Supercore inflation measures the persistent rise in prices by excluding volatile items like food and energy, offering a clearer view of underlying economic trends. Imported inflation occurs when increased costs of foreign goods and services drive up domestic price levels, influenced by exchange rates and global supply chain disruptions. Explore deeper insights into how these inflation types impact monetary policy and economic growth.

Why it is important

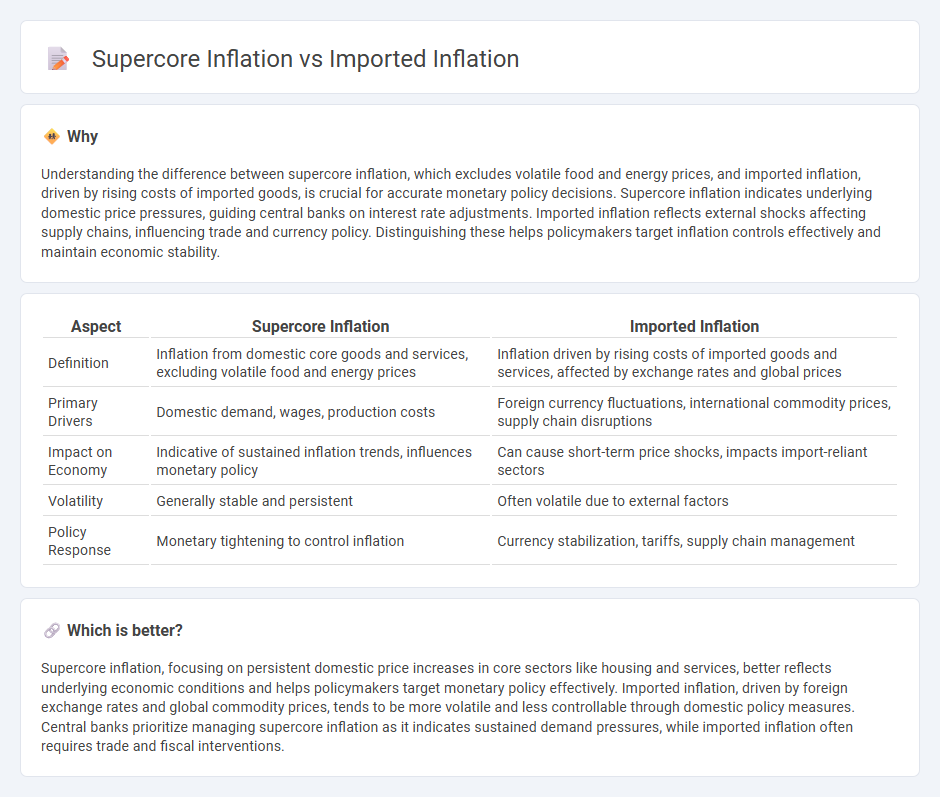

Understanding the difference between supercore inflation, which excludes volatile food and energy prices, and imported inflation, driven by rising costs of imported goods, is crucial for accurate monetary policy decisions. Supercore inflation indicates underlying domestic price pressures, guiding central banks on interest rate adjustments. Imported inflation reflects external shocks affecting supply chains, influencing trade and currency policy. Distinguishing these helps policymakers target inflation controls effectively and maintain economic stability.

Comparison Table

| Aspect | Supercore Inflation | Imported Inflation |

|---|---|---|

| Definition | Inflation from domestic core goods and services, excluding volatile food and energy prices | Inflation driven by rising costs of imported goods and services, affected by exchange rates and global prices |

| Primary Drivers | Domestic demand, wages, production costs | Foreign currency fluctuations, international commodity prices, supply chain disruptions |

| Impact on Economy | Indicative of sustained inflation trends, influences monetary policy | Can cause short-term price shocks, impacts import-reliant sectors |

| Volatility | Generally stable and persistent | Often volatile due to external factors |

| Policy Response | Monetary tightening to control inflation | Currency stabilization, tariffs, supply chain management |

Which is better?

Supercore inflation, focusing on persistent domestic price increases in core sectors like housing and services, better reflects underlying economic conditions and helps policymakers target monetary policy effectively. Imported inflation, driven by foreign exchange rates and global commodity prices, tends to be more volatile and less controllable through domestic policy measures. Central banks prioritize managing supercore inflation as it indicates sustained demand pressures, while imported inflation often requires trade and fiscal interventions.

Connection

Supercore inflation reflects persistent price increases in services and non-tradable goods, deeply influenced by domestic wage growth and consumer demand, while imported inflation results from rising costs of foreign goods due to global supply chain disruptions and currency fluctuations. The interaction occurs as higher imported inflation raises production costs for domestically consumed goods, which then fuels supercore inflation through increased prices in services and non-tradable sectors. Central banks monitor both to gauge underlying inflation pressures and adjust monetary policy accordingly, maintaining economic stability.

Key Terms

Exchange Rates

Imported inflation arises when rising foreign prices increase domestic costs, heavily influenced by exchange rate fluctuations, as a depreciated currency makes imports more expensive. Supercore inflation, which excludes volatile items like food and energy, reflects underlying inflation trends less sensitive to exchange rate movements but still influenced indirectly through broader price-setting. Explore the dynamics between exchange rates, imported inflation, and supercore inflation to understand their impact on monetary policy and economic stability.

Core Services Prices

Imported inflation reflects rising costs of goods and services due to higher prices of imported inputs, impacting overall consumer prices through supply chain channels. Supercore inflation zeroes in on Core Services Prices, excluding volatile sectors like energy and food, providing a clearer gauge of underlying domestic price pressures driven primarily by labor and rent costs. Explore how differences between these inflation measures influence monetary policy and economic forecasts.

Trade Balance

Imported inflation arises from rising prices of goods and services sourced from abroad, impacting the overall cost structure of an economy. Supercore inflation excludes volatile items like food and energy, offering a clearer view of underlying price pressures linked to domestic demand and wage growth. Understanding the trade balance's role can reveal how import price fluctuations influence inflation trends; discover more insights on this interplay.

Source and External Links

Imported Inflation: Causes & Impact | Vaia - Imported inflation occurs when rising prices of imported goods--due to factors like higher global commodity prices, exchange rate fluctuations, or increased tariffs--lead to higher domestic price levels.

What Drives U.S. Import Price Inflation? | NBER - Sharp increases in U.S. import prices, driven by global commodity costs and later by domestic demand shocks, significantly contributed to overall U.S. inflation during the COVID-19 pandemic.

The Impact of Tariffs on Inflation - Federal Reserve Bank of Boston - Tariffs directly increase the border prices of imported goods, which can be passed through to consumers and have a measurable effect on core inflation, depending on the size and scope of the tariff policy.

dowidth.com

dowidth.com