Unretirement involves re-entering the workforce after a period of full retirement, often driven by financial needs or a desire for continued engagement, while phased retirement allows employees to gradually reduce working hours or responsibilities before fully retiring. Phased retirement provides smoother income transition and benefits retention, whereas unretirement may offer full-time opportunities but with less job security. Explore the economic impacts and personal benefits of each approach to retirement planning.

Why it is important

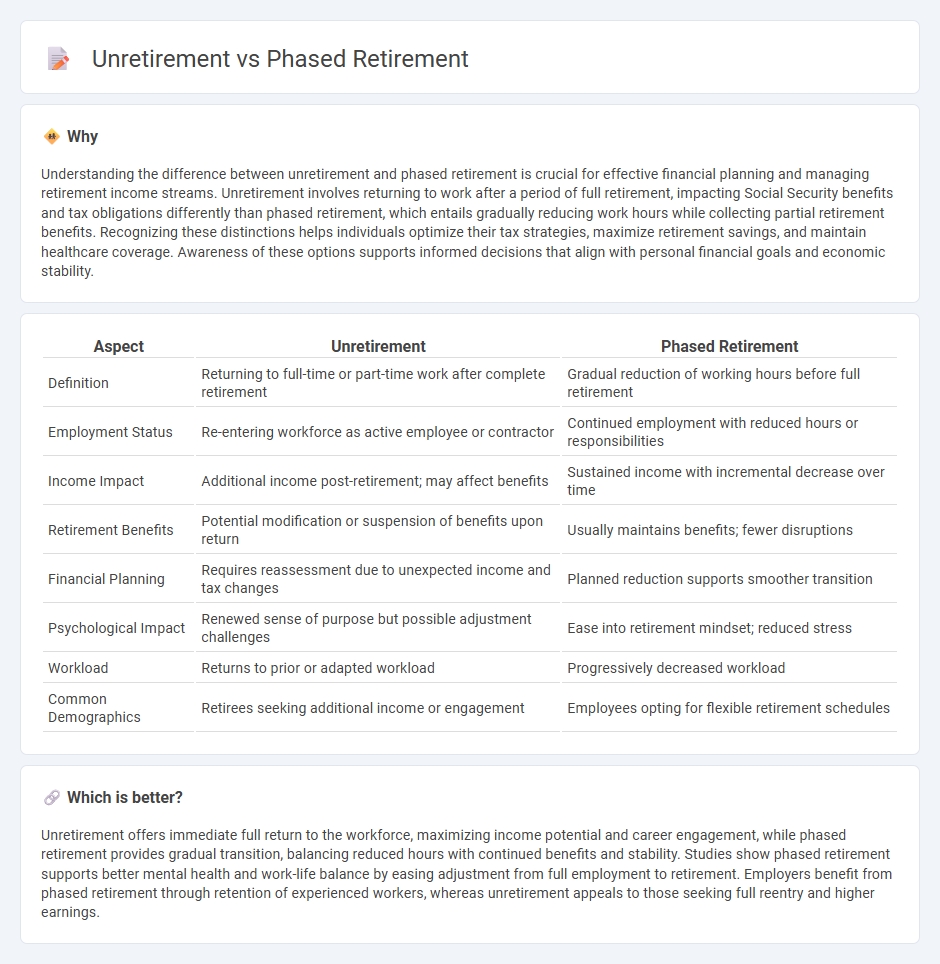

Understanding the difference between unretirement and phased retirement is crucial for effective financial planning and managing retirement income streams. Unretirement involves returning to work after a period of full retirement, impacting Social Security benefits and tax obligations differently than phased retirement, which entails gradually reducing work hours while collecting partial retirement benefits. Recognizing these distinctions helps individuals optimize their tax strategies, maximize retirement savings, and maintain healthcare coverage. Awareness of these options supports informed decisions that align with personal financial goals and economic stability.

Comparison Table

| Aspect | Unretirement | Phased Retirement |

|---|---|---|

| Definition | Returning to full-time or part-time work after complete retirement | Gradual reduction of working hours before full retirement |

| Employment Status | Re-entering workforce as active employee or contractor | Continued employment with reduced hours or responsibilities |

| Income Impact | Additional income post-retirement; may affect benefits | Sustained income with incremental decrease over time |

| Retirement Benefits | Potential modification or suspension of benefits upon return | Usually maintains benefits; fewer disruptions |

| Financial Planning | Requires reassessment due to unexpected income and tax changes | Planned reduction supports smoother transition |

| Psychological Impact | Renewed sense of purpose but possible adjustment challenges | Ease into retirement mindset; reduced stress |

| Workload | Returns to prior or adapted workload | Progressively decreased workload |

| Common Demographics | Retirees seeking additional income or engagement | Employees opting for flexible retirement schedules |

Which is better?

Unretirement offers immediate full return to the workforce, maximizing income potential and career engagement, while phased retirement provides gradual transition, balancing reduced hours with continued benefits and stability. Studies show phased retirement supports better mental health and work-life balance by easing adjustment from full employment to retirement. Employers benefit from phased retirement through retention of experienced workers, whereas unretirement appeals to those seeking full reentry and higher earnings.

Connection

Unretirement and phased retirement are connected as both represent flexible work arrangements allowing older adults to gradually reduce labor participation while maintaining economic activity. This approach supports sustained income flow and leverages experienced human capital, benefiting individuals and economies facing aging populations. By enabling smoother transitions from full-time employment to retirement, these concepts help mitigate labor shortages and promote financial stability for retirees.

Key Terms

Workforce Participation

Phased retirement allows employees to gradually reduce working hours while maintaining workforce participation, offering flexibility for aging workers to transition smoothly. Unretirement involves re-entering the workforce after full retirement, often driven by financial necessity or personal fulfillment, impacting labor market dynamics. Explore how these trends reshape workforce participation and aging employment strategies.

Pension Flexibility

Phased retirement enables employees to gradually reduce work hours while drawing partial pension benefits, providing enhanced pension flexibility and smoother financial transition. Unretirement, or returning to work after full retirement, may impact pension payouts depending on plan rules, often requiring careful consideration to avoid benefit reductions. Explore detailed comparisons to optimize your retirement strategy based on pension plan specifics.

Labor Market Reentry

Phased retirement allows employees to gradually reduce their working hours while still remaining in the labor market, promoting a smoother transition from full-time employment to retirement. Unretirement refers to retirees reentering the labor force, often driven by financial needs or personal fulfillment, impacting labor market dynamics and workforce participation rates among older adults. Explore more to understand the economic and social implications of labor market reentry trends among aging populations.

Source and External Links

Guide to Phased Retirement (With Benefits and Challenges) - Indeed - Provides an overview of phased retirement, including its benefits, challenges, and how to discuss it with an employer.

Phased Retirement - Human Resources University of Michigan - Describes the criteria and process for phased retirement, emphasizing eligibility and gradual effort reduction.

Phased Retirement - OPM - Explains phased retirement as a tool allowing full-time employees to transition to part-time work while drawing retirement benefits.

dowidth.com

dowidth.com