Revenge spending occurs when consumers increase their expenditure sharply after a period of restricted spending, often following economic downturns or crises. Catch-up growth refers to the rapid economic expansion experienced by developing economies as they adopt advanced technologies and improve productivity to close the gap with developed nations. Explore the dynamics and impacts of revenge spending and catch-up growth to better understand modern economic recovery trends.

Why it is important

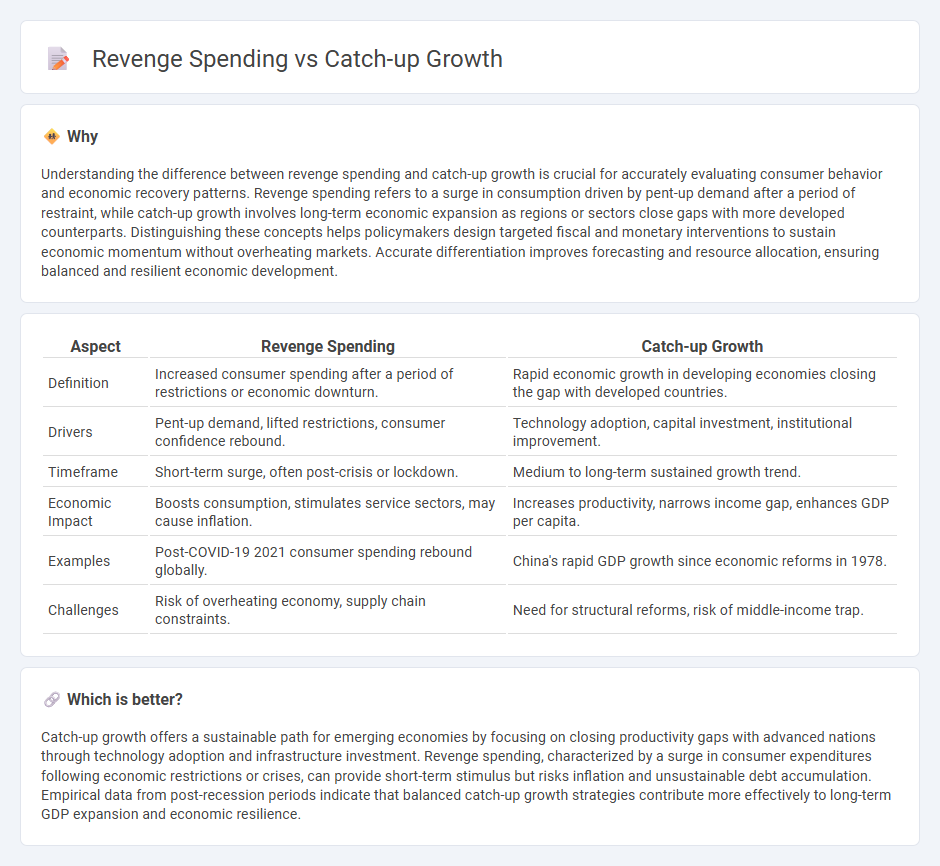

Understanding the difference between revenge spending and catch-up growth is crucial for accurately evaluating consumer behavior and economic recovery patterns. Revenge spending refers to a surge in consumption driven by pent-up demand after a period of restraint, while catch-up growth involves long-term economic expansion as regions or sectors close gaps with more developed counterparts. Distinguishing these concepts helps policymakers design targeted fiscal and monetary interventions to sustain economic momentum without overheating markets. Accurate differentiation improves forecasting and resource allocation, ensuring balanced and resilient economic development.

Comparison Table

| Aspect | Revenge Spending | Catch-up Growth |

|---|---|---|

| Definition | Increased consumer spending after a period of restrictions or economic downturn. | Rapid economic growth in developing economies closing the gap with developed countries. |

| Drivers | Pent-up demand, lifted restrictions, consumer confidence rebound. | Technology adoption, capital investment, institutional improvement. |

| Timeframe | Short-term surge, often post-crisis or lockdown. | Medium to long-term sustained growth trend. |

| Economic Impact | Boosts consumption, stimulates service sectors, may cause inflation. | Increases productivity, narrows income gap, enhances GDP per capita. |

| Examples | Post-COVID-19 2021 consumer spending rebound globally. | China's rapid GDP growth since economic reforms in 1978. |

| Challenges | Risk of overheating economy, supply chain constraints. | Need for structural reforms, risk of middle-income trap. |

Which is better?

Catch-up growth offers a sustainable path for emerging economies by focusing on closing productivity gaps with advanced nations through technology adoption and infrastructure investment. Revenge spending, characterized by a surge in consumer expenditures following economic restrictions or crises, can provide short-term stimulus but risks inflation and unsustainable debt accumulation. Empirical data from post-recession periods indicate that balanced catch-up growth strategies contribute more effectively to long-term GDP expansion and economic resilience.

Connection

Revenge spending drives economic recovery by increasing consumer demand after prolonged periods of financial restraint, fueling catch-up growth in sectors such as retail, hospitality, and travel. This surge in expenditure helps close output gaps created during downturns, accelerating GDP growth and employment rates. Strong consumer confidence and pent-up savings are key factors linking revenge spending to rapid economic catch-up following recessions or crises.

Key Terms

Convergence

Catch-up growth refers to the accelerated economic expansion experienced by developing countries as they adopt advanced technologies and practices from developed nations, promoting convergence in income levels. Revenge spending describes the surge in consumer expenditures post-crisis, which can stimulate short-term demand but may not lead to sustainable economic convergence. Explore the dynamics of how catch-up growth and revenge spending drive economic convergence and disparities.

Consumption

Catch-up growth refers to the accelerated economic expansion in consumption following a period of constrained spending, often seen after economic downturns or crises. Revenge spending, a subset of this phenomenon, highlights consumers' tendency to increase discretionary purchases aggressively to compensate for previously restricted consumption opportunities, driving strong demand in sectors like travel, dining, and retail. Explore deeper insights into how these consumption behaviors shape economic recovery and market trends.

Pent-up demand

Pent-up demand drives both catch-up growth and revenge spending, with consumers rapidly increasing purchases after prolonged restrictions or economic downturns. Catch-up growth reflects sustained economic recovery as individuals and businesses restore consumption and investment to pre-crisis levels. Explore how these dynamics reshape market trends and influence future economic forecasts.

Source and External Links

Catch-up growth in stunted children: Definitions and predictors - Catch-up growth is defined as an improvement in height-for-age z-score (HAZ), reflecting a child's height becoming less of an outlier compared to healthy population norms, which can occur even if the absolute height deficit remains the same or widens more slowly than the standard deviation increases with age.

Catch-up growth - Catch-up growth is a phenomenon seen in young children after growth retardation when the cause of the deficit is removed, characterized by a period of accelerated growth that gradually slows until normal growth rates are restored, and is more likely in infants and younger children than those near puberty.

Catch-up growth cannot undo damage from undernutrition - Catch-up growth requires that children grow faster than expected for their age and sex after a period of growth inhibition, but while it can reverse linear growth retardation, it may not fully recover other consequences of undernutrition such as neurocognitive delays or chronic disease risks.

dowidth.com

dowidth.com