Greedflation occurs when businesses raise prices excessively beyond production costs to boost profits, exacerbating inflation independently of supply-demand dynamics. Monetary inflation results from an increase in money supply, reducing currency value and causing broad price rises across the economy. Explore how these distinct inflation types influence markets and policy decisions for deeper insights.

Why it is important

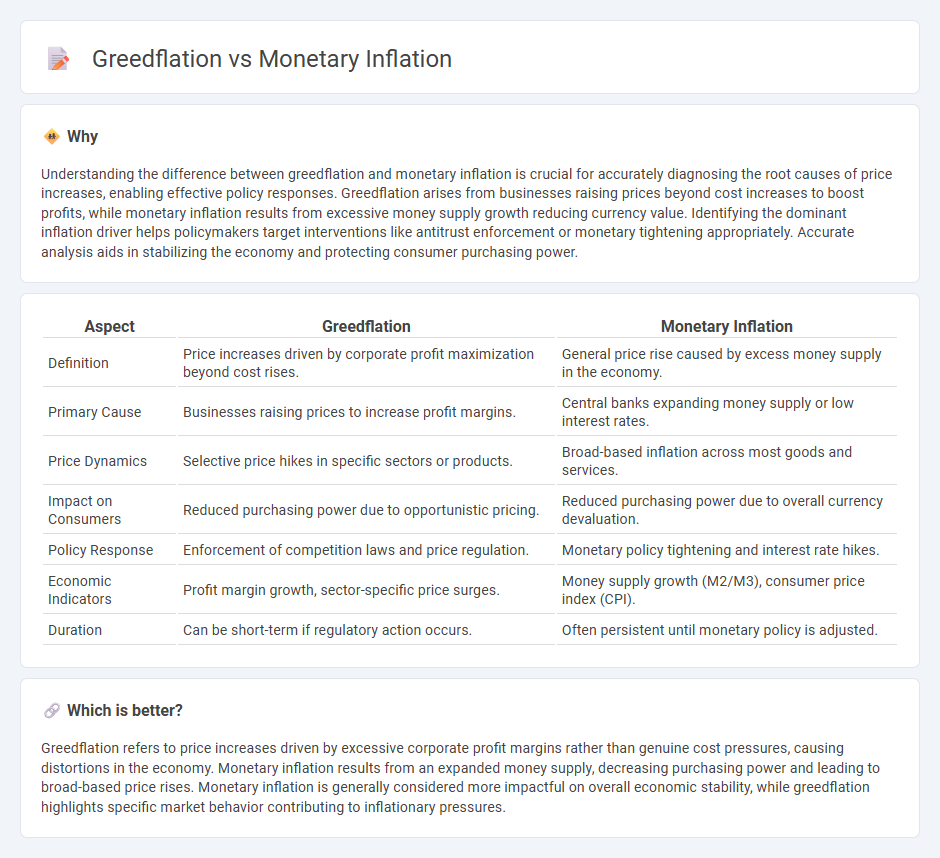

Understanding the difference between greedflation and monetary inflation is crucial for accurately diagnosing the root causes of price increases, enabling effective policy responses. Greedflation arises from businesses raising prices beyond cost increases to boost profits, while monetary inflation results from excessive money supply growth reducing currency value. Identifying the dominant inflation driver helps policymakers target interventions like antitrust enforcement or monetary tightening appropriately. Accurate analysis aids in stabilizing the economy and protecting consumer purchasing power.

Comparison Table

| Aspect | Greedflation | Monetary Inflation |

|---|---|---|

| Definition | Price increases driven by corporate profit maximization beyond cost rises. | General price rise caused by excess money supply in the economy. |

| Primary Cause | Businesses raising prices to increase profit margins. | Central banks expanding money supply or low interest rates. |

| Price Dynamics | Selective price hikes in specific sectors or products. | Broad-based inflation across most goods and services. |

| Impact on Consumers | Reduced purchasing power due to opportunistic pricing. | Reduced purchasing power due to overall currency devaluation. |

| Policy Response | Enforcement of competition laws and price regulation. | Monetary policy tightening and interest rate hikes. |

| Economic Indicators | Profit margin growth, sector-specific price surges. | Money supply growth (M2/M3), consumer price index (CPI). |

| Duration | Can be short-term if regulatory action occurs. | Often persistent until monetary policy is adjusted. |

Which is better?

Greedflation refers to price increases driven by excessive corporate profit margins rather than genuine cost pressures, causing distortions in the economy. Monetary inflation results from an expanded money supply, decreasing purchasing power and leading to broad-based price rises. Monetary inflation is generally considered more impactful on overall economic stability, while greedflation highlights specific market behavior contributing to inflationary pressures.

Connection

Greedflation occurs when businesses increase prices beyond cost pressures, driven by excessive profit motives, amplifying the effects of monetary inflation, which arises from an increased money supply reducing currency value. The interplay between greedflation and monetary inflation accelerates overall price levels, eroding purchasing power more rapidly. Central banks face challenges controlling inflation when corporate profit-driven price hikes compound the inflation caused by expansive monetary policies.

Key Terms

Money Supply

Monetary inflation occurs when an increase in the money supply outpaces economic growth, leading to a general rise in prices across goods and services. Greedflation, however, stems from companies raising prices disproportionately to costs to boost profit margins, reflecting corporate behavior rather than monetary policy. Explore how shifts in money supply uniquely impact these inflation types to better understand their economic consequences.

Price Setting

Monetary inflation occurs when an increase in the money supply leads to a general rise in prices, impacting overall purchasing power. Greedflation, by contrast, refers to price hikes driven primarily by companies exploiting market conditions to maximize profits rather than by genuine cost increases. Explore more about how price setting dynamics differ between these inflation types and their broader economic implications.

Profit Margins

Monetary inflation typically causes a general rise in prices due to increased money supply and demand-pull factors, while greedflation refers to businesses deliberately expanding profit margins beyond cost increases, exploiting inflationary conditions. Profit margins under greedflation rise disproportionately as companies capitalize on consumer price sensitivity, leading to elevated markups that exceed actual inflation rates. Explore the detailed mechanics behind profit margin shifts in greinflation to understand its impact on the economy.

Source and External Links

Monetary inflation - Wikipedia - Monetary inflation is a sustained increase in a country's money supply, which, according to the quantity theory of money, leads to inflation when the money supply grows faster than output; it affects aggregate demand and price levels through different economic mechanisms including wage and import price effects.

Monetary Policy, Money, and Inflation - San Francisco Fed - While traditional economic theory asserts that increasing the money supply causes inflation, recent experience shows that large expansions of the monetary base do not always immediately produce high inflation due to factors like low interest rates and breakdowns in money multiplier processes.

Inflation: Prices on the Rise - International Monetary Fund (IMF) - Inflation occurs when money supply growth exceeds economic growth, lowering currency purchasing power, with both "demand-pull" and "cost-push" factors, as well as inflation expectations, influencing price increases alongside monetary inflation.

dowidth.com

dowidth.com