Vibe shift and sector rotation are pivotal concepts influencing economic trends and investment strategies. Vibe shift captures evolving consumer preferences and cultural changes that drive demand across industries, while sector rotation refers to the deliberate shift of investment capital among different economic sectors to capitalize on market cycles. Explore how these dynamics interact to shape the economy and inform smart investment decisions.

Why it is important

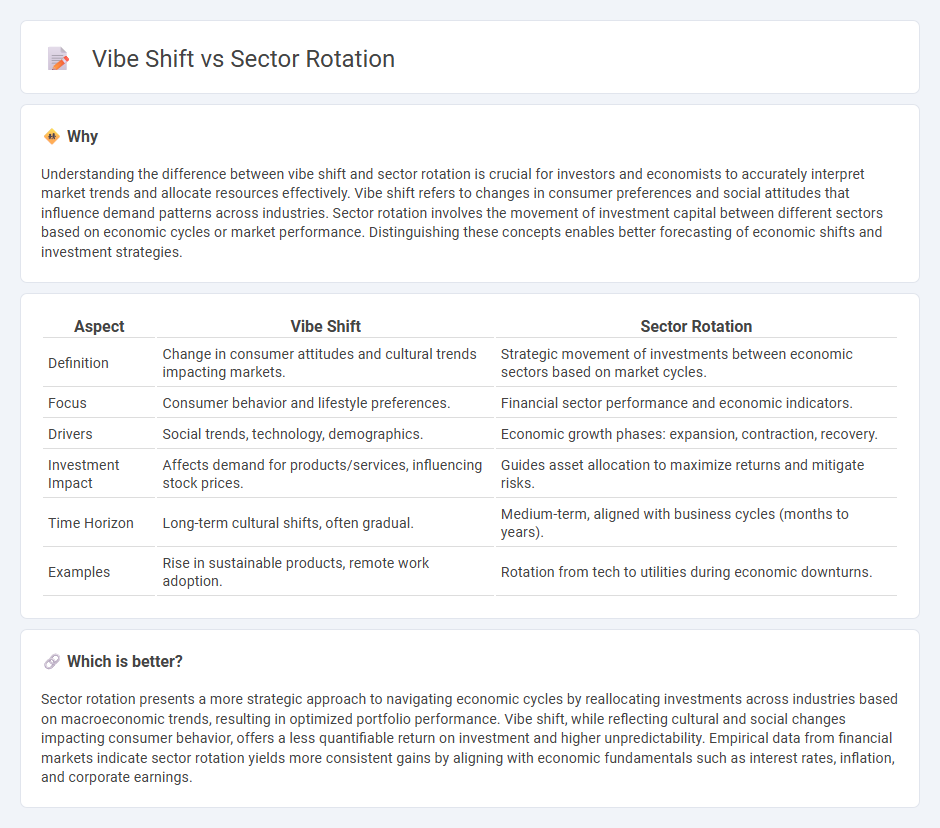

Understanding the difference between vibe shift and sector rotation is crucial for investors and economists to accurately interpret market trends and allocate resources effectively. Vibe shift refers to changes in consumer preferences and social attitudes that influence demand patterns across industries. Sector rotation involves the movement of investment capital between different sectors based on economic cycles or market performance. Distinguishing these concepts enables better forecasting of economic shifts and investment strategies.

Comparison Table

| Aspect | Vibe Shift | Sector Rotation |

|---|---|---|

| Definition | Change in consumer attitudes and cultural trends impacting markets. | Strategic movement of investments between economic sectors based on market cycles. |

| Focus | Consumer behavior and lifestyle preferences. | Financial sector performance and economic indicators. |

| Drivers | Social trends, technology, demographics. | Economic growth phases: expansion, contraction, recovery. |

| Investment Impact | Affects demand for products/services, influencing stock prices. | Guides asset allocation to maximize returns and mitigate risks. |

| Time Horizon | Long-term cultural shifts, often gradual. | Medium-term, aligned with business cycles (months to years). |

| Examples | Rise in sustainable products, remote work adoption. | Rotation from tech to utilities during economic downturns. |

Which is better?

Sector rotation presents a more strategic approach to navigating economic cycles by reallocating investments across industries based on macroeconomic trends, resulting in optimized portfolio performance. Vibe shift, while reflecting cultural and social changes impacting consumer behavior, offers a less quantifiable return on investment and higher unpredictability. Empirical data from financial markets indicate sector rotation yields more consistent gains by aligning with economic fundamentals such as interest rates, inflation, and corporate earnings.

Connection

Vibe shift influences investor sentiment, prompting a reevaluation of market priorities and triggering sector rotation as capital moves from overvalued sectors to emerging opportunities. This dynamic drives changes in asset allocation, impacting economic growth patterns and stock market performance. Understanding the interplay between vibe shift and sector rotation helps predict shifts in investment trends and economic cycles.

Key Terms

Business Cycle

Sector rotation aligns investment strategies with phases of the business cycle, optimizing returns by shifting capital into sectors poised for growth during economic expansions or contractions. Vibe shift reflects broader market sentiment and cultural trends influencing investor behavior, often independent of traditional economic indicators. Explore deeper insights into how sector rotation and vibe shifts impact portfolio management throughout business cycles.

Market Sentiment

Sector rotation involves investors reallocating assets based on economic cycles and market indicators to optimize returns, whereas a vibe shift reflects broader changes in investor sentiment and cultural trends impacting market behavior. Market sentiment drives both strategies, influencing which sectors attract capital due to perceived growth or risk, with sector rotation grounded in fundamental analysis and vibe shifts often linked to social and psychological factors. Explore deeper insights into how market sentiment shapes investment strategies and the interplay between sector rotation and vibe shifts.

Asset Allocation

Sector rotation strategically reallocates investments among industries like technology, healthcare, and energy to capitalize on economic cycles and market trends, optimizing asset allocation for growth and risk management. Vibe shift reflects changing investor sentiment and consumer behavior influencing market preferences, often driving momentum in trending sectors and thematic investments. Explore how integrating sector rotation and vibe shift insights can enhance your asset allocation strategy.

Source and External Links

Sector Rotation Strategies - Fidelity Investments - Sector rotation is an investing approach where you shift allocations among stock market sectors based on the economy's business cycle, aiming to capitalize on sectors expected to outperform in each phase.

Sector Rotation Analysis - ChartSchool - StockCharts.com - Sector rotation links market sector performance to the business cycle, with different sectors leading at various stages, such as technology early in recovery and materials/energy near the peak.

A Stock Market Rotation Is Underway. Will It Last? - Morningstar - Market rotations involve investors moving from recently strong sectors (like tech) into lagging ones (like materials or healthcare), often driven by shifting valuations and economic outlooks.

dowidth.com

dowidth.com