Revenge spending refers to the surge in consumer purchases following periods of economic or social restriction, driven by pent-up demand and a desire to regain normalcy. In contrast, hoarding involves accumulating goods or money as a protective measure against economic uncertainty, often resulting in reduced market circulation and slower economic growth. Explore more insights into how these opposing behaviors shape economic recovery and consumer trends.

Why it is important

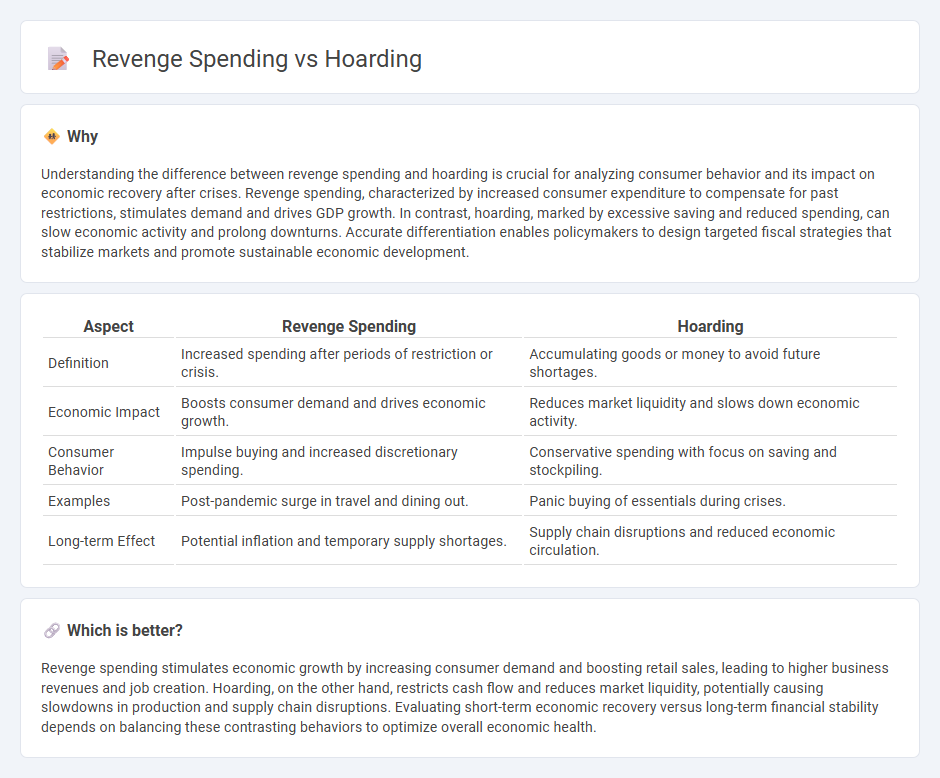

Understanding the difference between revenge spending and hoarding is crucial for analyzing consumer behavior and its impact on economic recovery after crises. Revenge spending, characterized by increased consumer expenditure to compensate for past restrictions, stimulates demand and drives GDP growth. In contrast, hoarding, marked by excessive saving and reduced spending, can slow economic activity and prolong downturns. Accurate differentiation enables policymakers to design targeted fiscal strategies that stabilize markets and promote sustainable economic development.

Comparison Table

| Aspect | Revenge Spending | Hoarding |

|---|---|---|

| Definition | Increased spending after periods of restriction or crisis. | Accumulating goods or money to avoid future shortages. |

| Economic Impact | Boosts consumer demand and drives economic growth. | Reduces market liquidity and slows down economic activity. |

| Consumer Behavior | Impulse buying and increased discretionary spending. | Conservative spending with focus on saving and stockpiling. |

| Examples | Post-pandemic surge in travel and dining out. | Panic buying of essentials during crises. |

| Long-term Effect | Potential inflation and temporary supply shortages. | Supply chain disruptions and reduced economic circulation. |

Which is better?

Revenge spending stimulates economic growth by increasing consumer demand and boosting retail sales, leading to higher business revenues and job creation. Hoarding, on the other hand, restricts cash flow and reduces market liquidity, potentially causing slowdowns in production and supply chain disruptions. Evaluating short-term economic recovery versus long-term financial stability depends on balancing these contrasting behaviors to optimize overall economic health.

Connection

Revenge spending, driven by pent-up demand and a desire to regain control post-crisis, often leads consumers to rapidly increase expenditures on luxury goods and experiences. Hoarding behavior, characterized by stockpiling essential items due to fear of scarcity, reflects consumer uncertainty and disrupts supply chains. Both phenomena influence economic recovery patterns by altering consumption habits and creating volatility in market demand and inventory levels.

Key Terms

Consumer Behavior

Consumer behavior reveals distinct psychological drivers behind hoarding and revenge spending, where hoarding often stems from anxiety and uncertainty, leading individuals to stockpile essential goods. Revenge spending, conversely, represents a compensatory mechanism, with consumers indulging in discretionary purchases to regain a sense of control and pleasure after periods of restriction. Explore comprehensive insights into these contrasting behaviors to understand their impact on market trends and personal finance.

Liquidity Trap

Hoarding and revenge spending both significantly impact consumer behavior during a liquidity trap, where low interest rates fail to stimulate demand. Hoarding increases cash reserves as consumers fear economic uncertainty, reducing overall spending and deepening deflationary pressures. Explore how these contrasting responses influence monetary policy effectiveness and economic recovery strategies.

Marginal Propensity to Consume

Hoarding refers to accumulating wealth or goods instead of spending, leading to a lower Marginal Propensity to Consume (MPC), while revenge spending involves increased consumption to compensate for past deprivation, raising the MPC. Economic studies indicate that revenge spending significantly boosts consumer demand, driving short-term economic growth, whereas hoarding dampens consumption and economic activity. Explore the behavioral drivers and economic impacts of these contrasting spending patterns to understand consumption dynamics better.

Source and External Links

Hoarding - Wikipedia - Hoarding is the act of excessive acquisition of items not needed or without space, often linked to anxiety about shortages; it may involve collecting valuables or survival supplies and can be associated with anthropomorphism and age or gender differences.

Hoarding | Fact Sheet - ABCT - Hoarding disorder is characterized by difficulty discarding items, clutter that disrupts living spaces, and distress in daily activities, with signs including inability to rid of useless items, clutter, embarrassment, and refusal of help.

Hoarding disorder - NHS - Hoarding disorder involves disorganized, excessive accumulation of items often with little value, causing clutter that impairs function and relationships; it differs from collecting by lack of organization and accessibility.

dowidth.com

dowidth.com