Doom spending, characterized by excessive and fear-driven expenditures, contrasts sharply with strategic investment focused on long-term economic growth and stability. While doom spending often leads to short-term financial strain and reduced resource efficiency, investments aim to generate sustainable returns and foster innovation. Explore the key differences and impacts of doom spending versus investment to understand their roles in shaping economic futures.

Why it is important

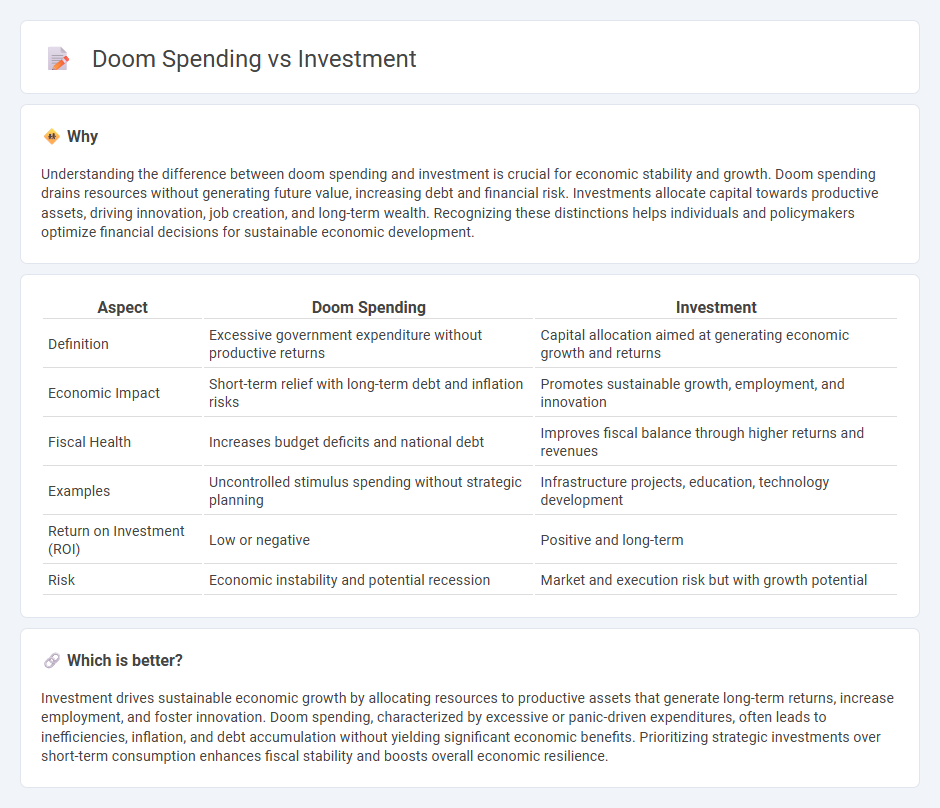

Understanding the difference between doom spending and investment is crucial for economic stability and growth. Doom spending drains resources without generating future value, increasing debt and financial risk. Investments allocate capital towards productive assets, driving innovation, job creation, and long-term wealth. Recognizing these distinctions helps individuals and policymakers optimize financial decisions for sustainable economic development.

Comparison Table

| Aspect | Doom Spending | Investment |

|---|---|---|

| Definition | Excessive government expenditure without productive returns | Capital allocation aimed at generating economic growth and returns |

| Economic Impact | Short-term relief with long-term debt and inflation risks | Promotes sustainable growth, employment, and innovation |

| Fiscal Health | Increases budget deficits and national debt | Improves fiscal balance through higher returns and revenues |

| Examples | Uncontrolled stimulus spending without strategic planning | Infrastructure projects, education, technology development |

| Return on Investment (ROI) | Low or negative | Positive and long-term |

| Risk | Economic instability and potential recession | Market and execution risk but with growth potential |

Which is better?

Investment drives sustainable economic growth by allocating resources to productive assets that generate long-term returns, increase employment, and foster innovation. Doom spending, characterized by excessive or panic-driven expenditures, often leads to inefficiencies, inflation, and debt accumulation without yielding significant economic benefits. Prioritizing strategic investments over short-term consumption enhances fiscal stability and boosts overall economic resilience.

Connection

Doom spending often spikes during economic uncertainty as consumers prioritize immediate needs, reducing long-term investments and slowing economic growth. Reduced investment during these periods limits capital formation, hindering innovation and productivity improvements essential for recovery. Policymakers must balance fiscal measures to stabilize consumer confidence and encourage sustained investment to foster economic resilience.

Key Terms

Capital Allocation

Effective capital allocation distinguishes investment, which drives long-term growth and value creation, from doom spending, characterized by inefficient use of resources leading to financial decline. Strategic investments prioritize projects with measurable returns and sustainable impact, while doom spending often results in wasted capital without generating significant benefits. Explore detailed strategies on optimizing capital allocation to maximize investment outcomes and avoid financial pitfalls.

Asset Depreciation

Investment typically involves allocating funds to assets expected to appreciate or generate income, such as real estate or stocks, whereas doom spending refers to impulsive purchases that rapidly lose value without long-term benefits. Asset depreciation measures the decline in value of investments over time, highlighting the importance of strategic asset selection to mitigate financial loss. Explore more insights on asset depreciation and smart investment strategies to safeguard your wealth.

Return on Investment (ROI)

Investment prioritizes the strategic allocation of resources to generate measurable returns over time, emphasizing positive Return on Investment (ROI) outcomes. Doom spending, characterized by impulsive or fear-driven expenses, lacks sustainable value and often results in negative ROI. Explore effective strategies to maximize ROI and distinguish between prudent investment and detrimental spending.

Source and External Links

Investment - Wikipedia - Investment is the commitment of resources, especially money, to obtain a return over time, balancing risk and potential profit through vehicles like stocks, bonds, or real estate, with diversification recommended to reduce risk.

Investment Products - Investor.gov - Different investment products such as stocks, bonds, mutual funds, ETFs, and insurance have varying risk levels and returns; considerations include fees, liquidity, diversification, and risk tolerance.

Ten Things to Consider Before You Make Investing Decisions - SEC.gov - Successful investing begins with defining your goals and understanding your risk tolerance, recognizing that all investments carry risk, and that potential returns generally correlate with the level of risk accepted.

dowidth.com

dowidth.com