Doom spending, often characterized by aggressive government expenditure to stimulate economic growth during crises, contrasts sharply with austerity measures that focus on reducing public debt through budget cuts and fiscal restraint. These opposing economic strategies influence unemployment rates, inflation, and long-term national debt differently, with doom spending potentially boosting demand while austerity aims at fiscal stability. Explore the nuanced impacts of doom spending versus austerity to understand their roles in economic recovery and stability.

Why it is important

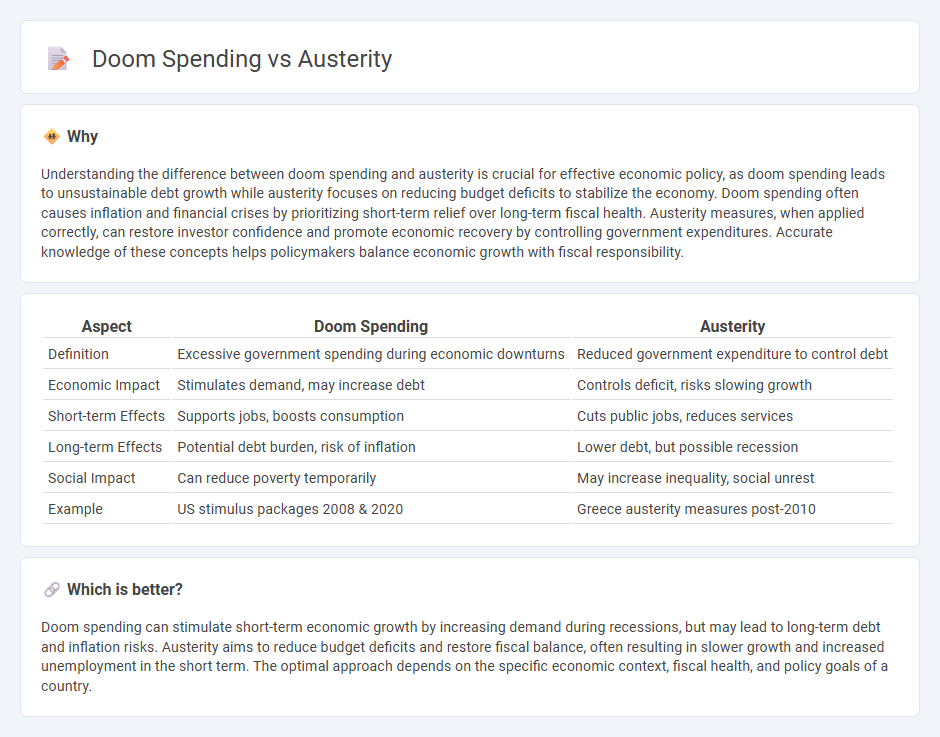

Understanding the difference between doom spending and austerity is crucial for effective economic policy, as doom spending leads to unsustainable debt growth while austerity focuses on reducing budget deficits to stabilize the economy. Doom spending often causes inflation and financial crises by prioritizing short-term relief over long-term fiscal health. Austerity measures, when applied correctly, can restore investor confidence and promote economic recovery by controlling government expenditures. Accurate knowledge of these concepts helps policymakers balance economic growth with fiscal responsibility.

Comparison Table

| Aspect | Doom Spending | Austerity |

|---|---|---|

| Definition | Excessive government spending during economic downturns | Reduced government expenditure to control debt |

| Economic Impact | Stimulates demand, may increase debt | Controls deficit, risks slowing growth |

| Short-term Effects | Supports jobs, boosts consumption | Cuts public jobs, reduces services |

| Long-term Effects | Potential debt burden, risk of inflation | Lower debt, but possible recession |

| Social Impact | Can reduce poverty temporarily | May increase inequality, social unrest |

| Example | US stimulus packages 2008 & 2020 | Greece austerity measures post-2010 |

Which is better?

Doom spending can stimulate short-term economic growth by increasing demand during recessions, but may lead to long-term debt and inflation risks. Austerity aims to reduce budget deficits and restore fiscal balance, often resulting in slower growth and increased unemployment in the short term. The optimal approach depends on the specific economic context, fiscal health, and policy goals of a country.

Connection

Doom spending and austerity are connected through their impact on economic stability during financial crises, where doom spending involves excessive government expenditure on ineffective projects, leading to increased debt and fiscal deficits. Austerity measures respond to such fiscal imbalances by implementing strict budget cuts and reducing public services to restore debt sustainability and investor confidence. Both approaches influence economic growth, unemployment rates, and public trust in government policies, making their balanced application critical for long-term economic recovery.

Key Terms

Fiscal Policy

Fiscal policy decisions pivot between austerity, which emphasizes reducing government deficits through spending cuts and tax increases, and doom spending, characterized by excessive, unsustainable expenditure aimed at stimulating growth but risking long-term debt crises. Austerity measures often lead to short-term economic contraction but aim to restore fiscal balance, while doom spending may temporarily boost demand but can trigger inflation and undermine investor confidence. Explore the impacts of these contrasting fiscal strategies on economic stability and growth patterns for a deeper understanding.

Budget Deficit

Austerity measures aim to reduce budget deficits by cutting government spending and increasing taxes, promoting fiscal discipline and slowing debt accumulation. Doom spending, on the other hand, refers to excessive or reckless government expenditures that can exacerbate budget deficits and fuel inflationary pressures. Explore deeper insights on how these contrasting strategies impact economic stability and growth.

Government Expenditure

Government expenditure strategies oscillate between austerity, emphasizing reduced public spending to control deficits and debt, and doom spending, characterized by excessive expenditure that risks fiscal instability. Austerity policies often aim to restore investor confidence and ensure long-term economic sustainability, while doom spending may trigger inflation, currency devaluation, and increased borrowing costs. Explore the intricate impacts of these contrasting fiscal approaches on national economies and public welfare to understand their broader implications.

Source and External Links

Austerity - Wikipedia - Austerity refers to political-economic policies aimed at reducing government budget deficits through spending cuts, tax increases, or both, often leading to short-term unemployment and slower GDP growth but sometimes potentially stimulating growth when an economy is near capacity.

Austerity: a failed experiment on the people of Europe - PMC - Stringent austerity policies in Europe after the financial crisis have led to economic stagnation, rising debt-to-GDP ratios, and negative health impacts including increased suicides and reduced access to healthcare.

Austerity | Economics, Government Spending & Social Policy - Britannica - Austerity consists of tax increases, spending cuts, or a combination, used by governments to reduce budget deficits and stabilize debt, often causing short-term economic hardship but aimed at long-term fiscal balance.

dowidth.com

dowidth.com