Neobank stacking leverages digital-first banks to offer integrated financial services, enhancing convenience and customization for users. Peer-to-peer lending connects borrowers directly with investors, bypassing traditional financial institutions to provide competitive interest rates and increased accessibility. Explore these innovative economic models to understand their impact on the future of personal finance.

Why it is important

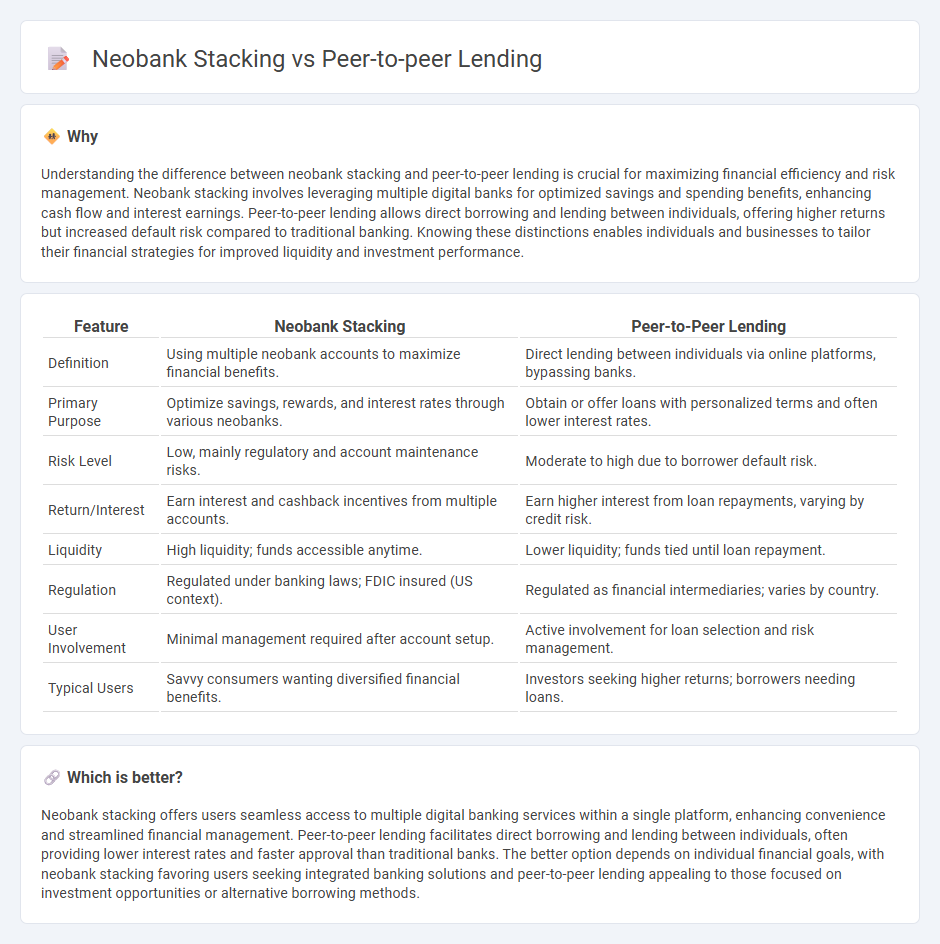

Understanding the difference between neobank stacking and peer-to-peer lending is crucial for maximizing financial efficiency and risk management. Neobank stacking involves leveraging multiple digital banks for optimized savings and spending benefits, enhancing cash flow and interest earnings. Peer-to-peer lending allows direct borrowing and lending between individuals, offering higher returns but increased default risk compared to traditional banking. Knowing these distinctions enables individuals and businesses to tailor their financial strategies for improved liquidity and investment performance.

Comparison Table

| Feature | Neobank Stacking | Peer-to-Peer Lending |

|---|---|---|

| Definition | Using multiple neobank accounts to maximize financial benefits. | Direct lending between individuals via online platforms, bypassing banks. |

| Primary Purpose | Optimize savings, rewards, and interest rates through various neobanks. | Obtain or offer loans with personalized terms and often lower interest rates. |

| Risk Level | Low, mainly regulatory and account maintenance risks. | Moderate to high due to borrower default risk. |

| Return/Interest | Earn interest and cashback incentives from multiple accounts. | Earn higher interest from loan repayments, varying by credit risk. |

| Liquidity | High liquidity; funds accessible anytime. | Lower liquidity; funds tied until loan repayment. |

| Regulation | Regulated under banking laws; FDIC insured (US context). | Regulated as financial intermediaries; varies by country. |

| User Involvement | Minimal management required after account setup. | Active involvement for loan selection and risk management. |

| Typical Users | Savvy consumers wanting diversified financial benefits. | Investors seeking higher returns; borrowers needing loans. |

Which is better?

Neobank stacking offers users seamless access to multiple digital banking services within a single platform, enhancing convenience and streamlined financial management. Peer-to-peer lending facilitates direct borrowing and lending between individuals, often providing lower interest rates and faster approval than traditional banks. The better option depends on individual financial goals, with neobank stacking favoring users seeking integrated banking solutions and peer-to-peer lending appealing to those focused on investment opportunities or alternative borrowing methods.

Connection

Neobank stacking leverages multiple digital banks to optimize financial management, enhancing access to diverse lending products while peer-to-peer lending facilitates direct borrower-investor connections bypassing traditional banks. Both models disrupt conventional banking by promoting financial inclusivity and reducing intermediaries, leading to more competitive interest rates and personalized lending solutions. The synergy between neobank platforms and peer-to-peer networks creates an integrated ecosystem that empowers users through streamlined lending processes and flexible credit options.

Key Terms

Disintermediation

Peer-to-peer lending platforms eliminate traditional financial intermediaries by directly connecting borrowers with investors, reducing costs and increasing efficiency in loan transactions. Neobank stacking involves leveraging multiple digital banks to optimize financial services but still relies on underlying banking infrastructure and intermediaries. Explore the nuances of disintermediation in these financial models to understand their impact on the future of lending and banking innovation.

Alternative Credit Scoring

Peer-to-peer lending platforms leverage alternative credit scoring models by analyzing non-traditional data points such as social media activity, utility payments, and transaction histories to assess borrower risk more inclusively. Neobank stacking integrates multiple neobanks' financial data and user behaviors to create comprehensive, alternative credit profiles that enable accurate credit assessments for underserved consumers. Discover how alternative credit scoring innovations transform access to credit and financial inclusion by exploring this evolving landscape.

Regulatory Compliance

Peer-to-peer lending platforms and neobank stacking each face distinct regulatory compliance challenges; P2P lenders must navigate securities laws and consumer protection regulations, while neobanks are subject to banking licenses and robust anti-money laundering (AML) standards. Effective compliance strategies include regular audits, transparent disclosures, and strict adherence to Know Your Customer (KYC) protocols to ensure investor and customer protection. Explore deeper insights into regulatory frameworks shaping the fintech industry's compliance landscape.

Source and External Links

Peer-to-peer lending - Wikipedia - Peer-to-peer lending (P2P lending) is the online practice of lending money directly to individuals or businesses through platforms that match lenders and borrowers without traditional financial intermediaries, featuring services such as credit checks, payment processing, and loan servicing by the P2P company.

PEER-TO-PEER LENDING - NASAA - P2P lending is an online financial service allowing individuals and small businesses to obtain unsecured loans funded by other individuals, typically involving loan matchmaking on the internet for amounts typically between $1,000 and $25,000.

Peer to peer lending: what you need to know - MoneyHelper - P2P lending is a marketplace where people lend money to borrowers online, with lenders earning interest but facing higher risks than traditional savings accounts, emphasizing the importance of regulatory checks before lending.

dowidth.com

dowidth.com