Carbon border adjustment mechanisms aim to level the playing field by imposing tariffs on imported goods with high carbon footprints, encouraging global emissions reduction. Renewable energy subsidies focus on accelerating clean energy adoption by financially supporting solar, wind, and other sustainable technologies. Explore the economic impact and policy debates surrounding these strategies to understand their roles in combating climate change.

Why it is important

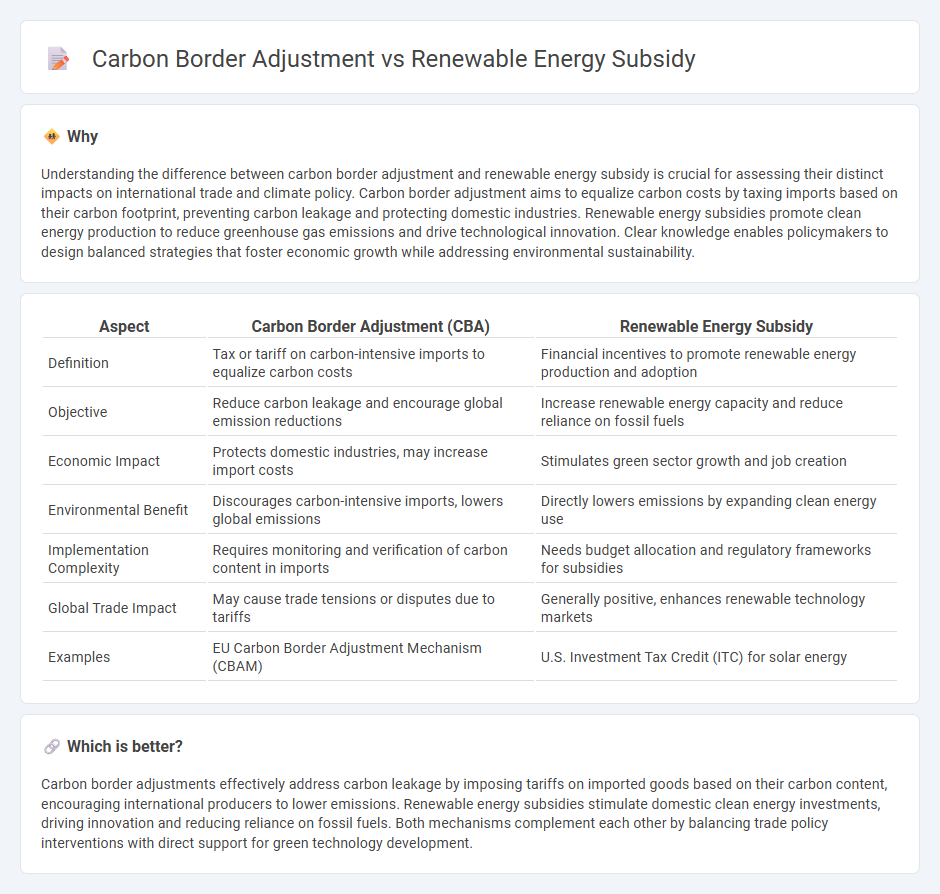

Understanding the difference between carbon border adjustment and renewable energy subsidy is crucial for assessing their distinct impacts on international trade and climate policy. Carbon border adjustment aims to equalize carbon costs by taxing imports based on their carbon footprint, preventing carbon leakage and protecting domestic industries. Renewable energy subsidies promote clean energy production to reduce greenhouse gas emissions and drive technological innovation. Clear knowledge enables policymakers to design balanced strategies that foster economic growth while addressing environmental sustainability.

Comparison Table

| Aspect | Carbon Border Adjustment (CBA) | Renewable Energy Subsidy |

|---|---|---|

| Definition | Tax or tariff on carbon-intensive imports to equalize carbon costs | Financial incentives to promote renewable energy production and adoption |

| Objective | Reduce carbon leakage and encourage global emission reductions | Increase renewable energy capacity and reduce reliance on fossil fuels |

| Economic Impact | Protects domestic industries, may increase import costs | Stimulates green sector growth and job creation |

| Environmental Benefit | Discourages carbon-intensive imports, lowers global emissions | Directly lowers emissions by expanding clean energy use |

| Implementation Complexity | Requires monitoring and verification of carbon content in imports | Needs budget allocation and regulatory frameworks for subsidies |

| Global Trade Impact | May cause trade tensions or disputes due to tariffs | Generally positive, enhances renewable technology markets |

| Examples | EU Carbon Border Adjustment Mechanism (CBAM) | U.S. Investment Tax Credit (ITC) for solar energy |

Which is better?

Carbon border adjustments effectively address carbon leakage by imposing tariffs on imported goods based on their carbon content, encouraging international producers to lower emissions. Renewable energy subsidies stimulate domestic clean energy investments, driving innovation and reducing reliance on fossil fuels. Both mechanisms complement each other by balancing trade policy interventions with direct support for green technology development.

Connection

Carbon border adjustment mechanisms incentivize countries to adopt renewable energy by imposing tariffs on imported goods based on their carbon emissions, thereby encouraging greener production methods globally. Renewable energy subsidies lower the cost of clean energy technologies, increasing their competitiveness against fossil fuels and reducing overall carbon footprints. Together, these policies create economic incentives that align international trade with climate goals, promoting sustainable economic growth.

Key Terms

Incentives

Renewable energy subsidies directly incentivize clean technology adoption by reducing upfront costs and enhancing market competitiveness, accelerating the transition to low-carbon energy systems. Carbon Border Adjustment Mechanisms (CBAM) impose tariffs on imported goods based on their carbon content, motivating producers worldwide to lower emissions to maintain market access and avoid financial penalties. Explore how these policy tools complement each other to drive global decarbonization efforts.

Carbon pricing

Renewable energy subsidies lower the cost of clean energy technologies, incentivizing adoption and reducing carbon emissions by promoting alternatives to fossil fuels. Carbon border adjustment mechanisms impose fees on imported goods based on their carbon content, preventing carbon leakage and ensuring that domestic industries are not disadvantaged in global markets with differing carbon pricing schemes. Explore the comparative impacts of these policies on carbon pricing and international trade to understand their roles in climate strategy.

Trade competitiveness

Renewable energy subsidies lower production costs for clean energy, enhancing trade competitiveness by making exports more attractive and supporting domestic industries in global markets. Carbon border adjustment mechanisms (CBAM) protect industries from unfair competition by imposing tariffs on imports based on their carbon intensity, encouraging greener production worldwide. Explore the impact of these policies on international trade dynamics and competitiveness for deeper insights.

Source and External Links

Federal Energy Subsidies Distort the Market and Impact Texas - From 2010 to 2023, the U.S. federal government provided substantial subsidies to renewable energy, with solar receiving $76 billion and wind $65 billion, far exceeding support for fossil fuels and coal, highlighting renewable energy's reliance on these subsidies to compete in the market.

Fossil Fuel Subsidies Are Mostly Fiction, But the Real Energy Subsidies Should Go - Renewable energy receives subsidies approximately 30 times higher than fossil fuels, primarily through tax code provisions, accounting for 94% of projected $1.2 trillion in forgone federal revenues over the next decade related to energy tax incentives.

Federal Financial Interventions and Subsidies in Energy - Federal subsidies for renewable energy more than doubled from $7.4 billion in FY 2016 to $15.6 billion in FY 2022, with nearly half of all federal energy subsidies during that period supporting renewable energy sources.

dowidth.com

dowidth.com