The carbon border tax imposes fees on imported goods based on their carbon emissions to prevent carbon leakage and protect domestic industries from unfair competition. Emissions trading systems (ETS) establish a market for carbon allowances, enabling companies to buy and sell emission permits within a capped limit to reduce overall greenhouse gas output. Explore how these mechanisms shape economic strategies for sustainable development and global trade policies.

Why it is important

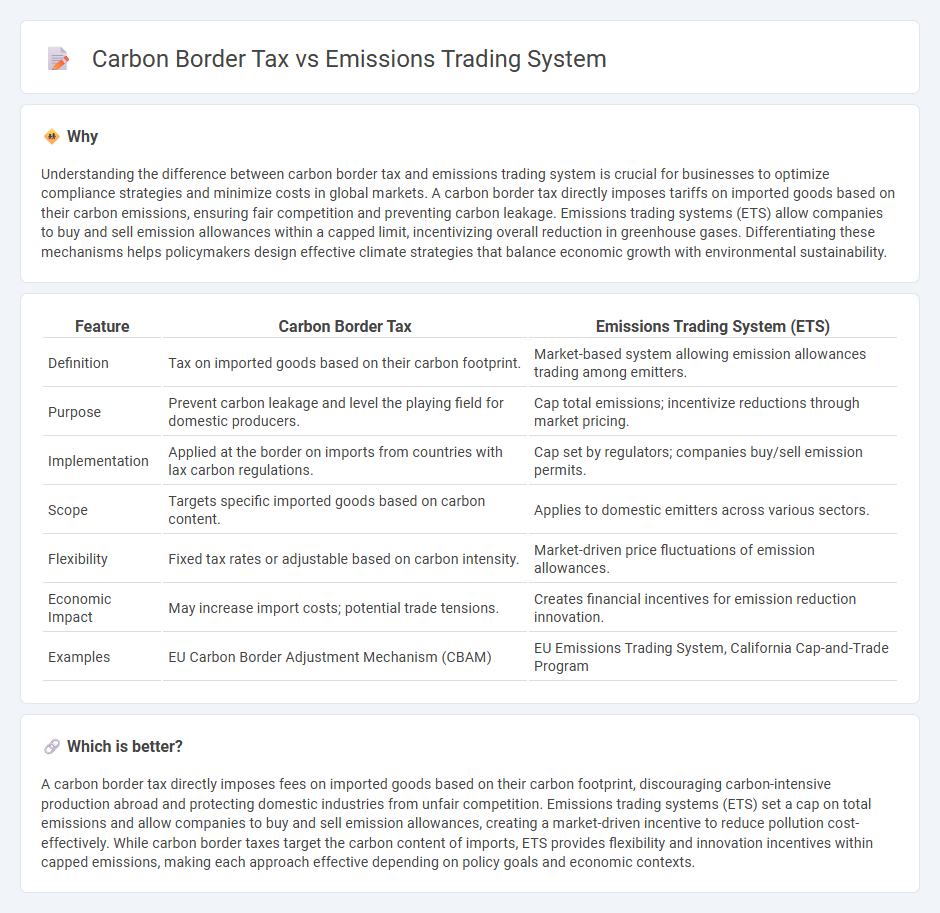

Understanding the difference between carbon border tax and emissions trading system is crucial for businesses to optimize compliance strategies and minimize costs in global markets. A carbon border tax directly imposes tariffs on imported goods based on their carbon emissions, ensuring fair competition and preventing carbon leakage. Emissions trading systems (ETS) allow companies to buy and sell emission allowances within a capped limit, incentivizing overall reduction in greenhouse gases. Differentiating these mechanisms helps policymakers design effective climate strategies that balance economic growth with environmental sustainability.

Comparison Table

| Feature | Carbon Border Tax | Emissions Trading System (ETS) |

|---|---|---|

| Definition | Tax on imported goods based on their carbon footprint. | Market-based system allowing emission allowances trading among emitters. |

| Purpose | Prevent carbon leakage and level the playing field for domestic producers. | Cap total emissions; incentivize reductions through market pricing. |

| Implementation | Applied at the border on imports from countries with lax carbon regulations. | Cap set by regulators; companies buy/sell emission permits. |

| Scope | Targets specific imported goods based on carbon content. | Applies to domestic emitters across various sectors. |

| Flexibility | Fixed tax rates or adjustable based on carbon intensity. | Market-driven price fluctuations of emission allowances. |

| Economic Impact | May increase import costs; potential trade tensions. | Creates financial incentives for emission reduction innovation. |

| Examples | EU Carbon Border Adjustment Mechanism (CBAM) | EU Emissions Trading System, California Cap-and-Trade Program |

Which is better?

A carbon border tax directly imposes fees on imported goods based on their carbon footprint, discouraging carbon-intensive production abroad and protecting domestic industries from unfair competition. Emissions trading systems (ETS) set a cap on total emissions and allow companies to buy and sell emission allowances, creating a market-driven incentive to reduce pollution cost-effectively. While carbon border taxes target the carbon content of imports, ETS provides flexibility and innovation incentives within capped emissions, making each approach effective depending on policy goals and economic contexts.

Connection

The carbon border tax and emissions trading system (ETS) are connected as complementary tools to combat climate change by pricing carbon emissions. The ETS sets a cap on allowable emissions and enables companies to trade emissions allowances, creating a market-driven incentive to reduce carbon output. The carbon border tax ensures that imported goods face equivalent carbon costs, preventing carbon leakage and leveling the playing field for domestic industries subject to the ETS.

Key Terms

Cap-and-trade

The Emissions Trading System (ETS) operates as a cap-and-trade mechanism, setting a limit on total greenhouse gas emissions and allowing companies to buy and sell emission permits to meet regulatory requirements efficiently. In contrast, a Carbon Border Tax imposes fees on imported goods based on their carbon footprint, aiming to prevent carbon leakage and level the playing field between domestic and foreign producers. Explore the nuances and impacts of cap-and-trade versus carbon border taxes to understand their roles in global climate policy.

Carbon leakage

The emissions trading system (ETS) aims to reduce carbon leakage by setting a cap on emissions and allowing companies to trade permits, creating financial incentives to minimize emissions within regulated regions. In contrast, a carbon border tax targets carbon leakage by imposing tariffs on imported goods based on their carbon footprint, leveling the playing field for domestic industries facing stricter climate regulations. Explore the mechanisms and effectiveness of ETS and carbon border taxes in preventing carbon leakage to understand their roles in global climate policy.

Import tariff

Emissions trading systems (ETS) regulate carbon emissions by setting a cap and allowing companies to buy and sell allowances, incentivizing reductions within domestic markets. In contrast, carbon border tax imposes import tariffs on goods from countries with less stringent carbon policies, aiming to prevent carbon leakage and encourage global emission reductions. Explore in-depth comparisons and implications of these mechanisms on international trade and climate policy.

Source and External Links

Emissions trading - Emissions trading, also known as cap and trade or emissions trading scheme (ETS), is a market-oriented approach that sets a cap on pollution and allows companies to buy and sell permits to emit pollutants, thereby incentivizing emission reductions economically.

European Union Emissions Trading System - The EU ETS, started in 2005, is the largest carbon trading scheme that caps greenhouse gas emissions across sectors in the EU and allows companies to trade emission allowances to meet reduction targets, covering about 45% of EU emissions.

What Is Emissions Trading? | US EPA - Emissions trading programs set pollution limits (caps) and issue tradable allowances to sources, providing flexibility for compliance and proven effectiveness in reducing air pollution and protecting public health, notably under the U.S. Acid Rain Program.

dowidth.com

dowidth.com