Carbon border adjustment mechanisms aim to equalize carbon costs between domestic producers and importers by imposing fees based on the carbon content of imported goods, thereby preventing carbon leakage and protecting local industries. Border carbon taxes, on the other hand, directly tax imported goods according to their associated carbon emissions to incentivize cleaner production worldwide. Explore further to understand how these policies impact global trade and climate goals.

Why it is important

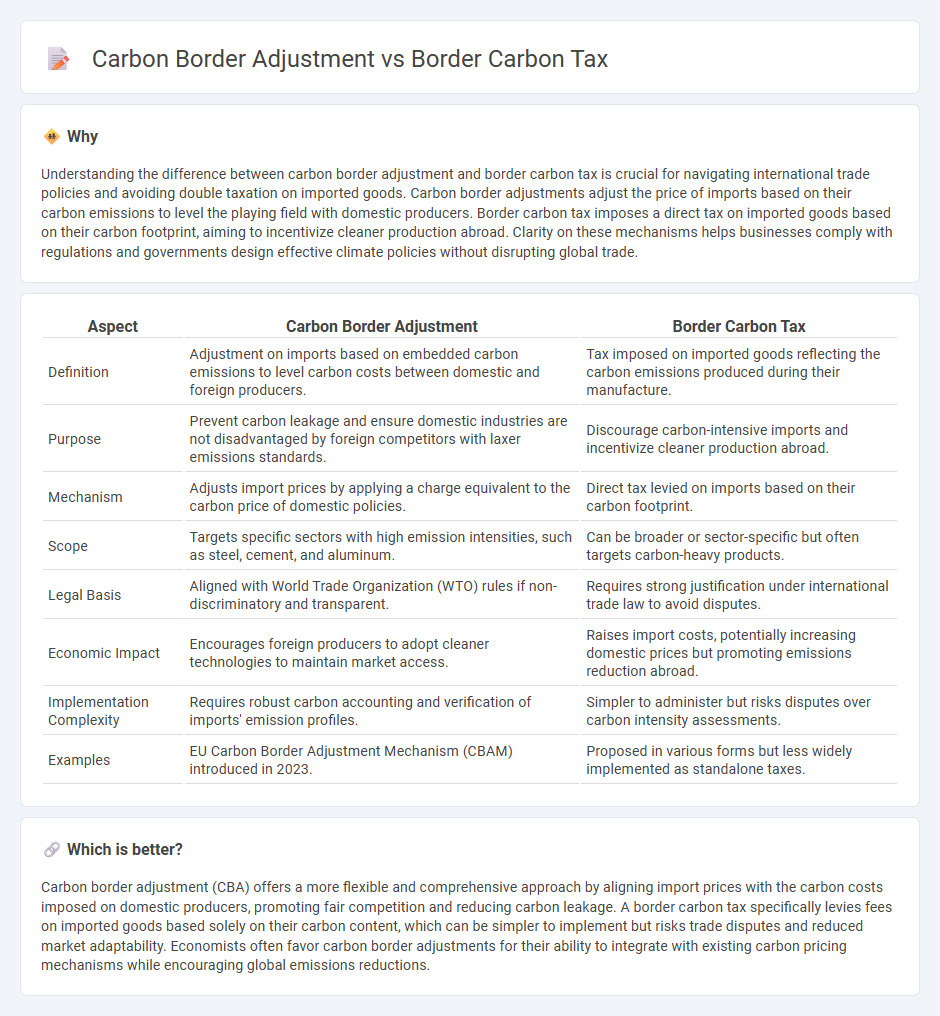

Understanding the difference between carbon border adjustment and border carbon tax is crucial for navigating international trade policies and avoiding double taxation on imported goods. Carbon border adjustments adjust the price of imports based on their carbon emissions to level the playing field with domestic producers. Border carbon tax imposes a direct tax on imported goods based on their carbon footprint, aiming to incentivize cleaner production abroad. Clarity on these mechanisms helps businesses comply with regulations and governments design effective climate policies without disrupting global trade.

Comparison Table

| Aspect | Carbon Border Adjustment | Border Carbon Tax |

|---|---|---|

| Definition | Adjustment on imports based on embedded carbon emissions to level carbon costs between domestic and foreign producers. | Tax imposed on imported goods reflecting the carbon emissions produced during their manufacture. |

| Purpose | Prevent carbon leakage and ensure domestic industries are not disadvantaged by foreign competitors with laxer emissions standards. | Discourage carbon-intensive imports and incentivize cleaner production abroad. |

| Mechanism | Adjusts import prices by applying a charge equivalent to the carbon price of domestic policies. | Direct tax levied on imports based on their carbon footprint. |

| Scope | Targets specific sectors with high emission intensities, such as steel, cement, and aluminum. | Can be broader or sector-specific but often targets carbon-heavy products. |

| Legal Basis | Aligned with World Trade Organization (WTO) rules if non-discriminatory and transparent. | Requires strong justification under international trade law to avoid disputes. |

| Economic Impact | Encourages foreign producers to adopt cleaner technologies to maintain market access. | Raises import costs, potentially increasing domestic prices but promoting emissions reduction abroad. |

| Implementation Complexity | Requires robust carbon accounting and verification of imports' emission profiles. | Simpler to administer but risks disputes over carbon intensity assessments. |

| Examples | EU Carbon Border Adjustment Mechanism (CBAM) introduced in 2023. | Proposed in various forms but less widely implemented as standalone taxes. |

Which is better?

Carbon border adjustment (CBA) offers a more flexible and comprehensive approach by aligning import prices with the carbon costs imposed on domestic producers, promoting fair competition and reducing carbon leakage. A border carbon tax specifically levies fees on imported goods based solely on their carbon content, which can be simpler to implement but risks trade disputes and reduced market adaptability. Economists often favor carbon border adjustments for their ability to integrate with existing carbon pricing mechanisms while encouraging global emissions reductions.

Connection

Carbon border adjustment and border carbon tax both aim to address carbon leakage by leveling the playing field between domestic producers subject to carbon regulations and international competitors from regions with less stringent emissions policies. Carbon border adjustments impose fees on imported goods based on their carbon content, effectively acting as a border carbon tax to incentivize low-carbon production globally. These mechanisms promote fair trade practices while encouraging countries to adopt stronger climate policies, minimizing economic distortions in international markets.

Key Terms

Carbon Leakage

Border carbon tax imposes a tariff on imported goods based on their carbon emissions, directly targeting carbon leakage by discouraging production shifts to countries with lax environmental regulations. Carbon border adjustment mechanisms (CBAM) extend beyond tariffs, adjusting the carbon price embedded in imports to maintain competitive parity and incentivize global emission reductions. Explore how these tools combat carbon leakage and drive international climate policy innovation.

Trade Competitiveness

Border carbon tax imposes a direct tax on imported goods based on their carbon emissions, potentially raising costs for foreign producers and protecting domestic industries from carbon leakage. Carbon border adjustment mechanisms adjust the price of imports to reflect the carbon costs faced by domestic producers, aiming to equalize competitive conditions and incentivize cleaner production globally. Explore how these tools impact trade competitiveness and international market dynamics in depth.

Emissions Pricing

Border carbon tax imposes direct fees on imported goods based on their carbon emissions, incentivizing cleaner production processes globally while leveling the playing field for domestic industries facing carbon pricing. Carbon Border Adjustment Mechanism (CBAM) incorporates emissions pricing into import costs, allowing countries to mitigate carbon leakage by adjusting tariffs to reflect the carbon content embedded in products. Explore how these mechanisms shape emissions pricing to drive sustainable trade and global carbon reduction efforts.

Source and External Links

Carbon Border Adjustments | MIT Climate Portal - A Carbon Border Adjustment Mechanism (CBAM) charges a fee on imported goods based on the greenhouse gas emissions created during their production to level the playing field with domestic products subject to carbon pricing, also incentivizing other countries to adopt their own carbon prices.

Carbon Border Adjustment Mechanism - Wikipedia - The EU CBAM, effective in transitional form from October 2023 and fully from 2026, applies a carbon tariff on certain carbon-intensive imports to prevent carbon leakage and complement the EU Emissions Trading System.

What is a Carbon Border Adjustment Mechanism? | Brookings - A CBAM is a tariff on imported goods based on their embedded carbon emissions to reduce global emissions, prevent competitive distortions due to differing climate policies, and encourage cleaner production worldwide.

dowidth.com

dowidth.com