Funflation describes rising prices fueled by increased consumer spending on leisure activities, while reflation refers to government policies aimed at boosting economic growth and inflation after a downturn. Both phenomena impact inflation rates and purchasing power but stem from different economic triggers and policy responses. Explore how these contrasting trends influence markets and household budgets.

Why it is important

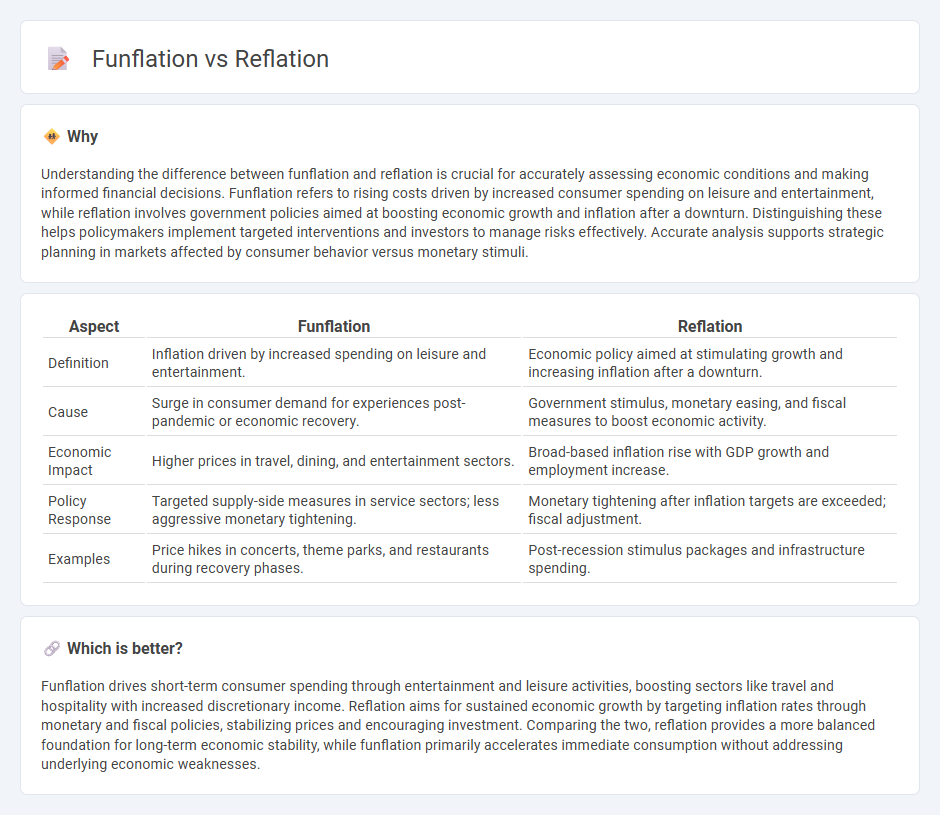

Understanding the difference between funflation and reflation is crucial for accurately assessing economic conditions and making informed financial decisions. Funflation refers to rising costs driven by increased consumer spending on leisure and entertainment, while reflation involves government policies aimed at boosting economic growth and inflation after a downturn. Distinguishing these helps policymakers implement targeted interventions and investors to manage risks effectively. Accurate analysis supports strategic planning in markets affected by consumer behavior versus monetary stimuli.

Comparison Table

| Aspect | Funflation | Reflation |

|---|---|---|

| Definition | Inflation driven by increased spending on leisure and entertainment. | Economic policy aimed at stimulating growth and increasing inflation after a downturn. |

| Cause | Surge in consumer demand for experiences post-pandemic or economic recovery. | Government stimulus, monetary easing, and fiscal measures to boost economic activity. |

| Economic Impact | Higher prices in travel, dining, and entertainment sectors. | Broad-based inflation rise with GDP growth and employment increase. |

| Policy Response | Targeted supply-side measures in service sectors; less aggressive monetary tightening. | Monetary tightening after inflation targets are exceeded; fiscal adjustment. |

| Examples | Price hikes in concerts, theme parks, and restaurants during recovery phases. | Post-recession stimulus packages and infrastructure spending. |

Which is better?

Funflation drives short-term consumer spending through entertainment and leisure activities, boosting sectors like travel and hospitality with increased discretionary income. Reflation aims for sustained economic growth by targeting inflation rates through monetary and fiscal policies, stabilizing prices and encouraging investment. Comparing the two, reflation provides a more balanced foundation for long-term economic stability, while funflation primarily accelerates immediate consumption without addressing underlying economic weaknesses.

Connection

Funflation, characterized by increased spending on entertainment and leisure, drives consumer demand that stimulates reflationary pressures in the economy. Reflation, marked by rising prices and economic growth following a downturn, benefits from the heightened consumption patterns fueled by funflation trends. Together, funflation amplifies consumption dynamics, while reflation reflects broader economic recovery and inflationary responses.

Key Terms

Inflation

Reflation targets economic recovery by stimulating demand through monetary and fiscal policies, aiming to push inflation towards a healthy 2% target after a downturn. Funflation, a newer term, describes rising prices driven primarily by increased consumer spending on leisure and entertainment, reflecting shifting consumer priorities rather than supply constraints. Explore more to understand how these inflation types shape economic strategies and market behavior.

Monetary Policy

Reflation refers to deliberate monetary policy actions aimed at increasing inflation rates to counteract deflation and stimulate economic growth, while funflation is a recent term describing inflation driven by heightened consumer spending on entertainment and leisure activities as economies reopen. Central banks implement reflation strategies by lowering interest rates and increasing money supply to achieve target inflation, contrasting with funflation's demand-pull nature fueled by increased discretionary expenditures rather than policy shifts. Explore how evolving monetary policies distinguish reflation efforts from funflation trends in shaping economic recovery.

Consumer Spending

Reflation refers to policies aimed at increasing economic activity and boosting consumer spending after a downturn by raising aggregate demand through fiscal stimulus or monetary easing. Funflation, a more recent concept, describes the rise in consumer spending driven by experiential purchases and discretionary activities, even amid inflationary pressures, signaling a shift in spending habits towards enjoyment and lifestyle. Explore how these dynamics reshape consumer behavior and economic recovery strategies.

Source and External Links

Reflation - Wikipedia - Reflation is the process of stimulating the economy by increasing the money supply or reducing taxes to bring the price level back up to a long-term trend after a dip, effectively reversing deflation or disinflation to restore inflation to a normal level.

What's the Reflation Trade? - SoFi - Reflation refers to the recovery of prices and employment after an economic downturn, often supported by stimulus policies, and the reflation trade involves investing in sectors that typically benefit from this recovery phase, such as hospitality, energy, and financials.

What is Reflation and How Do You Trade it? | IG International - Reflationary policies aim to counteract deflation by using monetary easing and fiscal stimulus to lift prices back to their long-term trend after recessions, though there is a risk of overshooting into inflation if policies are too aggressive.

dowidth.com

dowidth.com