Price gouging occurs when sellers increase prices to an unfair level during emergencies, exploiting urgent consumer demand. Monopoly pricing involves a single firm controlling the market, setting prices above competitive levels to maximize profits without immediate external constraints. Explore the nuanced differences and economic impacts of these pricing strategies to understand their roles in market dynamics.

Why it is important

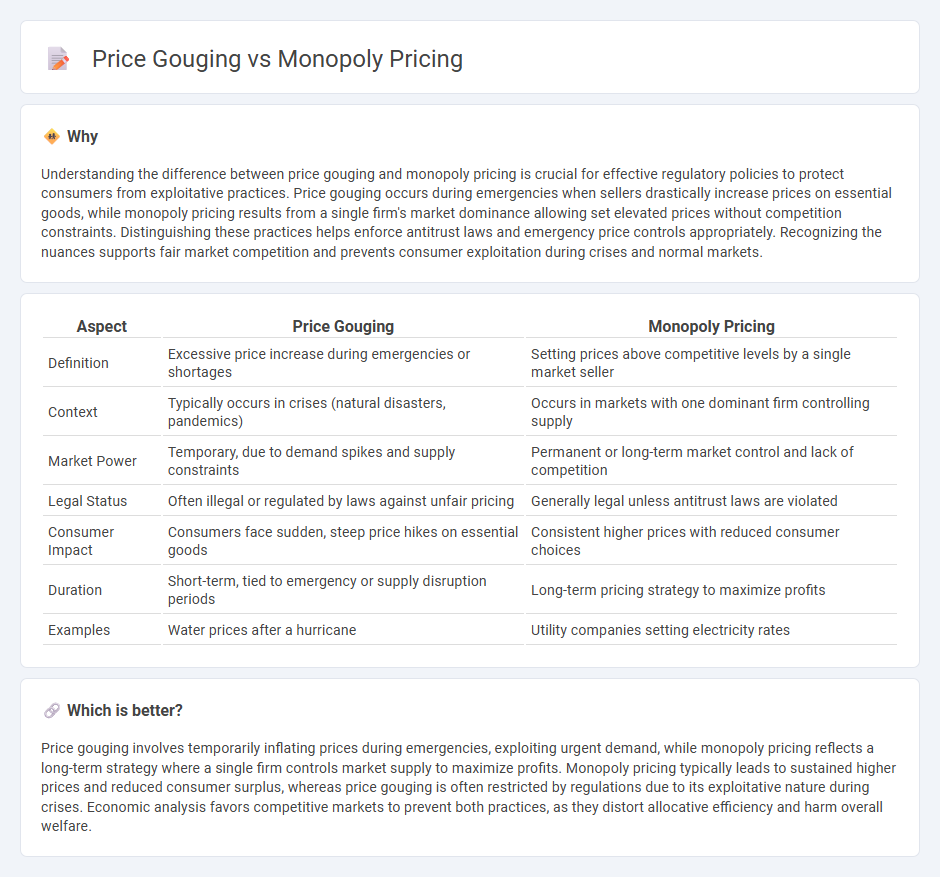

Understanding the difference between price gouging and monopoly pricing is crucial for effective regulatory policies to protect consumers from exploitative practices. Price gouging occurs during emergencies when sellers drastically increase prices on essential goods, while monopoly pricing results from a single firm's market dominance allowing set elevated prices without competition constraints. Distinguishing these practices helps enforce antitrust laws and emergency price controls appropriately. Recognizing the nuances supports fair market competition and prevents consumer exploitation during crises and normal markets.

Comparison Table

| Aspect | Price Gouging | Monopoly Pricing |

|---|---|---|

| Definition | Excessive price increase during emergencies or shortages | Setting prices above competitive levels by a single market seller |

| Context | Typically occurs in crises (natural disasters, pandemics) | Occurs in markets with one dominant firm controlling supply |

| Market Power | Temporary, due to demand spikes and supply constraints | Permanent or long-term market control and lack of competition |

| Legal Status | Often illegal or regulated by laws against unfair pricing | Generally legal unless antitrust laws are violated |

| Consumer Impact | Consumers face sudden, steep price hikes on essential goods | Consistent higher prices with reduced consumer choices |

| Duration | Short-term, tied to emergency or supply disruption periods | Long-term pricing strategy to maximize profits |

| Examples | Water prices after a hurricane | Utility companies setting electricity rates |

Which is better?

Price gouging involves temporarily inflating prices during emergencies, exploiting urgent demand, while monopoly pricing reflects a long-term strategy where a single firm controls market supply to maximize profits. Monopoly pricing typically leads to sustained higher prices and reduced consumer surplus, whereas price gouging is often restricted by regulations due to its exploitative nature during crises. Economic analysis favors competitive markets to prevent both practices, as they distort allocative efficiency and harm overall welfare.

Connection

Price gouging and monopoly pricing both involve artificially inflated prices that exploit market power to maximize profits. While price gouging typically occurs in emergency situations where demand spikes and competition is limited, monopoly pricing happens when a single firm dominates the market, restricting supply to set high prices. Both practices undermine consumer welfare by reducing accessibility and affordability of essential goods and services.

Key Terms

Market Power

Monopoly pricing occurs when a firm with significant market power sets prices above competitive levels to maximize profits without necessarily exploiting consumers unfairly. Price gouging refers to the rapid increase of prices by sellers during emergencies, often exploiting consumers' urgent needs despite not having sustained market power. Explore the distinctions and implications of market power in these pricing strategies to understand their economic and ethical impacts.

Price Discrimination

Monopoly pricing involves a single seller setting prices above competitive levels to maximize profits, often using price discrimination to charge different prices based on consumer segments or willingness to pay. Price gouging occurs during emergencies, where sellers exploit urgent demand by imposing excessively high prices, typically without sophisticated price discrimination strategies. Explore how varying price discrimination techniques distinguish lawful monopoly pricing from unethical price gouging practices.

Supply Constraints

Monopoly pricing occurs when a single supplier controls the market, setting prices above competitive levels due to limited supply and lack of alternatives. Price gouging happens during acute supply constraints, such as emergencies, where sellers exploit scarcity to charge excessively high prices beyond normal market margins. Explore the distinctions between these pricing behaviors and their impact on consumers and markets.

Source and External Links

Monopoly price - Wikipedia - A monopoly sets a price above marginal cost by choosing a quantity where marginal revenue equals marginal cost, maximizing economic profit without competition.

Lecture Note 3: Monopoly Pricing - Monopolists price where demand is elastic and use the markup formula \( \frac{p - MC}{MC} = -\frac{1}{1 + \varepsilon} \), ensuring prices always exceed marginal cost if demand elasticity is less than -1.

Chapter 3. Monopoly and Market Power - The optimal monopoly markup depends on demand elasticity; for example, if elasticity is -2, the monopoly price is twice the marginal cost, illustrating how market power influences prices.

dowidth.com

dowidth.com