Shadow inflation measures the hidden rise in prices not fully captured by official statistics, often reflecting the true cost increase experienced by consumers. Hyperinflation represents an extreme, rapid escalation in prices, typically exceeding 50% per month, severely undermining currency value and economic stability. Explore deeper insights into how these inflation types differently impact economies and policy responses.

Why it is important

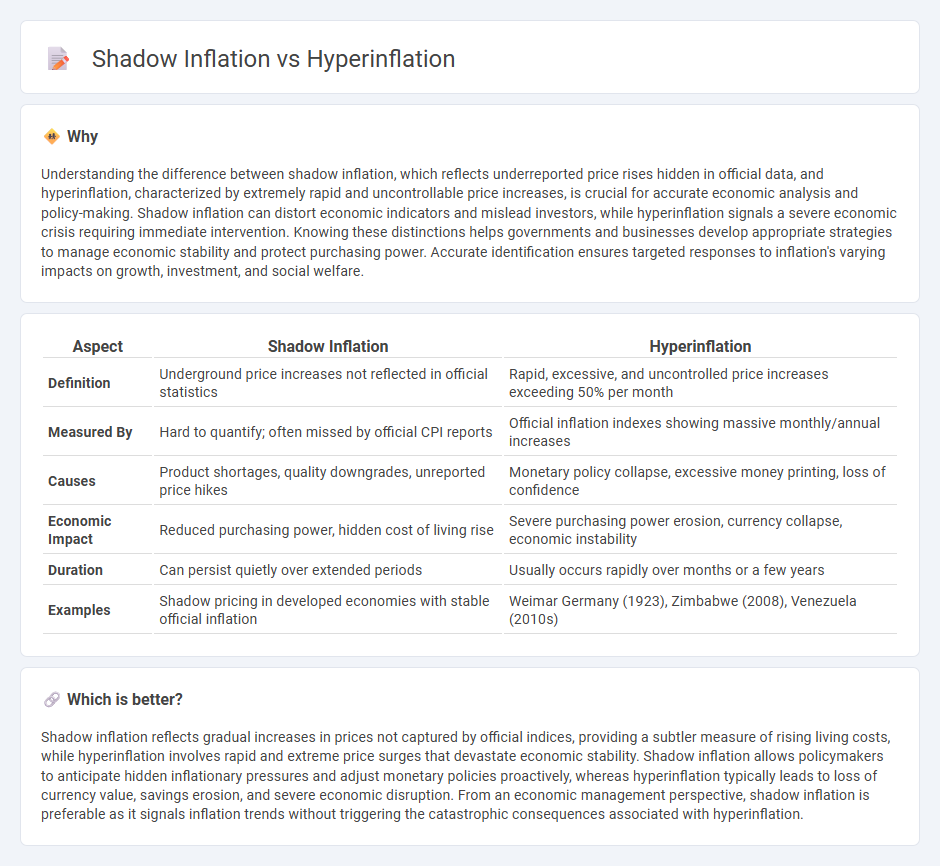

Understanding the difference between shadow inflation, which reflects underreported price rises hidden in official data, and hyperinflation, characterized by extremely rapid and uncontrollable price increases, is crucial for accurate economic analysis and policy-making. Shadow inflation can distort economic indicators and mislead investors, while hyperinflation signals a severe economic crisis requiring immediate intervention. Knowing these distinctions helps governments and businesses develop appropriate strategies to manage economic stability and protect purchasing power. Accurate identification ensures targeted responses to inflation's varying impacts on growth, investment, and social welfare.

Comparison Table

| Aspect | Shadow Inflation | Hyperinflation |

|---|---|---|

| Definition | Underground price increases not reflected in official statistics | Rapid, excessive, and uncontrolled price increases exceeding 50% per month |

| Measured By | Hard to quantify; often missed by official CPI reports | Official inflation indexes showing massive monthly/annual increases |

| Causes | Product shortages, quality downgrades, unreported price hikes | Monetary policy collapse, excessive money printing, loss of confidence |

| Economic Impact | Reduced purchasing power, hidden cost of living rise | Severe purchasing power erosion, currency collapse, economic instability |

| Duration | Can persist quietly over extended periods | Usually occurs rapidly over months or a few years |

| Examples | Shadow pricing in developed economies with stable official inflation | Weimar Germany (1923), Zimbabwe (2008), Venezuela (2010s) |

Which is better?

Shadow inflation reflects gradual increases in prices not captured by official indices, providing a subtler measure of rising living costs, while hyperinflation involves rapid and extreme price surges that devastate economic stability. Shadow inflation allows policymakers to anticipate hidden inflationary pressures and adjust monetary policies proactively, whereas hyperinflation typically leads to loss of currency value, savings erosion, and severe economic disruption. From an economic management perspective, shadow inflation is preferable as it signals inflation trends without triggering the catastrophic consequences associated with hyperinflation.

Connection

Shadow inflation occurs when hidden or indirect price increases erode purchasing power, often preceding or accompanying hyperinflation, which is an extreme and rapid escalation of prices across an economy. Both phenomena reflect a loss of currency value, with shadow inflation signaling underlying economic distortions before hyperinflation manifests visibly. Monitoring shadow inflation indicators, such as rising costs in non-official markets, helps predict hyperinflationary trends and assess currency stability.

Key Terms

Price Levels

Hyperinflation causes price levels to skyrocket dramatically, eroding purchasing power at an exponential rate and destabilizing economies. Shadow inflation refers to hidden price increases through reduced product sizes or quality, effectively raising prices without apparent changes in labels, subtly impacting consumer spending. Explore the nuances between hyperinflation and shadow inflation to better understand their effects on real price levels.

Money Supply

Hyperinflation occurs when excessive growth in money supply severely devalues a currency, causing prices to skyrocket rapidly and uncontrollably. Shadow inflation, however, reflects hidden price increases not captured by official inflation metrics, often driven by subtle monetary expansion affecting essential goods and services. Explore deeper insights into how variations in money supply influence these inflation types and their broader economic impacts.

Hidden Costs

Hyperinflation dramatically erodes purchasing power as prices skyrocket uncontrollably, creating visible economic distress and rapidly diminishing savings. Shadow inflation, often unnoticed, represents hidden costs through smaller package sizes, reduced product quality, or delayed price increases that subtly devalue consumer spending power over time. Explore deeper insights into how hidden inflation impacts everyday finances and long-term economic stability.

Source and External Links

Hyperinflation - Wikipedia - Hyperinflation is a very high and typically accelerating inflation that quickly erodes the real value of the local currency as prices for all goods increase rapidly.

Hyperinflation: Definition, Causes, Effects and Examples - NetSuite - Hyperinflation is characterized by extremely rapid price increases (often 50% or more per month), leading to a complete loss of confidence in the currency, usually following major political or economic upheaval.

Hyperinflation - Definition, Causes and Effects, Example - Hyperinflation occurs when prices of goods and services rise uncontrollably, often due to a sharp increase in money supply not supported by economic growth, causing the currency to rapidly lose value.

dowidth.com

dowidth.com