Greenflation refers to rising prices driven by increased costs of environmentally sustainable goods and energy transition efforts, impacting supply chains and consumer expenses. Hyperinflation involves an extremely rapid and uncontrolled rise in general price levels, often due to excessive money supply growth or economic instability, severely devaluing currency and eroding purchasing power. Explore the key differences and economic implications of greenflation versus hyperinflation to understand their effects on markets and policy.

Why it is important

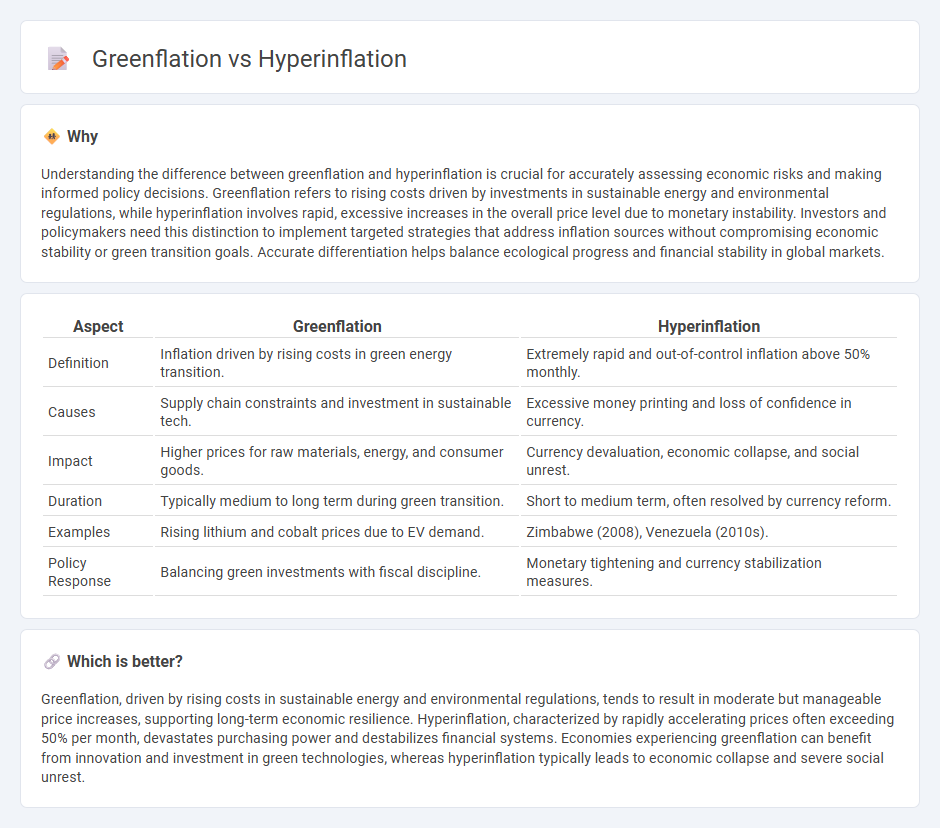

Understanding the difference between greenflation and hyperinflation is crucial for accurately assessing economic risks and making informed policy decisions. Greenflation refers to rising costs driven by investments in sustainable energy and environmental regulations, while hyperinflation involves rapid, excessive increases in the overall price level due to monetary instability. Investors and policymakers need this distinction to implement targeted strategies that address inflation sources without compromising economic stability or green transition goals. Accurate differentiation helps balance ecological progress and financial stability in global markets.

Comparison Table

| Aspect | Greenflation | Hyperinflation |

|---|---|---|

| Definition | Inflation driven by rising costs in green energy transition. | Extremely rapid and out-of-control inflation above 50% monthly. |

| Causes | Supply chain constraints and investment in sustainable tech. | Excessive money printing and loss of confidence in currency. |

| Impact | Higher prices for raw materials, energy, and consumer goods. | Currency devaluation, economic collapse, and social unrest. |

| Duration | Typically medium to long term during green transition. | Short to medium term, often resolved by currency reform. |

| Examples | Rising lithium and cobalt prices due to EV demand. | Zimbabwe (2008), Venezuela (2010s). |

| Policy Response | Balancing green investments with fiscal discipline. | Monetary tightening and currency stabilization measures. |

Which is better?

Greenflation, driven by rising costs in sustainable energy and environmental regulations, tends to result in moderate but manageable price increases, supporting long-term economic resilience. Hyperinflation, characterized by rapidly accelerating prices often exceeding 50% per month, devastates purchasing power and destabilizes financial systems. Economies experiencing greenflation can benefit from innovation and investment in green technologies, whereas hyperinflation typically leads to economic collapse and severe social unrest.

Connection

Greenflation, driven by rising costs in renewable energy and sustainable resources, fuels overall price increases in key sectors contributing to inflationary pressures. Hyperinflation occurs when these inflationary forces accelerate uncontrollably, often exacerbated by excessive monetary supply and loss of confidence in currency stability. The interconnection lies in greenflation acting as a catalyst that, combined with fiscal mismanagement, can escalate into hyperinflation scenarios, severely impacting economic stability.

Key Terms

Money Supply

Hyperinflation occurs when the money supply expands rapidly, causing prices to surge uncontrollably due to excessive currency in circulation overwhelming the economy. Greenflation refers to rising prices driven by increased costs of raw materials and energy as economies transition to sustainable practices, often influenced by policies limiting fossil fuel use and promoting renewable energy. Explore further to understand how money supply dynamics uniquely impact these inflationary pressures.

Commodity Prices

Hyperinflation causes rapid and uncontrolled increases in commodity prices due to excessive money supply and loss of confidence in currency value. Greenflation, driven by the global transition to sustainable energy and stricter environmental regulations, leads to higher costs for raw materials like metals and energy commodities essential for clean technologies. Explore the detailed impacts of these inflationary pressures on commodity markets to understand future economic challenges.

Purchasing Power

Hyperinflation drastically erodes purchasing power as prices skyrocket uncontrollably, leading to a rapid decrease in the real value of money and savings. Greenflation, driven by the rising costs of sustainable materials and carbon reduction efforts, causes a gradual increase in prices affecting purchasing power over time, especially in energy and consumer goods sectors. Explore the impacts of these inflation types on your financial decisions and long-term value preservation.

Source and External Links

Hyperinflation | EBSCO Research Starters - Hyperinflation is a severe economic condition defined by an inflation rate exceeding 50% per month, caused by excessive money printing without economic growth, leading to rapid price increases and currency devaluation, with historical examples including post-WWI Germany and Zimbabwe.

Hyperinflation - Wikipedia - Hyperinflation is very high and accelerating inflation eroding currency value rapidly, often following government budget stress or sociopolitical crises, prompting people to abandon the local currency and sometimes leading to solutions like dollarization or capital controls.

Hyperinflation: Definition, Causes, Effects and Examples - Hyperinflation is generally defined as monthly price increases above 50%, occurring when public confidence in government and currency collapses, often due to political upheaval; it destroys currency value and requires replacement with a new stable currency to restore control.

dowidth.com

dowidth.com