Rentvesting combines property investment with renting, enabling individuals to build equity while living in affordable rental accommodations. This strategy contrasts traditional renting by allowing tenants to benefit from property market appreciation and potential rental income. Explore how rentvesting can optimize your financial future in the housing market.

Why it is important

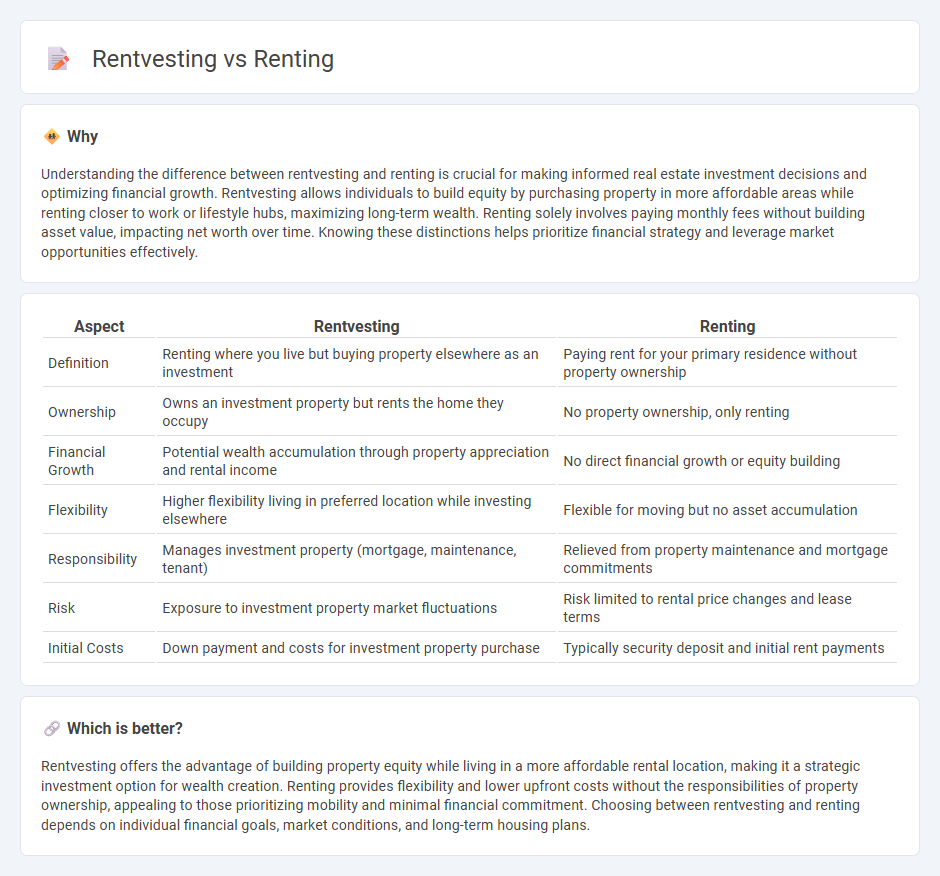

Understanding the difference between rentvesting and renting is crucial for making informed real estate investment decisions and optimizing financial growth. Rentvesting allows individuals to build equity by purchasing property in more affordable areas while renting closer to work or lifestyle hubs, maximizing long-term wealth. Renting solely involves paying monthly fees without building asset value, impacting net worth over time. Knowing these distinctions helps prioritize financial strategy and leverage market opportunities effectively.

Comparison Table

| Aspect | Rentvesting | Renting |

|---|---|---|

| Definition | Renting where you live but buying property elsewhere as an investment | Paying rent for your primary residence without property ownership |

| Ownership | Owns an investment property but rents the home they occupy | No property ownership, only renting |

| Financial Growth | Potential wealth accumulation through property appreciation and rental income | No direct financial growth or equity building |

| Flexibility | Higher flexibility living in preferred location while investing elsewhere | Flexible for moving but no asset accumulation |

| Responsibility | Manages investment property (mortgage, maintenance, tenant) | Relieved from property maintenance and mortgage commitments |

| Risk | Exposure to investment property market fluctuations | Risk limited to rental price changes and lease terms |

| Initial Costs | Down payment and costs for investment property purchase | Typically security deposit and initial rent payments |

Which is better?

Rentvesting offers the advantage of building property equity while living in a more affordable rental location, making it a strategic investment option for wealth creation. Renting provides flexibility and lower upfront costs without the responsibilities of property ownership, appealing to those prioritizing mobility and minimal financial commitment. Choosing between rentvesting and renting depends on individual financial goals, market conditions, and long-term housing plans.

Connection

Rentvesting allows individuals to rent a property while investing in real estate elsewhere, blending the benefits of both renting and property ownership. This strategy enables tenants to build equity in investment properties without the immediate need to buy their own home to live in. Consequently, rentvesting influences housing market dynamics by increasing demand for rental properties while promoting property investment growth.

Key Terms

Cash Flow

Renting offers predictable monthly expenses without the burden of property maintenance costs, which can enhance short-term cash flow stability. Rentvesting enables individuals to build property equity by investing in more affordable locations while renting in their preferred area, potentially generating positive cash flow through rental income. Explore how these strategies impact your financial goals and cash flow management.

Equity

Rentvesting allows individuals to build equity in a property while renting in a more desirable location, combining the benefits of homeownership and rental flexibility. Renting, on the other hand, provides no opportunity to accumulate property equity, limiting long-term wealth growth. Explore the advantages of rentvesting strategies to maximize your investment potential and secure financial growth.

Opportunity Cost

Renting offers flexibility without the burden of property maintenance, but it often means missing out on building home equity, representing an opportunity cost in potential asset growth. Rentvesting blends renting and investing by allowing individuals to live affordably while owning a rental property elsewhere, creating a balance between lifestyle and investment returns. Explore how understanding opportunity cost can optimize your financial decisions in housing.

Source and External Links

Apartments for Rent in Boulder CO - Lists current Boulder apartments for rent, with prices ranging from $1,705 to $3,675 per month depending on size and location, and includes average rents for studios, 1-bed, 2-bed, and 3-bed units.

Apartments Available Now - Boulder Housing Partners - Offers affordable and market-rate apartments in Boulder, with some units including utilities and community Wi-Fi, and provides specific prices for studios and multi-bedroom units based on income eligibility.

A Complete Guide to Renting A Home - Zillow - Provides comprehensive advice and resources for finding, applying, and settling into a rental, along with access to up-to-date rental listings and search tools.

dowidth.com

dowidth.com