Doom spending, characterized by impulsive, fear-driven purchases during economic uncertainty, contrasts sharply with strategic budgeting, which emphasizes disciplined allocation of resources to ensure financial stability. Effective budgeting incorporates monitoring income, controlling expenses, and planning for future needs, reducing stress and promoting long-term wealth accumulation. Discover practical tips to balance spending impulses with smart budgeting strategies for economic resilience.

Why it is important

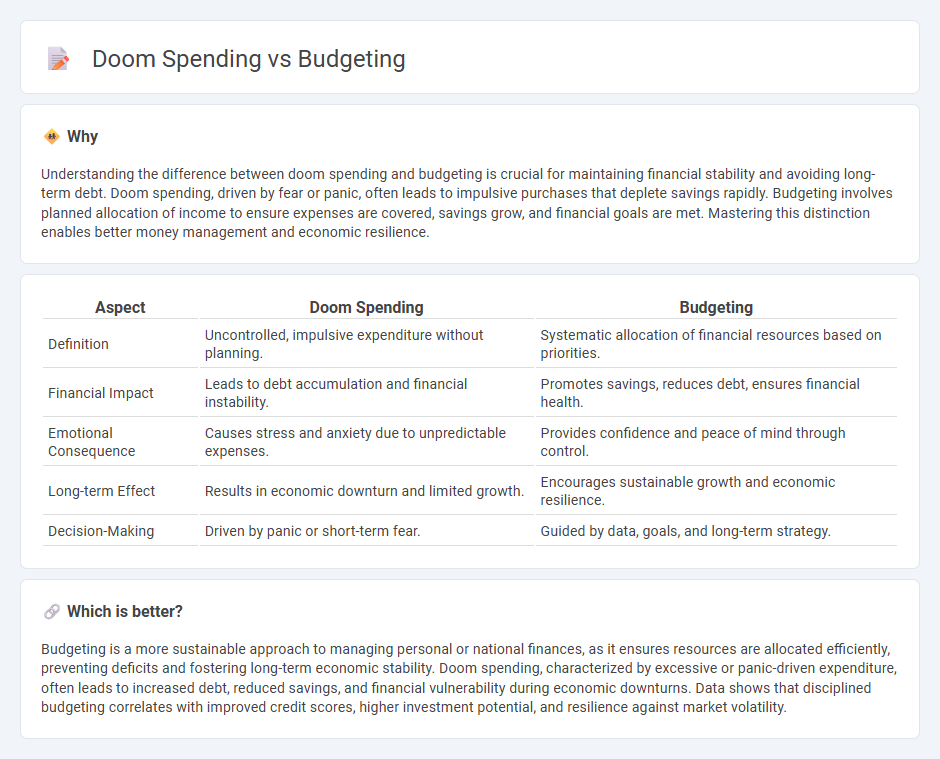

Understanding the difference between doom spending and budgeting is crucial for maintaining financial stability and avoiding long-term debt. Doom spending, driven by fear or panic, often leads to impulsive purchases that deplete savings rapidly. Budgeting involves planned allocation of income to ensure expenses are covered, savings grow, and financial goals are met. Mastering this distinction enables better money management and economic resilience.

Comparison Table

| Aspect | Doom Spending | Budgeting |

|---|---|---|

| Definition | Uncontrolled, impulsive expenditure without planning. | Systematic allocation of financial resources based on priorities. |

| Financial Impact | Leads to debt accumulation and financial instability. | Promotes savings, reduces debt, ensures financial health. |

| Emotional Consequence | Causes stress and anxiety due to unpredictable expenses. | Provides confidence and peace of mind through control. |

| Long-term Effect | Results in economic downturn and limited growth. | Encourages sustainable growth and economic resilience. |

| Decision-Making | Driven by panic or short-term fear. | Guided by data, goals, and long-term strategy. |

Which is better?

Budgeting is a more sustainable approach to managing personal or national finances, as it ensures resources are allocated efficiently, preventing deficits and fostering long-term economic stability. Doom spending, characterized by excessive or panic-driven expenditure, often leads to increased debt, reduced savings, and financial vulnerability during economic downturns. Data shows that disciplined budgeting correlates with improved credit scores, higher investment potential, and resilience against market volatility.

Connection

Doom spending, characterized by excessive or panic-driven expenditure, directly disrupts effective budgeting by causing unpredictable financial imbalances and resource misallocation. Budgeting relies on accurate forecasting and disciplined allocation, which doom spending undermines through impulsive decisions often triggered by economic uncertainty or fear. This connection highlights the importance of maintaining fiscal restraint and strategic planning to safeguard economic stability and prevent financial crises.

Key Terms

Income

Budgeting emphasizes managing income by allocating funds purposefully to meet expenses, savings, and investments, ensuring financial stability and growth. Doom spending occurs when individuals spend impulsively due to stress or anxiety, often disregarding their actual income constraints, leading to debt and financial insecurity. Explore effective strategies to balance income management and emotional spending for healthier financial habits.

Expenses

Budgeting emphasizes careful tracking and allocation of expenses to ensure financial stability, while doom spending involves impulsive, excessive purchases driven by anxiety or stress. Effective budgeting reduces unnecessary expenditures and promotes mindful spending habits that protect long-term financial health. Explore strategies to transform your expense management from doom spending to disciplined budgeting for improved money control.

Financial discipline

Budgeting involves strategically allocating income to expenses, savings, and investments to maintain financial stability and achieve long-term goals. Doom spending, driven by emotional triggers, leads to impulsive purchases that disrupt financial discipline and increase debt. Explore effective methods to strengthen your financial discipline and avoid pitfalls of doom spending.

Source and External Links

Making a Budget | consumer.gov - Provides a simple guide to creating a budget, emphasizing the importance of tracking income and expenses to manage finances effectively.

Free Budget Template and Tips For Getting Started - NerdWallet - Offers a free budget template and recommends using the 50/30/20 rule for allocating income towards needs, wants, and savings.

Budget planner | Free online budget planning tool - MoneyHelper - Provides a free online tool to track income and expenses, helping users identify areas for cost savings and financial improvement.

dowidth.com

dowidth.com