De-dollarization refers to the process where countries reduce reliance on the US dollar in international trade and reserves, aiming to strengthen monetary sovereignty and mitigate risks from dollar fluctuations. In contrast, a barter economy operates without a formal currency system, relying instead on direct exchange of goods and services, often seen in situations with weak or collapsed monetary infrastructures. Explore the complexities and impacts of these contrasting economic approaches in modern financial systems.

Why it is important

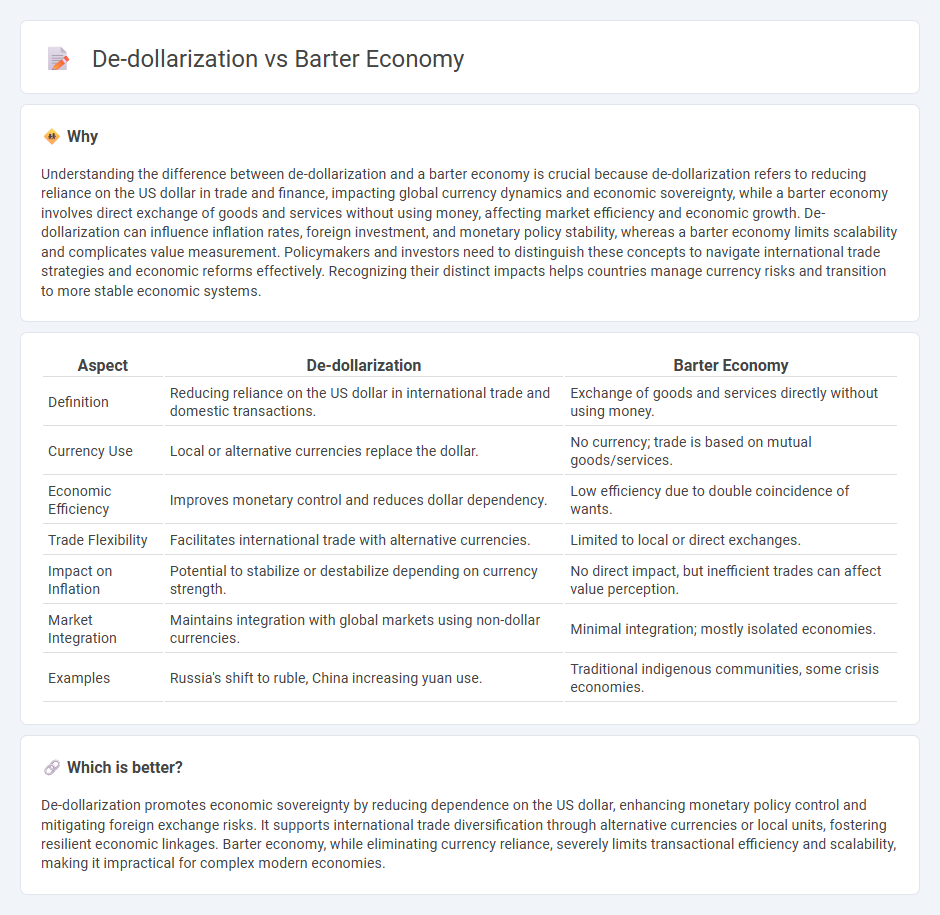

Understanding the difference between de-dollarization and a barter economy is crucial because de-dollarization refers to reducing reliance on the US dollar in trade and finance, impacting global currency dynamics and economic sovereignty, while a barter economy involves direct exchange of goods and services without using money, affecting market efficiency and economic growth. De-dollarization can influence inflation rates, foreign investment, and monetary policy stability, whereas a barter economy limits scalability and complicates value measurement. Policymakers and investors need to distinguish these concepts to navigate international trade strategies and economic reforms effectively. Recognizing their distinct impacts helps countries manage currency risks and transition to more stable economic systems.

Comparison Table

| Aspect | De-dollarization | Barter Economy |

|---|---|---|

| Definition | Reducing reliance on the US dollar in international trade and domestic transactions. | Exchange of goods and services directly without using money. |

| Currency Use | Local or alternative currencies replace the dollar. | No currency; trade is based on mutual goods/services. |

| Economic Efficiency | Improves monetary control and reduces dollar dependency. | Low efficiency due to double coincidence of wants. |

| Trade Flexibility | Facilitates international trade with alternative currencies. | Limited to local or direct exchanges. |

| Impact on Inflation | Potential to stabilize or destabilize depending on currency strength. | No direct impact, but inefficient trades can affect value perception. |

| Market Integration | Maintains integration with global markets using non-dollar currencies. | Minimal integration; mostly isolated economies. |

| Examples | Russia's shift to ruble, China increasing yuan use. | Traditional indigenous communities, some crisis economies. |

Which is better?

De-dollarization promotes economic sovereignty by reducing dependence on the US dollar, enhancing monetary policy control and mitigating foreign exchange risks. It supports international trade diversification through alternative currencies or local units, fostering resilient economic linkages. Barter economy, while eliminating currency reliance, severely limits transactional efficiency and scalability, making it impractical for complex modern economies.

Connection

De-dollarization reduces reliance on the US dollar, prompting countries to seek alternative trade mechanisms such as barter economy to facilitate transactions without using major global currencies. This shift strengthens bilateral trade agreements and supports economic resilience by minimizing exposure to currency fluctuations and sanctions. The interconnected rise of de-dollarization and barter systems reflects a strategic move towards economic sovereignty and diversification.

Key Terms

**Barter economy:**

Barter economy operates on the direct exchange of goods and services without using money, often emerging in situations of currency instability or economic sanctions. This system bypasses traditional banking and currency exchange, reducing reliance on the US dollar in international trade. Explore how barter economies reshape global trade dynamics and challenge de-dollarization efforts.

Double coincidence of wants

The barter economy relies heavily on the double coincidence of wants, where two parties must have mutual desires to exchange goods or services directly, often limiting transaction efficiency and scale. In contrast, de-dollarization moves economies away from the U.S. dollar as a medium of exchange, fostering alternative currency systems that reduce dependency on double coincidence constraints. Explore how de-dollarization strategies impact global trade dynamics and economic sovereignty.

Commodity exchange

Commodity exchange within a barter economy relies on direct trade of goods without monetary intermediaries, emphasizing the intrinsic value and negotiation between parties. De-dollarization promotes shifting from US dollar reliance to alternative currencies or commodities, enhancing the role of tangible assets in international trade and reducing currency risk. Explore the impact of these economic shifts on global trade and commodity markets in greater detail.

Source and External Links

What is Barter Economy? How does it Work? - A barter economy is a system where goods and services are exchanged directly without using money, supporting local businesses, reducing reliance on cash, and being less prone to inflation when values are mutually agreed upon.

Barter Economy Definition: 3 Examples of Bartering - 2025 - Barter economies often arise between businesses exchanging goods and services, during economic crises when currency fails, or informally between individuals exchanging favors or time.

Barter - Organized barter involves companies joining barter networks to trade goods and services without money, improving liquidity and enabling transactions with surplus inventory, although challenges exist in matching the value and demand of exchanged items.

dowidth.com

dowidth.com