Revenge spending occurs when consumers increase their purchases to compensate for previous financial restrictions, often boosting economic activity and retail sales. Conversely, buyer's remorse results in regretful purchases that can lead to return rates and reduced future spending. Explore the dynamics between these consumer behaviors and their impact on market trends.

Why it is important

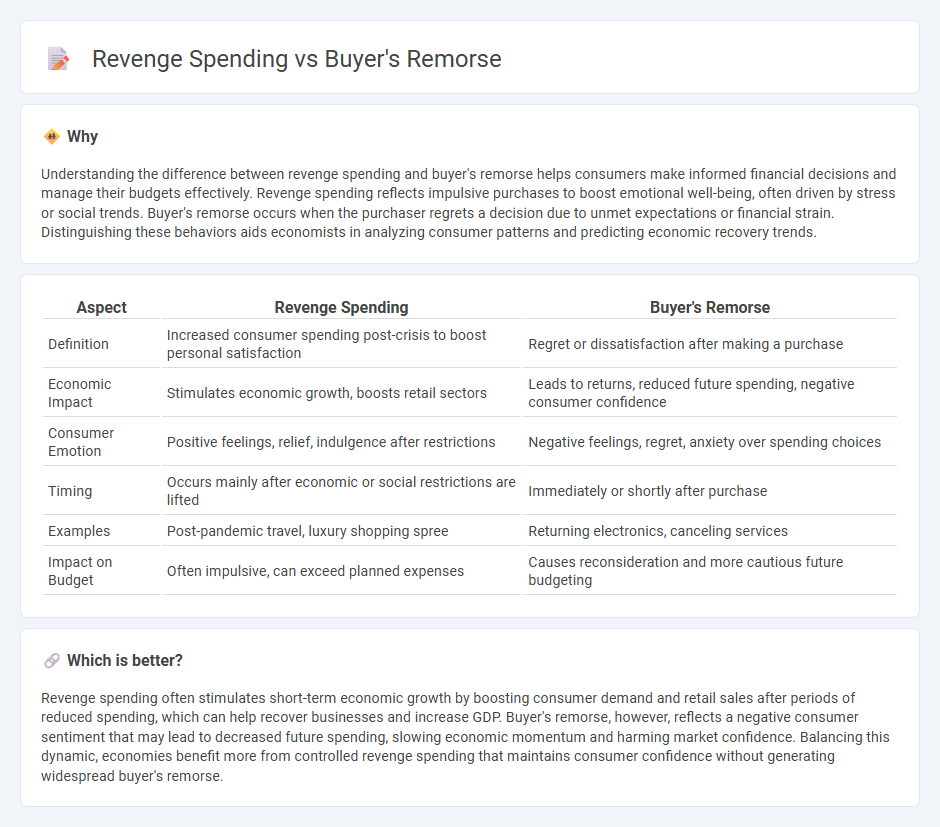

Understanding the difference between revenge spending and buyer's remorse helps consumers make informed financial decisions and manage their budgets effectively. Revenge spending reflects impulsive purchases to boost emotional well-being, often driven by stress or social trends. Buyer's remorse occurs when the purchaser regrets a decision due to unmet expectations or financial strain. Distinguishing these behaviors aids economists in analyzing consumer patterns and predicting economic recovery trends.

Comparison Table

| Aspect | Revenge Spending | Buyer's Remorse |

|---|---|---|

| Definition | Increased consumer spending post-crisis to boost personal satisfaction | Regret or dissatisfaction after making a purchase |

| Economic Impact | Stimulates economic growth, boosts retail sectors | Leads to returns, reduced future spending, negative consumer confidence |

| Consumer Emotion | Positive feelings, relief, indulgence after restrictions | Negative feelings, regret, anxiety over spending choices |

| Timing | Occurs mainly after economic or social restrictions are lifted | Immediately or shortly after purchase |

| Examples | Post-pandemic travel, luxury shopping spree | Returning electronics, canceling services |

| Impact on Budget | Often impulsive, can exceed planned expenses | Causes reconsideration and more cautious future budgeting |

Which is better?

Revenge spending often stimulates short-term economic growth by boosting consumer demand and retail sales after periods of reduced spending, which can help recover businesses and increase GDP. Buyer's remorse, however, reflects a negative consumer sentiment that may lead to decreased future spending, slowing economic momentum and harming market confidence. Balancing this dynamic, economies benefit more from controlled revenge spending that maintains consumer confidence without generating widespread buyer's remorse.

Connection

Revenge spending often leads to buyer's remorse as consumers make impulsive purchases to compensate for past restrictions, resulting in financial regret. This cycle stresses personal budgets and can contribute to economic volatility by inflating short-term demand followed by spending pullbacks. Understanding this behavior is crucial for predicting shifts in market trends and consumer confidence.

Key Terms

Consumer Behavior

Buyer's remorse refers to the regret experienced after making a purchase, often driven by cognitive dissonance and unmet expectations, leading consumers to question the value of their decision. Revenge spending, on the other hand, involves increased discretionary purchases as a psychological response to prior deprivation or stress, often seen post-pandemic as consumers seek emotional compensation. Explore more about these consumer behavior patterns and their impact on marketing strategies.

Psychological Pricing

Buyer's remorse occurs when consumers regret a purchase due to perceived high cost or unmet expectations, while revenge spending involves impulsive buying driven by emotional relief, often after stressful events. Psychological pricing strategies, such as charm pricing and price anchoring, can mitigate buyer's remorse by creating perceived value and justifying purchases. Explore more about how tailored pricing tactics influence spending behaviors and emotional responses in consumers.

Post-Purchase Dissonance

Buyer's remorse and revenge spending both relate to post-purchase dissonance, where consumers experience emotional discomfort after a transaction. Buyer's remorse arises from regret or doubt about a purchase decision, while revenge spending is a compensatory behavior to regain control or emotional satisfaction after stress or deprivation. Explore these psychological dynamics to better understand consumer behavior and marketing strategies.

Source and External Links

Buyer's Remorse: What It Is And How To Avoid It | Rocket Money - Buyer's remorse is a feeling of regret, guilt, or disappointment after making a large purchase, often caused by going over budget, underestimating maintenance costs, or deciding too quickly on a purchase like a home.

What is Buyer's Remorse? - Clay - Buyer's remorse is post-purchase anxiety or regret, often due to cognitive dissonance where expectations clash with reality, commonly triggered by impulse buys, social pressure, or spending over budget.

What is Buyer's Remorse For Homebuyers? How To Avoid It | Bankrate - Buyer's remorse in homebuyers can stem from paying too much, not getting the desired home, disliking the neighborhood, facing overwhelming maintenance, or missing the old home, leading to regret or anxiety after purchase.

dowidth.com

dowidth.com