Zero-day work contracts offer employees immediate engagement without guaranteed hours or income, catering to flexible labor markets and gig economy demands. Commission-based work ties compensation directly to performance outcomes, incentivizing productivity while introducing income variability. Explore the implications of these labor models on income stability and workforce motivation.

Why it is important

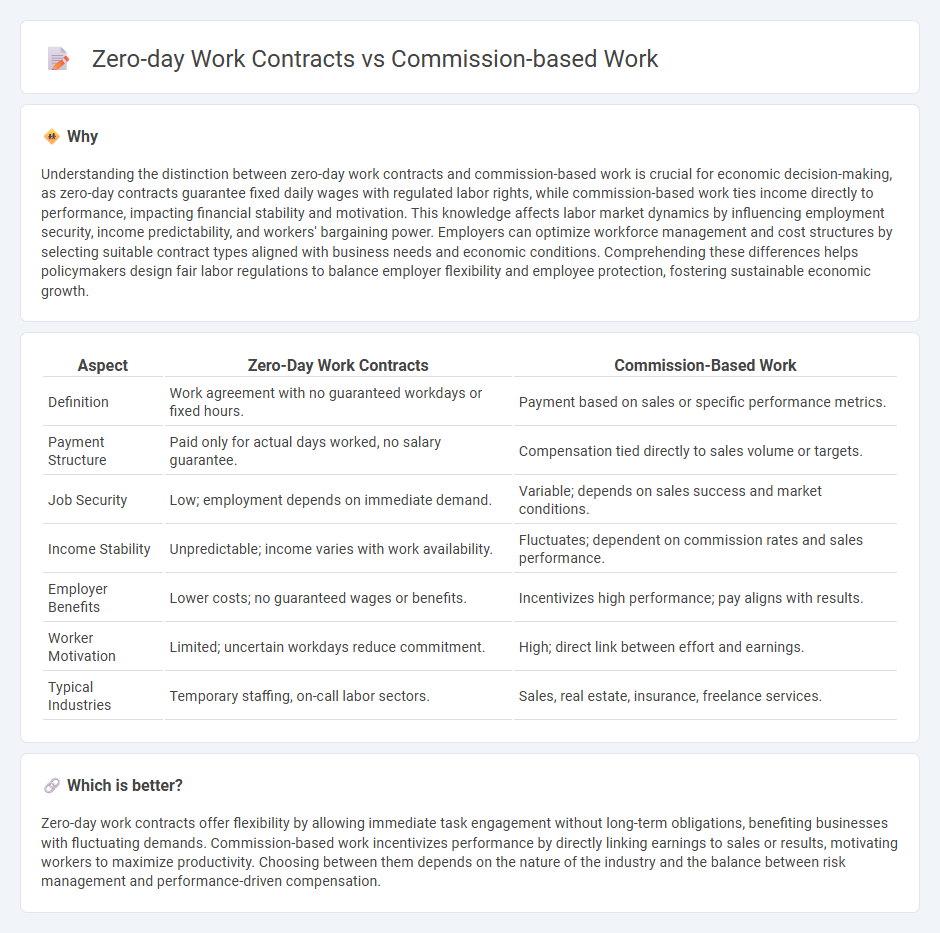

Understanding the distinction between zero-day work contracts and commission-based work is crucial for economic decision-making, as zero-day contracts guarantee fixed daily wages with regulated labor rights, while commission-based work ties income directly to performance, impacting financial stability and motivation. This knowledge affects labor market dynamics by influencing employment security, income predictability, and workers' bargaining power. Employers can optimize workforce management and cost structures by selecting suitable contract types aligned with business needs and economic conditions. Comprehending these differences helps policymakers design fair labor regulations to balance employer flexibility and employee protection, fostering sustainable economic growth.

Comparison Table

| Aspect | Zero-Day Work Contracts | Commission-Based Work |

|---|---|---|

| Definition | Work agreement with no guaranteed workdays or fixed hours. | Payment based on sales or specific performance metrics. |

| Payment Structure | Paid only for actual days worked, no salary guarantee. | Compensation tied directly to sales volume or targets. |

| Job Security | Low; employment depends on immediate demand. | Variable; depends on sales success and market conditions. |

| Income Stability | Unpredictable; income varies with work availability. | Fluctuates; dependent on commission rates and sales performance. |

| Employer Benefits | Lower costs; no guaranteed wages or benefits. | Incentivizes high performance; pay aligns with results. |

| Worker Motivation | Limited; uncertain workdays reduce commitment. | High; direct link between effort and earnings. |

| Typical Industries | Temporary staffing, on-call labor sectors. | Sales, real estate, insurance, freelance services. |

Which is better?

Zero-day work contracts offer flexibility by allowing immediate task engagement without long-term obligations, benefiting businesses with fluctuating demands. Commission-based work incentivizes performance by directly linking earnings to sales or results, motivating workers to maximize productivity. Choosing between them depends on the nature of the industry and the balance between risk management and performance-driven compensation.

Connection

Zero-day work contracts and commission-based work both prioritize flexibility and performance-driven compensation in the economy, often linked to gig and freelance labor markets. Zero-day contracts allow employers to engage workers without guaranteed hours, mirroring commission-based models where income depends directly on sales or output, reducing fixed labor costs and shifting financial risk onto workers. This connection influences labor dynamics and income stability, shaping economic trends in workforce management and employment law.

Key Terms

Incentive Structure

Commission-based work contracts offer financial incentives directly tied to performance, motivating employees to achieve higher sales or project completion rates. Zero-day work contracts provide fixed compensation regardless of output, reducing financial risk but often limiting motivation for extra effort. Explore deeper differences in incentive structures to determine the best contract type for your business needs.

Job Security

Commission-based work offers income tied directly to performance, making earnings variable and sometimes unstable, which can impact job security. Zero-day work contracts, often defined as contracts that can be terminated with no notice, provide minimal job stability, leaving employees vulnerable to sudden unemployment. Explore more about how these contract types affect long-term career stability and employee rights.

Income Stability

Commission-based work provides variable income tied directly to sales performance, creating potential for high earnings but also financial unpredictability. Zero-day work contracts offer guaranteed daily pay regardless of output, ensuring steady income stability beneficial for budgeting and financial planning. Explore detailed comparisons to determine which income model best aligns with your financial goals and risk tolerance.

Source and External Links

The pros and cons of commission-based pay for your employees - Commission-based pay means an employee's income is tied directly to a percentage or rate of goods or services sold, with common structures including straight commission, base pay plus commission, and variable or draw-against-commission setups.

The Pros and Cons of Working on Commission - gpac - Commission-based roles offer unlimited earning potential and autonomy, rewarding measurable outcomes and entrepreneurial skills, but require strong self-motivation and tolerance for income variability.

Everything you need to know about commission based pay - Primeum - Commission schemes can be fixed, variable, progressive, capped, or tiered, with payment based on sales volume, turnover, or profit, and sometimes subject to minimums or maximums set by the employer.

dowidth.com

dowidth.com