Carbon border tax targets imported goods based on their carbon emissions, aiming to reduce global carbon leakage and encourage sustainable production practices. Consumption tax applies broadly to goods and services purchased by consumers, influencing spending habits and overall demand. Explore the differences and impacts of these taxes on trade and environmental policy to understand their roles in economic strategy.

Why it is important

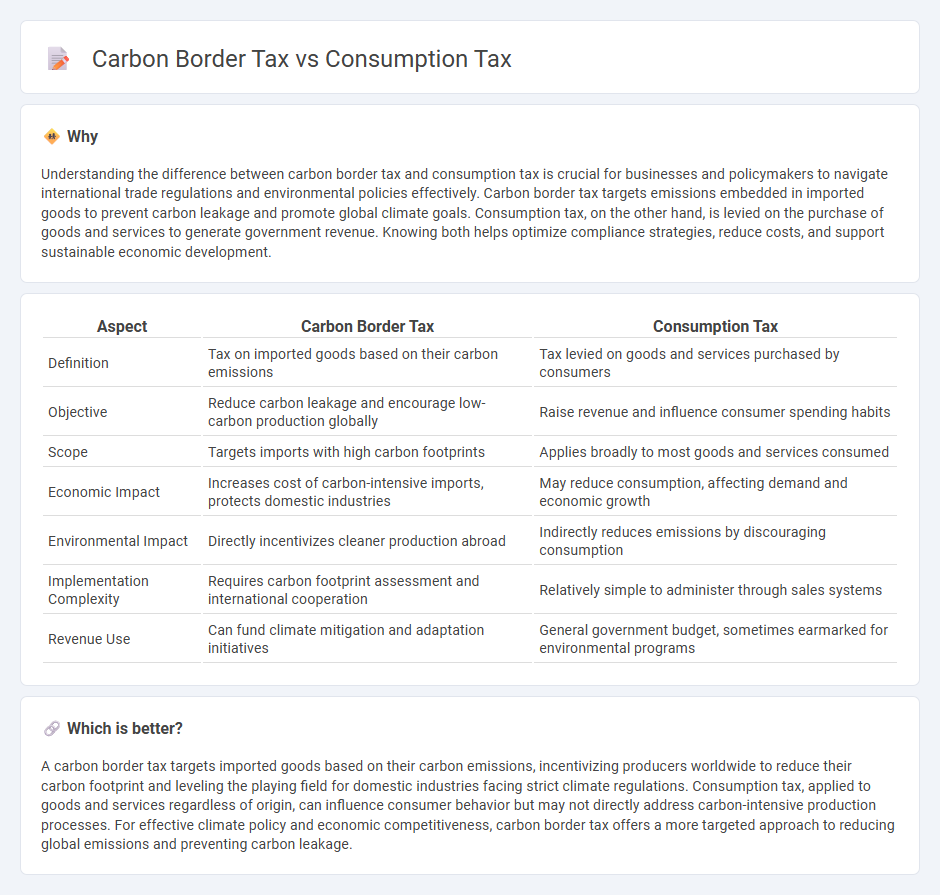

Understanding the difference between carbon border tax and consumption tax is crucial for businesses and policymakers to navigate international trade regulations and environmental policies effectively. Carbon border tax targets emissions embedded in imported goods to prevent carbon leakage and promote global climate goals. Consumption tax, on the other hand, is levied on the purchase of goods and services to generate government revenue. Knowing both helps optimize compliance strategies, reduce costs, and support sustainable economic development.

Comparison Table

| Aspect | Carbon Border Tax | Consumption Tax |

|---|---|---|

| Definition | Tax on imported goods based on their carbon emissions | Tax levied on goods and services purchased by consumers |

| Objective | Reduce carbon leakage and encourage low-carbon production globally | Raise revenue and influence consumer spending habits |

| Scope | Targets imports with high carbon footprints | Applies broadly to most goods and services consumed |

| Economic Impact | Increases cost of carbon-intensive imports, protects domestic industries | May reduce consumption, affecting demand and economic growth |

| Environmental Impact | Directly incentivizes cleaner production abroad | Indirectly reduces emissions by discouraging consumption |

| Implementation Complexity | Requires carbon footprint assessment and international cooperation | Relatively simple to administer through sales systems |

| Revenue Use | Can fund climate mitigation and adaptation initiatives | General government budget, sometimes earmarked for environmental programs |

Which is better?

A carbon border tax targets imported goods based on their carbon emissions, incentivizing producers worldwide to reduce their carbon footprint and leveling the playing field for domestic industries facing strict climate regulations. Consumption tax, applied to goods and services regardless of origin, can influence consumer behavior but may not directly address carbon-intensive production processes. For effective climate policy and economic competitiveness, carbon border tax offers a more targeted approach to reducing global emissions and preventing carbon leakage.

Connection

Carbon border tax and consumption tax are interconnected through their shared goal of regulating environmental impact while influencing economic behavior. Carbon border tax targets imported goods based on their carbon emissions, encouraging producers to adopt greener practices, whereas consumption tax affects the end consumer by taxing goods and services to potentially reduce carbon-intensive consumption. Together, these taxes create a comprehensive framework that promotes sustainability by aligning production and consumption incentives with environmental goals.

Key Terms

Indirect tax

Consumption tax is an indirect tax levied on the purchase of goods and services, impacting consumer spending patterns and government revenue streams. Carbon border tax, also an indirect tax, specifically targets imported goods based on their carbon emissions to incentivize environmentally sustainable production practices and prevent carbon leakage. Explore the nuances of indirect taxation in environmental policy and economic impact by learning more about these tax mechanisms.

Environmental regulation

Consumption tax primarily targets the general sale of goods and services to generate revenue, often lacking direct environmental incentives, whereas a carbon border tax specifically applies to imports based on their carbon emissions to prevent carbon leakage and promote cleaner production globally. Environmental regulation under carbon border tax frameworks aims to align international trade with climate goals by penalizing high-emission products, encouraging sustainable manufacturing practices. Explore how evolving policies integrate these taxes to advance global environmental sustainability and regulatory compliance.

Trade competitiveness

Consumption tax applies uniformly on goods and services irrespective of origin, maintaining neutral trade competitiveness across domestic and imported products. Carbon border tax targets imports based on their carbon footprint, aiming to level the playing field for domestic industries facing stricter environmental regulations and preventing carbon leakage. Explore how these tax mechanisms influence global trade competitiveness and environmental policy integration.

Source and External Links

Consumption Tax | TaxEDU Glossary - This webpage provides an overview of consumption taxes, including their types and effects on the economy.

Consumption Tax Definition & How It Works? - This article explains consumption taxes as charges applied to the purchase of goods and services, contrasting them with income taxes.

Consumption Tax: What It Is And How It Works - This page discusses consumption taxes, focusing on examples like sales tax and highlighting differences from income taxes.

dowidth.com

dowidth.com