Revenge spending refers to the surge in consumer purchases following periods of restricted spending, often fueled by pent-up demand and a desire to reclaim lost time or experiences. Deferred consumption occurs when individuals or households postpone expenditures due to economic uncertainty, credit constraints, or anticipated future financial needs. Explore the dynamics between these behaviors to understand their impact on market trends and economic recovery.

Why it is important

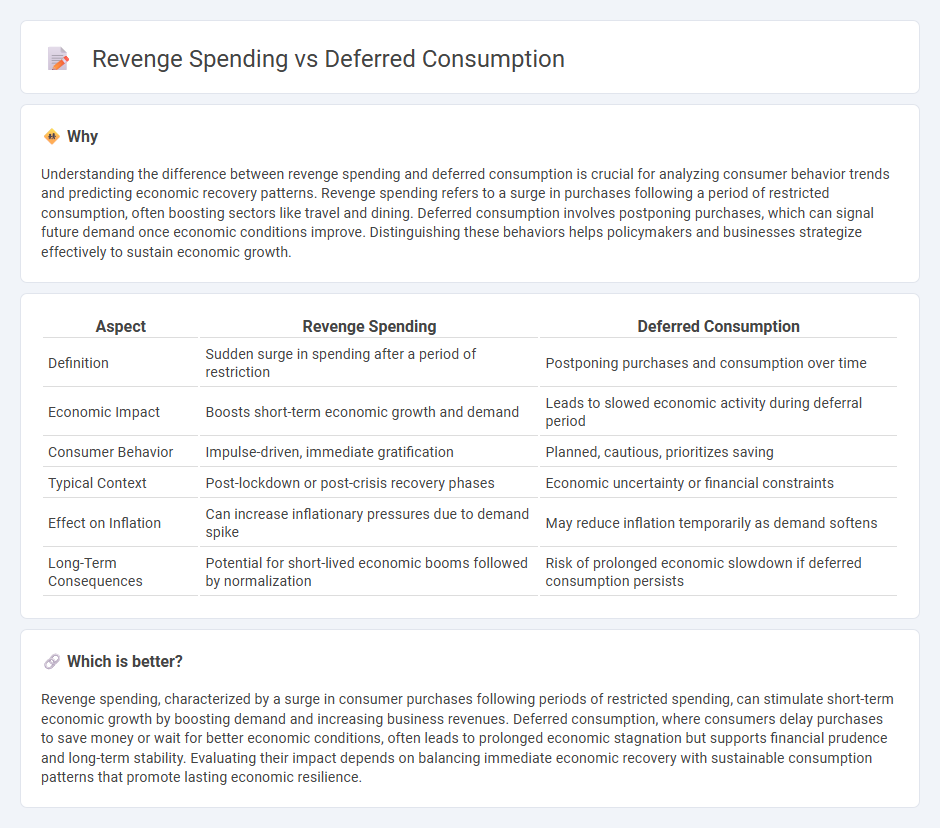

Understanding the difference between revenge spending and deferred consumption is crucial for analyzing consumer behavior trends and predicting economic recovery patterns. Revenge spending refers to a surge in purchases following a period of restricted consumption, often boosting sectors like travel and dining. Deferred consumption involves postponing purchases, which can signal future demand once economic conditions improve. Distinguishing these behaviors helps policymakers and businesses strategize effectively to sustain economic growth.

Comparison Table

| Aspect | Revenge Spending | Deferred Consumption |

|---|---|---|

| Definition | Sudden surge in spending after a period of restriction | Postponing purchases and consumption over time |

| Economic Impact | Boosts short-term economic growth and demand | Leads to slowed economic activity during deferral period |

| Consumer Behavior | Impulse-driven, immediate gratification | Planned, cautious, prioritizes saving |

| Typical Context | Post-lockdown or post-crisis recovery phases | Economic uncertainty or financial constraints |

| Effect on Inflation | Can increase inflationary pressures due to demand spike | May reduce inflation temporarily as demand softens |

| Long-Term Consequences | Potential for short-lived economic booms followed by normalization | Risk of prolonged economic slowdown if deferred consumption persists |

Which is better?

Revenge spending, characterized by a surge in consumer purchases following periods of restricted spending, can stimulate short-term economic growth by boosting demand and increasing business revenues. Deferred consumption, where consumers delay purchases to save money or wait for better economic conditions, often leads to prolonged economic stagnation but supports financial prudence and long-term stability. Evaluating their impact depends on balancing immediate economic recovery with sustainable consumption patterns that promote lasting economic resilience.

Connection

Revenge spending refers to consumers aggressively purchasing goods and services after periods of financial restraint, often following economic downturns or lockdowns, reflecting pent-up demand. Deferred consumption occurs when consumers delay non-essential spending due to uncertainty or reduced income, leading to accumulated purchasing power. The connection lies in how deferred consumption creates a reservoir of unmet demand that fuels revenge spending, driving sudden surges in economic activity and influencing market recovery patterns.

Key Terms

Savings

Deferred consumption involves delaying purchases to increase savings and build financial security, while revenge spending reflects sudden, impulsive purchases often triggered by pent-up demand or emotional responses. Savings growth is more sustainable through deferred consumption as it aligns with long-term financial goals, unlike revenge spending, which can lead to financial strain and reduced savings. Explore more about balancing spending behaviors to optimize your savings strategy.

Consumer behavior

Deferred consumption occurs when consumers postpone purchases due to economic uncertainty or external constraints, resulting in accumulated demand for future spending. Revenge spending describes a surge in consumer purchases following periods of restriction, driven by emotional desire to reclaim lost experiences. Explore the dynamics of these behaviors to understand evolving consumer patterns and market recovery.

Economic stimulus

Deferred consumption occurs when consumers delay purchases during economic downturns, leading to a temporary reduction in demand, while revenge spending emerges as a surge in spending once restrictions ease, driven by pent-up demand and improved consumer confidence. Economic stimulus measures amplify these effects by providing financial support and incentives, which encourage immediate consumption and help accelerate economic recovery. Explore more about how government stimulus programs influence consumer behavior and overall economic growth.

Source and External Links

How Many Units of Deferred Consumption Should You Keep? - Deferred consumption refers to the practice of saving or investing money today to consume or enjoy goods and services in the future; it involves delaying current consumption to build financial security and optionality but must be balanced to avoid turning saving into unspent potential rather than actual wealth.

Deferred expense definition - AccountingTools - In accounting, deferred consumption can be seen as a deferred expense, which is a cost already incurred but not yet consumed, recorded initially as an asset and recognized as an expense when the consumption actually occurs over time.

Cash Substitution and Deferred Consumption as Data-Breach Harms - Deferred consumption also appears in legal and economic contexts, for example, referring to consumers delaying spending due to harm such as data breaches, evidencing that deferred consumption can result from external factors reducing immediate consumption behavior.

dowidth.com

dowidth.com