Carbon farming enhances soil carbon sequestration through sustainable agricultural practices, offering tangible environmental benefits and new income streams for farmers. Green bonds finance large-scale projects promoting renewable energy and climate resilience, attracting institutional investors with environmentally responsible portfolios. Explore how these innovative strategies drive economic growth while addressing climate change challenges.

Why it is important

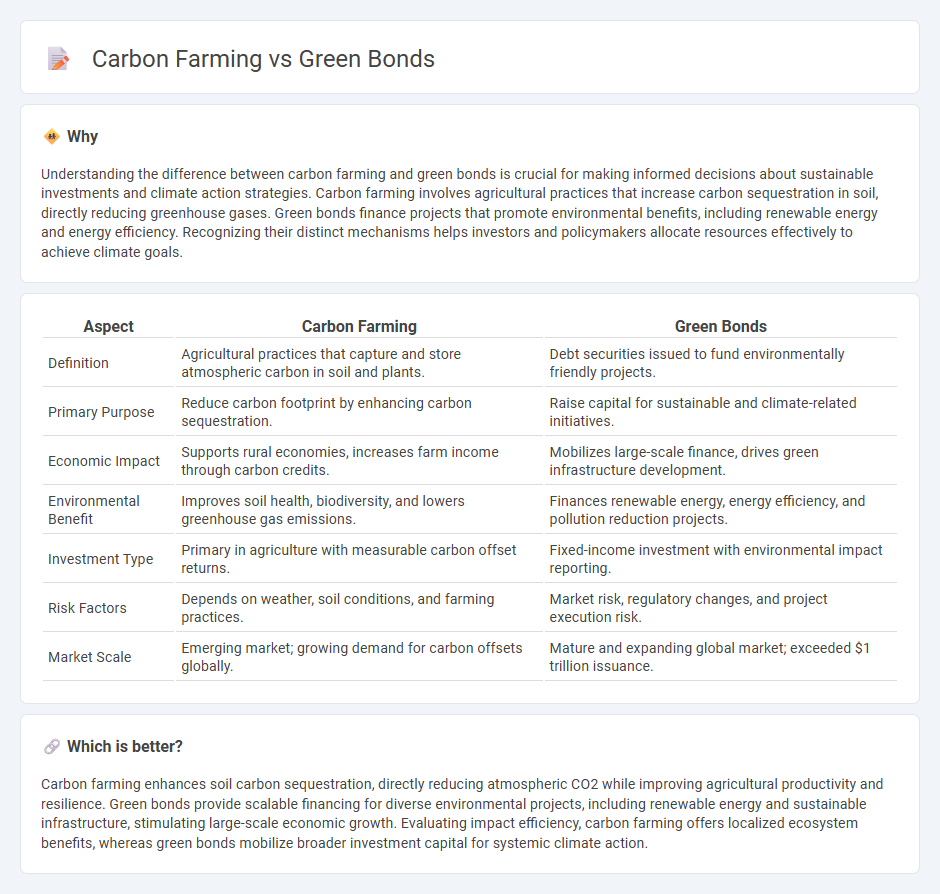

Understanding the difference between carbon farming and green bonds is crucial for making informed decisions about sustainable investments and climate action strategies. Carbon farming involves agricultural practices that increase carbon sequestration in soil, directly reducing greenhouse gases. Green bonds finance projects that promote environmental benefits, including renewable energy and energy efficiency. Recognizing their distinct mechanisms helps investors and policymakers allocate resources effectively to achieve climate goals.

Comparison Table

| Aspect | Carbon Farming | Green Bonds |

|---|---|---|

| Definition | Agricultural practices that capture and store atmospheric carbon in soil and plants. | Debt securities issued to fund environmentally friendly projects. |

| Primary Purpose | Reduce carbon footprint by enhancing carbon sequestration. | Raise capital for sustainable and climate-related initiatives. |

| Economic Impact | Supports rural economies, increases farm income through carbon credits. | Mobilizes large-scale finance, drives green infrastructure development. |

| Environmental Benefit | Improves soil health, biodiversity, and lowers greenhouse gas emissions. | Finances renewable energy, energy efficiency, and pollution reduction projects. |

| Investment Type | Primary in agriculture with measurable carbon offset returns. | Fixed-income investment with environmental impact reporting. |

| Risk Factors | Depends on weather, soil conditions, and farming practices. | Market risk, regulatory changes, and project execution risk. |

| Market Scale | Emerging market; growing demand for carbon offsets globally. | Mature and expanding global market; exceeded $1 trillion issuance. |

Which is better?

Carbon farming enhances soil carbon sequestration, directly reducing atmospheric CO2 while improving agricultural productivity and resilience. Green bonds provide scalable financing for diverse environmental projects, including renewable energy and sustainable infrastructure, stimulating large-scale economic growth. Evaluating impact efficiency, carbon farming offers localized ecosystem benefits, whereas green bonds mobilize broader investment capital for systemic climate action.

Connection

Carbon farming generates measurable carbon credits by sequestering atmospheric CO2 through sustainable agricultural practices, creating new revenue streams for farmers. Green bonds finance projects like carbon farming initiatives, providing capital for climate-smart agriculture that enhances carbon capture and supports environmental sustainability. The integration of carbon farming with green bond funding accelerates investment in low-carbon technologies, driving economic growth aligned with climate goals.

Key Terms

Sustainable Finance

Green bonds finance environmentally sustainable projects, channeling capital into renewable energy, clean transportation, and climate resilience initiatives, thereby supporting global carbon reduction targets. Carbon farming practices enhance soil carbon sequestration and improve agricultural sustainability, offering measurable environmental benefits and potential revenue streams through carbon credits. Explore detailed comparisons and investment opportunities in sustainable finance by diving deeper into green bonds and carbon farming strategies.

Carbon Credits

Green bonds finance projects that deliver environmental benefits, including renewable energy and reforestation, generating measurable carbon credits through verified emission reductions. Carbon farming involves agricultural practices that enhance soil carbon sequestration, producing carbon credits by capturing atmospheric CO2 in biomass and soils. Explore how these mechanisms differ and complement each other in driving sustainable carbon markets.

Environmental Impact

Green bonds finance projects that generate measurable environmental benefits, such as renewable energy, pollution reduction, and sustainable water management, directly contributing to climate change mitigation. Carbon farming enhances soil carbon sequestration by implementing agricultural practices that increase organic matter, reducing greenhouse gas emissions and improving soil health. Explore how these strategies complement each other in driving sustainable environmental outcomes.

Source and External Links

Green bond - A green bond is a fixed-income financial instrument used to fund projects with positive environmental benefits, such as renewable energy, energy efficiency, and climate change adaptation, following guidelines like the Green Bond Principles for transparency and impact tracking.

What are Green Bonds and what projects do they finance? - Green bonds are debt instruments issued to finance sustainable and socially responsible projects specifically related to environmental improvement and climate change goals, such as clean transportation and renewable energy.

Green Bond Principles (GBP) - The Green Bond Principles provide voluntary guidelines for transparency and integrity in issuing green bonds to finance environmentally sound and sustainable projects, emphasizing clear disclosure on the use of proceeds and environmental impact reporting.

dowidth.com

dowidth.com