A polycrisis involves multiple interconnected global crises impacting economies simultaneously, often exacerbating vulnerabilities across markets, supply chains, and financial systems. In contrast, a market crash specifically refers to a sudden and severe drop in stock prices, triggering widespread investor panic and economic instability. Explore the differences and implications of polycrisis versus market crash to better understand their economic consequences.

Why it is important

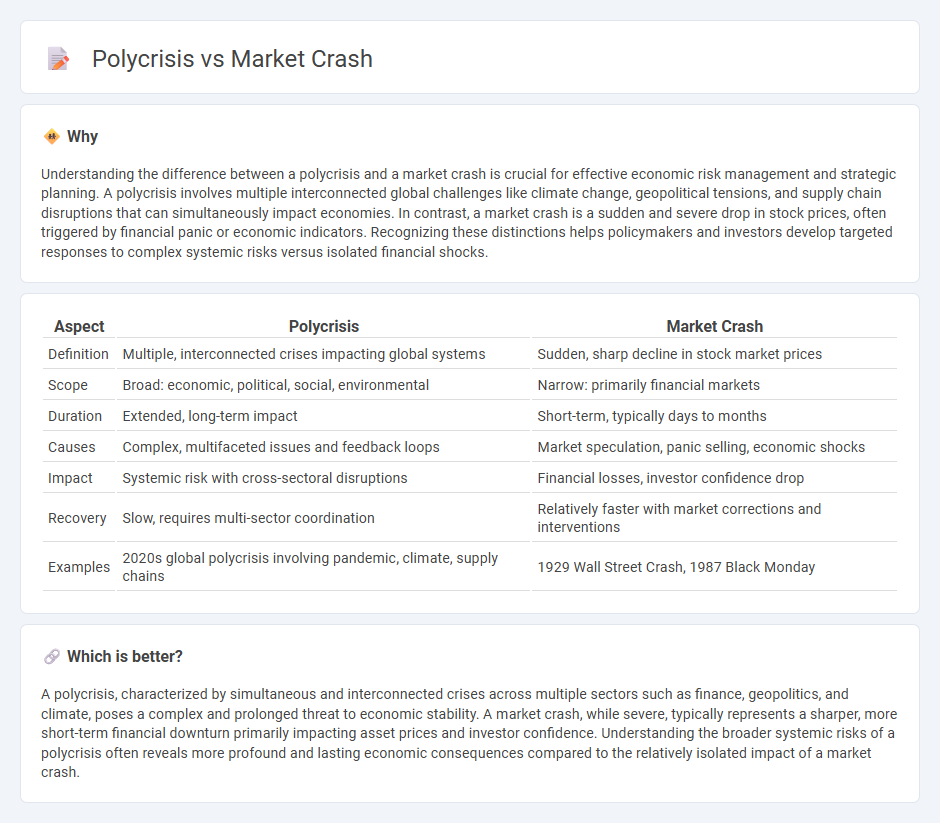

Understanding the difference between a polycrisis and a market crash is crucial for effective economic risk management and strategic planning. A polycrisis involves multiple interconnected global challenges like climate change, geopolitical tensions, and supply chain disruptions that can simultaneously impact economies. In contrast, a market crash is a sudden and severe drop in stock prices, often triggered by financial panic or economic indicators. Recognizing these distinctions helps policymakers and investors develop targeted responses to complex systemic risks versus isolated financial shocks.

Comparison Table

| Aspect | Polycrisis | Market Crash |

|---|---|---|

| Definition | Multiple, interconnected crises impacting global systems | Sudden, sharp decline in stock market prices |

| Scope | Broad: economic, political, social, environmental | Narrow: primarily financial markets |

| Duration | Extended, long-term impact | Short-term, typically days to months |

| Causes | Complex, multifaceted issues and feedback loops | Market speculation, panic selling, economic shocks |

| Impact | Systemic risk with cross-sectoral disruptions | Financial losses, investor confidence drop |

| Recovery | Slow, requires multi-sector coordination | Relatively faster with market corrections and interventions |

| Examples | 2020s global polycrisis involving pandemic, climate, supply chains | 1929 Wall Street Crash, 1987 Black Monday |

Which is better?

A polycrisis, characterized by simultaneous and interconnected crises across multiple sectors such as finance, geopolitics, and climate, poses a complex and prolonged threat to economic stability. A market crash, while severe, typically represents a sharper, more short-term financial downturn primarily impacting asset prices and investor confidence. Understanding the broader systemic risks of a polycrisis often reveals more profound and lasting economic consequences compared to the relatively isolated impact of a market crash.

Connection

Polycrisis, characterized by multiple overlapping global challenges such as geopolitical tensions, climate change, and supply chain disruptions, amplifies economic vulnerabilities and heightens market instability. The compounding effects of these crises can trigger widespread investor fear, leading to sudden market crashes as liquidity dries up and confidence erodes. Historical data indicates that periods marked by polycrisis often coincide with significant financial downturns, exemplified by the 2008 financial crisis coupled with simultaneous geopolitical unrest.

Key Terms

**Market Crash:**

A market crash is characterized by a sudden, sharp decline in stock prices, typically triggered by economic shocks, investor panic, or systemic failures, resulting in significant financial losses across markets. Unlike a polycrisis, which involves multiple interconnected global crises such as economic instability, geopolitical tensions, and climate challenges, a market crash primarily centers on rapid market value collapse. Explore deeper insights into market crash dynamics and their impact on global finance.

Asset Bubble

An asset bubble occurs when asset prices inflate beyond their intrinsic value, often driven by speculative demand and easy credit, leading to a sharp market crash once the bubble bursts. A polycrisis intensifies this scenario by combining economic, geopolitical, and social crises, which exacerbate the collapse of asset bubbles across multiple sectors simultaneously. Explore the dynamics of asset bubbles within polycrisis contexts to understand systemic financial risks better.

Panic Selling

Market crashes often trigger widespread panic selling, where investors rapidly liquidate assets out of fear, exacerbating price declines and market instability. In a polycrisis scenario, overlapping crises such as economic downturn, geopolitical tensions, and environmental disasters amplify investor uncertainty, intensifying panic selling across multiple sectors simultaneously. Discover how understanding these dynamics can aid in developing strategies to mitigate financial risk during turbulent times.

Source and External Links

Stock market crash - Wikipedia - A stock market crash is a sudden, dramatic decline in stock prices across a major part of the market, typically triggered by panic selling and often associated with economic events or speculative bubbles.

2025 stock market crash - Wikipedia - In early April 2025, global stock markets crashed amid volatility following sweeping U.S. tariff increases, sparking panic selling before stabilizing after policy reversals.

Why a top market strategist says his base case is still a 25% stock drop and a recession in 2025 - BCA Research strategist Peter Berezin predicts a 25% drop in the S&P 500 and a recession in 2025, despite recent market recoveries after U.S. tariff pauses.

dowidth.com

dowidth.com