, de-dollarisation refers to efforts by countries to reduce reliance on the US dollar in their financial systems and trade, often resulting in more flexible exchange rate regimes that allow for greater monetary policy autonomy. Explore more about how these contrasting approaches impact economic stability and fiscal sovereignty.

Source and External Links

Euroization Drivers and Effective Policy Response - Euroization refers to the use of the euro as a de facto currency in a country where it is not legal tender, typically arising as a response to macroeconomic instability, exchange rate depreciation, or as a portfolio optimization choice by economic agents seeking to minimize risks.

Dollarization and Euroization: A Post-Keynesian Institutional Perspective - Euroized countries lose monetary and exchange rate policy autonomy, face vulnerability to asymmetric shocks, and rely heavily on trade and investment links with the euro area, which impacts their growth and economic adjustment capacities.

De-euroization Package - High euroization levels reduce the effectiveness of domestic monetary and fiscal policies, limit exchange rate flexibility as a shock absorber, increase exposure to exchange rate volatility and financial risks, and impose costs on central banks from maintaining foreign reserves and losing seigniorage.

dowidth.com

dowidth.com