Liquidity crunch occurs when businesses and consumers face a sudden shortage of cash or easily accessible funds, restricting spending and investment capacity. A recession, by contrast, is a broader economic downturn characterized by falling GDP, high unemployment, and reduced consumer demand. Explore the differences and impacts of liquidity crunches and recessions to better understand economic cycles.

Why it is important

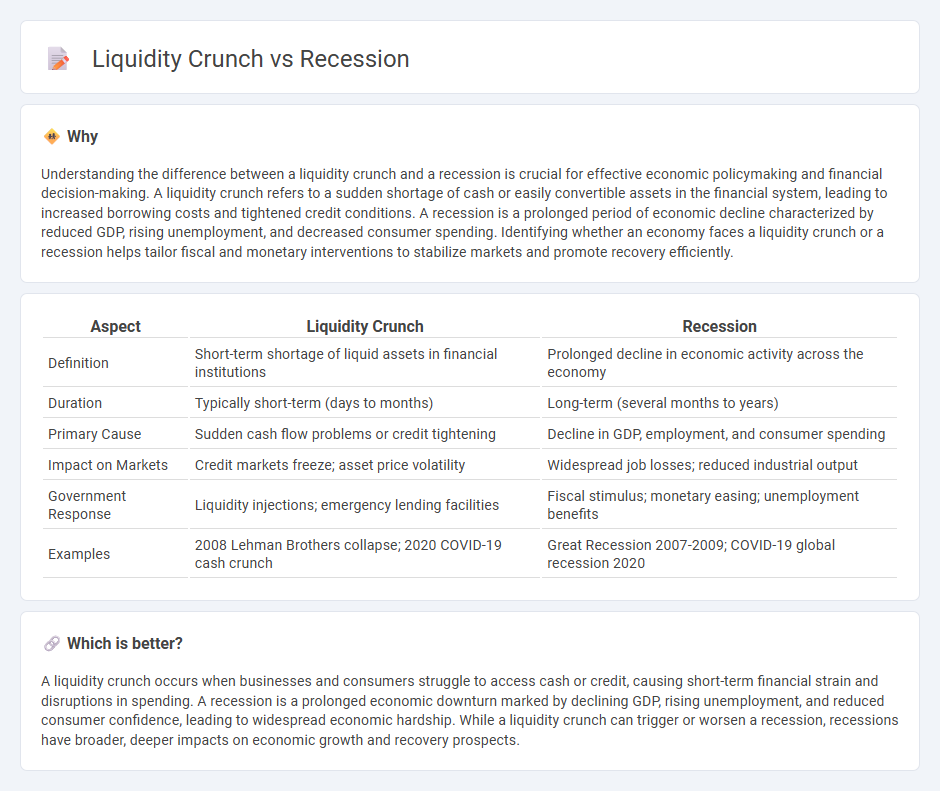

Understanding the difference between a liquidity crunch and a recession is crucial for effective economic policymaking and financial decision-making. A liquidity crunch refers to a sudden shortage of cash or easily convertible assets in the financial system, leading to increased borrowing costs and tightened credit conditions. A recession is a prolonged period of economic decline characterized by reduced GDP, rising unemployment, and decreased consumer spending. Identifying whether an economy faces a liquidity crunch or a recession helps tailor fiscal and monetary interventions to stabilize markets and promote recovery efficiently.

Comparison Table

| Aspect | Liquidity Crunch | Recession |

|---|---|---|

| Definition | Short-term shortage of liquid assets in financial institutions | Prolonged decline in economic activity across the economy |

| Duration | Typically short-term (days to months) | Long-term (several months to years) |

| Primary Cause | Sudden cash flow problems or credit tightening | Decline in GDP, employment, and consumer spending |

| Impact on Markets | Credit markets freeze; asset price volatility | Widespread job losses; reduced industrial output |

| Government Response | Liquidity injections; emergency lending facilities | Fiscal stimulus; monetary easing; unemployment benefits |

| Examples | 2008 Lehman Brothers collapse; 2020 COVID-19 cash crunch | Great Recession 2007-2009; COVID-19 global recession 2020 |

Which is better?

A liquidity crunch occurs when businesses and consumers struggle to access cash or credit, causing short-term financial strain and disruptions in spending. A recession is a prolonged economic downturn marked by declining GDP, rising unemployment, and reduced consumer confidence, leading to widespread economic hardship. While a liquidity crunch can trigger or worsen a recession, recessions have broader, deeper impacts on economic growth and recovery prospects.

Connection

A liquidity crunch reduces the availability of cash and credit, constraining consumer spending and business investment, which slows economic growth. This tightening of financial conditions increases the risk of a recession by triggering lower demand, rising unemployment, and reduced corporate earnings. Historical data shows liquidity shortages often precede economic downturns, signaling tighter credit markets as a key recession indicator.

Key Terms

GDP (Gross Domestic Product)

A recession is characterized by a prolonged decline in GDP, reflecting overall economic contraction and reduced production output across sectors. A liquidity crunch, however, primarily impacts the availability of cash and credit, potentially stalling investment and consumption without an immediate GDP drop. Explore more to understand how these financial phenomena differently influence economic growth metrics.

Credit Availability

A recession is a sustained period of economic decline marked by reduced GDP, high unemployment, and decreased consumer spending, often leading to tighter credit conditions. A liquidity crunch occurs when financial institutions or markets face a sudden shortage of liquid assets, severely limiting credit availability even if the broader economy is stable. Explore how these conditions uniquely impact credit markets and borrowing opportunities.

Interest Rates

A recession typically causes central banks to lower interest rates to stimulate economic growth by encouraging borrowing and investment. In contrast, a liquidity crunch leads to a sudden tightening of credit availability, often causing interest rates to spike as financial institutions become risk-averse. Explore the impact of these dynamics on market stability and monetary policy adjustments.

Source and External Links

What is a recession and what does it mean for you? | Fidelity - A recession is a prolonged period of negative economic growth leading to shrinking economy, lower employment, worsening corporate performance, and higher borrowing costs, often causing a negative cycle through reduced spending and layoffs.

Recession - Wikipedia - In economics, a recession is a broad decline in economic activity across the economy lasting more than a few months, often defined by negative GDP growth for two consecutive quarters, triggered by demand shocks, financial crises, or external shocks.

Recession: When Bad Times Prevail - Back to Basics - A recession is a significant, sustained fall in economic output and rise in unemployment, often synchronized globally, with recent recessions among the deepest since the 1930s Great Depression.

dowidth.com

dowidth.com