De-dollarization involves reducing reliance on the US dollar in global trade and finance, aiming to stabilize national currencies and lessen vulnerability to dollar fluctuations. Cryptoization refers to the increasing adoption of cryptocurrencies as alternatives to traditional fiat money, promoting decentralized and borderless financial transactions. Explore further to understand how these trends are reshaping the global economic landscape.

Why it is important

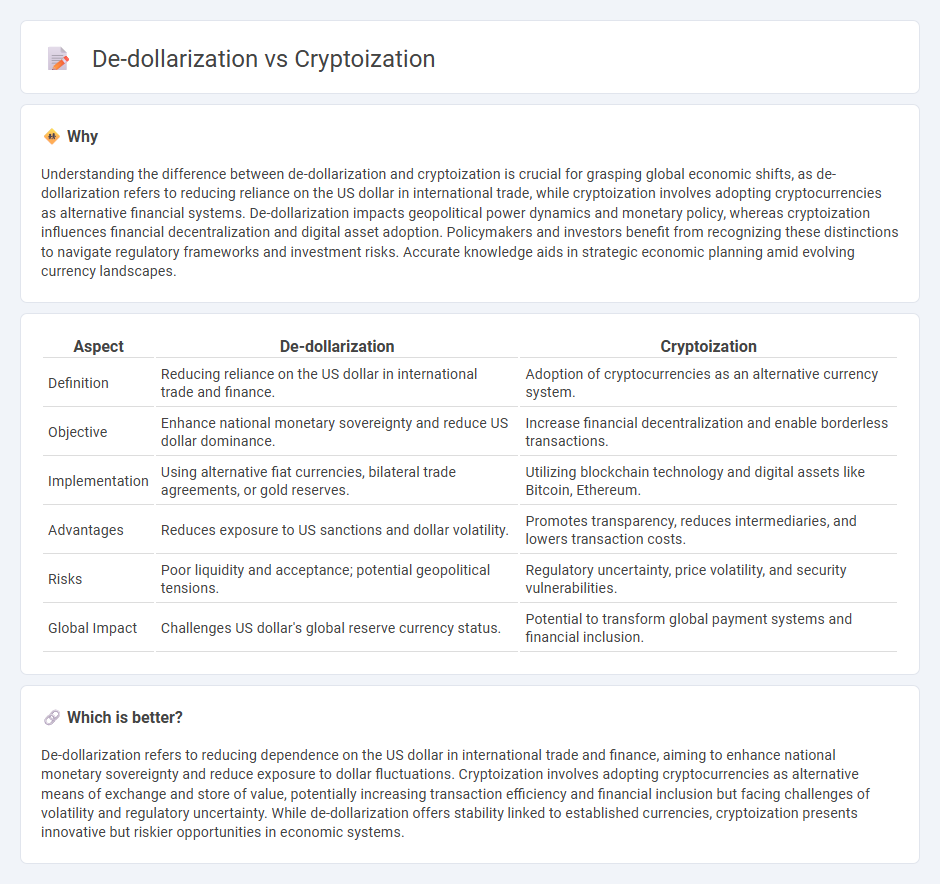

Understanding the difference between de-dollarization and cryptoization is crucial for grasping global economic shifts, as de-dollarization refers to reducing reliance on the US dollar in international trade, while cryptoization involves adopting cryptocurrencies as alternative financial systems. De-dollarization impacts geopolitical power dynamics and monetary policy, whereas cryptoization influences financial decentralization and digital asset adoption. Policymakers and investors benefit from recognizing these distinctions to navigate regulatory frameworks and investment risks. Accurate knowledge aids in strategic economic planning amid evolving currency landscapes.

Comparison Table

| Aspect | De-dollarization | Cryptoization |

|---|---|---|

| Definition | Reducing reliance on the US dollar in international trade and finance. | Adoption of cryptocurrencies as an alternative currency system. |

| Objective | Enhance national monetary sovereignty and reduce US dollar dominance. | Increase financial decentralization and enable borderless transactions. |

| Implementation | Using alternative fiat currencies, bilateral trade agreements, or gold reserves. | Utilizing blockchain technology and digital assets like Bitcoin, Ethereum. |

| Advantages | Reduces exposure to US sanctions and dollar volatility. | Promotes transparency, reduces intermediaries, and lowers transaction costs. |

| Risks | Poor liquidity and acceptance; potential geopolitical tensions. | Regulatory uncertainty, price volatility, and security vulnerabilities. |

| Global Impact | Challenges US dollar's global reserve currency status. | Potential to transform global payment systems and financial inclusion. |

Which is better?

De-dollarization refers to reducing dependence on the US dollar in international trade and finance, aiming to enhance national monetary sovereignty and reduce exposure to dollar fluctuations. Cryptoization involves adopting cryptocurrencies as alternative means of exchange and store of value, potentially increasing transaction efficiency and financial inclusion but facing challenges of volatility and regulatory uncertainty. While de-dollarization offers stability linked to established currencies, cryptoization presents innovative but riskier opportunities in economic systems.

Connection

De-dollarization reduces reliance on the US dollar by promoting alternative currencies and payment systems, creating a demand for decentralized digital assets like cryptocurrencies. Cryptoization accelerates this shift as blockchain technology provides secure, transparent, and borderless financial transactions. Together, they reshape global economic dynamics by challenging traditional fiat currency dominance and enhancing financial sovereignty.

Key Terms

Currency Substitution

Cryptoization refers to the increasing use of cryptocurrencies as alternatives to national currencies, influencing monetary sovereignty and disrupting traditional currency substitution patterns. De-dollarization involves reducing reliance on the US dollar in international trade and finance, promoting local currencies or alternatives to mitigate dollar dominance. Explore how these trends reshape currency substitution dynamics and global economic stability.

Reserve Currency

Cryptoization involves adopting cryptocurrencies as a medium of exchange, unit of account, or store of value, potentially challenging the dominance of traditional reserve currencies like the US dollar. De-dollarization refers to the strategic shift by countries or institutions to reduce reliance on the US dollar in global trade and finance, often seeking alternatives such as the euro, yuan, or emerging digital currencies. Explore how these trends reshape the future of reserve currencies and global economic power dynamics.

Financial Sovereignty

Cryptoization represents the integration of cryptocurrencies into the financial system, enabling decentralized transactions and enhanced control over personal assets. De-dollarization involves reducing reliance on the US dollar in global trade and finance to achieve greater national economic independence and mitigate currency risk. Explore how these strategies redefine financial sovereignty and reshape global monetary power dynamics.

Source and External Links

Where "cryptoization" could thrive - "Cryptoization" is a term used by the IMF and Financial Stability Board to describe a process where citizens increasingly prefer cryptocurrency over their country's sovereign currency, particularly in countries with unstable currencies and weak monetary systems.

Promotion of sustainable 'cryptoization' by global standard setters - Global regulatory bodies are assessing risks of cryptoization, including operational, cyber, and governance risks, while promoting supportive regulation to ensure sustainable adoption of crypto technologies like stablecoins and DeFi.

Crypto Boom Poses New Challenges to Financial Stability - Cryptoization can undermine central banks' monetary policy effectiveness, especially in emerging markets with weak banking systems; central bank digital currencies and improved payment systems are proposed to reduce cryptoization pressures.

dowidth.com

dowidth.com