Liquidity crunch occurs when financial institutions face a shortage of liquid assets, restricting their ability to meet short-term obligations and causing credit markets to tighten. Capital flight refers to the rapid outflow of financial assets and capital from a country due to economic instability or loss of investor confidence, often leading to currency depreciation and reduced investment. Explore the key differences and impacts of liquidity crunch and capital flight on global economies.

Why it is important

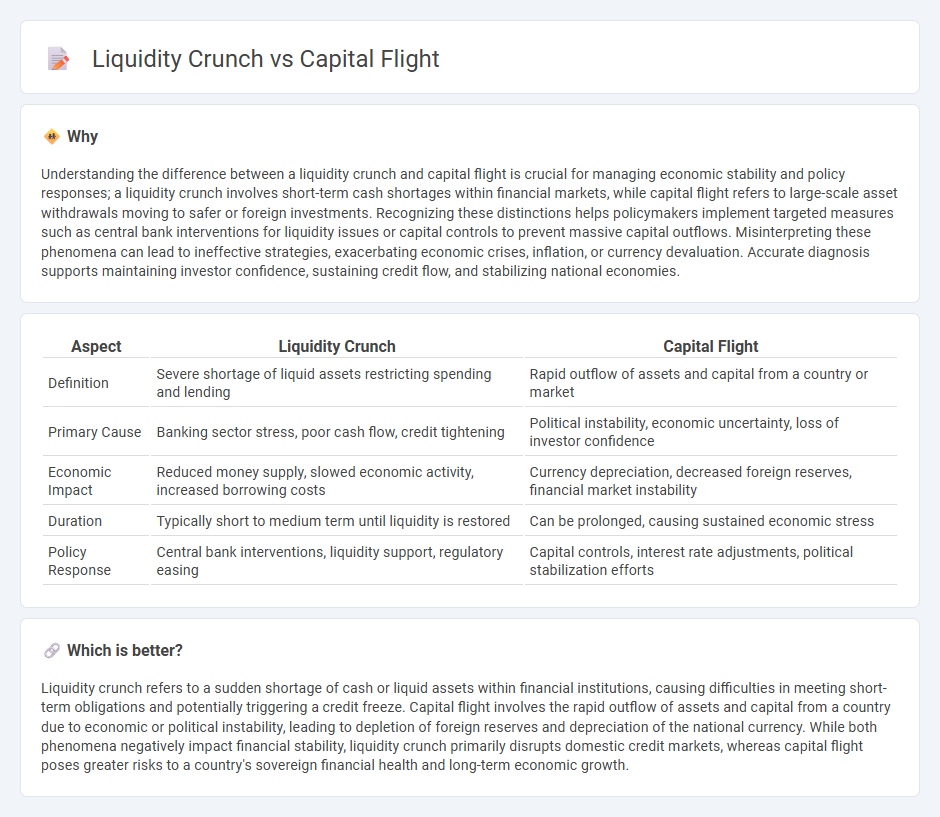

Understanding the difference between a liquidity crunch and capital flight is crucial for managing economic stability and policy responses; a liquidity crunch involves short-term cash shortages within financial markets, while capital flight refers to large-scale asset withdrawals moving to safer or foreign investments. Recognizing these distinctions helps policymakers implement targeted measures such as central bank interventions for liquidity issues or capital controls to prevent massive capital outflows. Misinterpreting these phenomena can lead to ineffective strategies, exacerbating economic crises, inflation, or currency devaluation. Accurate diagnosis supports maintaining investor confidence, sustaining credit flow, and stabilizing national economies.

Comparison Table

| Aspect | Liquidity Crunch | Capital Flight |

|---|---|---|

| Definition | Severe shortage of liquid assets restricting spending and lending | Rapid outflow of assets and capital from a country or market |

| Primary Cause | Banking sector stress, poor cash flow, credit tightening | Political instability, economic uncertainty, loss of investor confidence |

| Economic Impact | Reduced money supply, slowed economic activity, increased borrowing costs | Currency depreciation, decreased foreign reserves, financial market instability |

| Duration | Typically short to medium term until liquidity is restored | Can be prolonged, causing sustained economic stress |

| Policy Response | Central bank interventions, liquidity support, regulatory easing | Capital controls, interest rate adjustments, political stabilization efforts |

Which is better?

Liquidity crunch refers to a sudden shortage of cash or liquid assets within financial institutions, causing difficulties in meeting short-term obligations and potentially triggering a credit freeze. Capital flight involves the rapid outflow of assets and capital from a country due to economic or political instability, leading to depletion of foreign reserves and depreciation of the national currency. While both phenomena negatively impact financial stability, liquidity crunch primarily disrupts domestic credit markets, whereas capital flight poses greater risks to a country's sovereign financial health and long-term economic growth.

Connection

Liquidity crunch occurs when financial institutions and markets face a shortage of readily available cash, limiting lending and investment activities. Capital flight exacerbates this condition as investors withdraw assets en masse, seeking safer or more liquid markets abroad, thereby depleting domestic financial reserves. The interplay between liquidity crunch and capital flight intensifies economic instability by reducing market confidence and constraining economic growth.

Key Terms

Cross-border transfers

Capital flight refers to large-scale exodus of financial assets and capital out of a country, often driven by political instability or economic uncertainty, impacting cross-border transfers by increasing demand for foreign currency and reducing local liquidity. Liquidity crunch occurs when a country faces a sudden shortage of liquid assets, constraining the ability to meet short-term obligations and impairing smooth cross-border transactions due to tightened financial conditions. Explore detailed insights on how these phenomena influence global financial flows and cross-border transfer mechanisms.

Asset liquidation

Capital flight triggers rapid asset liquidation as investors urgently sell holdings to move funds abroad, intensifying market volatility and depleting domestic financial resources. In contrast, a liquidity crunch involves a constrained market where asset liquidation is difficult due to limited buyers, causing asset prices to plummet and restricting access to cash despite available assets. Explore the detailed dynamics between capital flight and liquidity crunch to understand their impact on asset liquidation strategies.

Credit availability

Capital flight severely restricts credit availability as it drains domestic financial resources, raising borrowing costs and limiting funds for businesses and consumers. Liquidity crunch also tightens credit access by reducing lenders' cash reserves, forcing stricter lending standards and curtailing loan issuance. Explore the dynamics of credit constraints in different economic crises for deeper insights.

Source and External Links

Capital Flight - Definitons, Impact, Causes, Prevention - Capital flight is characterized by large outflows of assets and/or capital from a country due to economic or political events, causing negative impacts such as reduced economic strength, loss of tax revenue, decreased purchasing power, and asset devaluation.

Capital Flight - Econlib - Capital flight typically involves short-term speculative capital outflows driven by fears of currency devaluation or financial instability, resulting in large cross-border movements of private funds that disrupt national financial markets.

Capital flight - Wikipedia - Capital flight is the rapid movement of assets or money out of a country triggered by events like political change or economic uncertainty, usually causing a sharp drop in the country's currency value and loss of wealth for its citizens.

dowidth.com

dowidth.com