Soft landing occurs when economic growth slows enough to reduce inflation without triggering a recession, balancing employment and price stability. Disinflation refers to a decrease in the rate of inflation, signaling a slowdown in price increases without negative impacts on economic growth. Explore the nuances of soft landing and disinflation to understand their roles in economic policy.

Why it is important

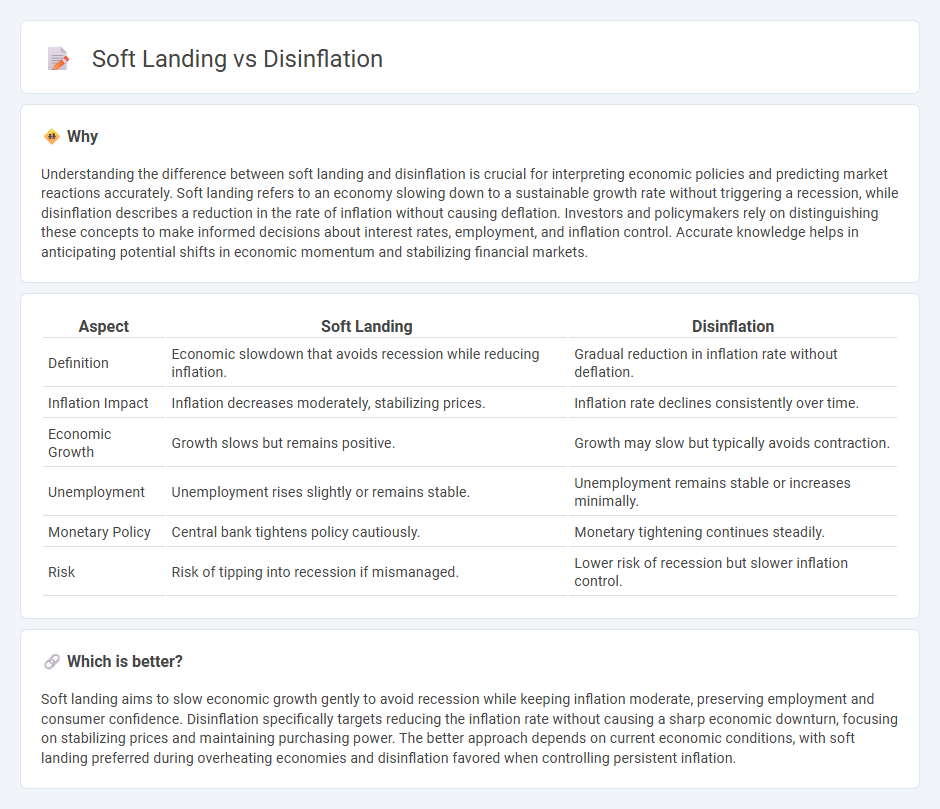

Understanding the difference between soft landing and disinflation is crucial for interpreting economic policies and predicting market reactions accurately. Soft landing refers to an economy slowing down to a sustainable growth rate without triggering a recession, while disinflation describes a reduction in the rate of inflation without causing deflation. Investors and policymakers rely on distinguishing these concepts to make informed decisions about interest rates, employment, and inflation control. Accurate knowledge helps in anticipating potential shifts in economic momentum and stabilizing financial markets.

Comparison Table

| Aspect | Soft Landing | Disinflation |

|---|---|---|

| Definition | Economic slowdown that avoids recession while reducing inflation. | Gradual reduction in inflation rate without deflation. |

| Inflation Impact | Inflation decreases moderately, stabilizing prices. | Inflation rate declines consistently over time. |

| Economic Growth | Growth slows but remains positive. | Growth may slow but typically avoids contraction. |

| Unemployment | Unemployment rises slightly or remains stable. | Unemployment remains stable or increases minimally. |

| Monetary Policy | Central bank tightens policy cautiously. | Monetary tightening continues steadily. |

| Risk | Risk of tipping into recession if mismanaged. | Lower risk of recession but slower inflation control. |

Which is better?

Soft landing aims to slow economic growth gently to avoid recession while keeping inflation moderate, preserving employment and consumer confidence. Disinflation specifically targets reducing the inflation rate without causing a sharp economic downturn, focusing on stabilizing prices and maintaining purchasing power. The better approach depends on current economic conditions, with soft landing preferred during overheating economies and disinflation favored when controlling persistent inflation.

Connection

Soft landing occurs when economic growth slows just enough to reduce inflation without causing a recession, directly influencing disinflation by easing price pressures gradually. Central banks aim for a soft landing through monetary policies that temper demand, leading to a decline in the inflation rate while maintaining employment levels. Effective management of interest rates and fiscal measures supports disinflation, aligning with the goals of a soft landing to stabilize the economy.

Key Terms

Monetary Policy

Disinflation refers to a slowdown in the rate of inflation, indicating that prices are rising at a reduced pace, often achieved through tighter monetary policy measures such as higher interest rates and reduced money supply. A soft landing occurs when monetary policy successfully cools an overheating economy to achieve stable growth and controlled inflation without triggering a recession. Explore the nuances of monetary policy strategies in managing inflation and economic stability for deeper insights.

Interest Rates

Disinflation refers to a slowdown in the rate of inflation, often influencing central banks to adjust interest rates cautiously to avoid stalling economic growth. A soft landing occurs when monetary policy, particularly interest rate hikes, successfully slows inflation without triggering a recession or significant unemployment rise. Explore further how interest rate strategies differentiate disinflation from a soft landing.

Economic Growth

Disinflation refers to a slowdown in the rate of inflation, signaling reduced price pressures without causing outright deflation, which can help sustain steady economic growth. A soft landing describes the Federal Reserve's goal to slow economic expansion just enough to curb inflation without triggering a recession, maintaining stable employment and moderate GDP growth. Explore the nuanced impacts of disinflation and soft landing on economic growth to gain deeper insights.

Source and External Links

Disinflation - Definition, How It Works, Examples - Disinflation is the slowing of the rate of price inflation, meaning the inflation rate is positive but decreasing, unlike deflation which is a negative inflation rate; it often results from tighter monetary policy or economic recession effects.

Disinflation - Disinflation refers to a decrease in the inflation rate over time, indicating slower price increases, and it can precede deflation if inflation drops below zero.

Inflation, Disinflation and Deflation: What Do They All Mean? - Disinflation means prices continue to rise but at a slower pace compared to previous periods, contrasted with inflation (rising prices) and deflation (falling prices).

dowidth.com

dowidth.com