Carbon border tax targets carbon emissions embedded in imported goods to promote environmental sustainability and fair trade, while import tariffs primarily aim to protect domestic industries by imposing taxes on foreign products. Unlike traditional tariffs, carbon border taxes incentivize greener production practices globally by equalizing carbon costs across borders. Explore the impact of these economic tools on international trade and environmental policy to understand their growing significance.

Why it is important

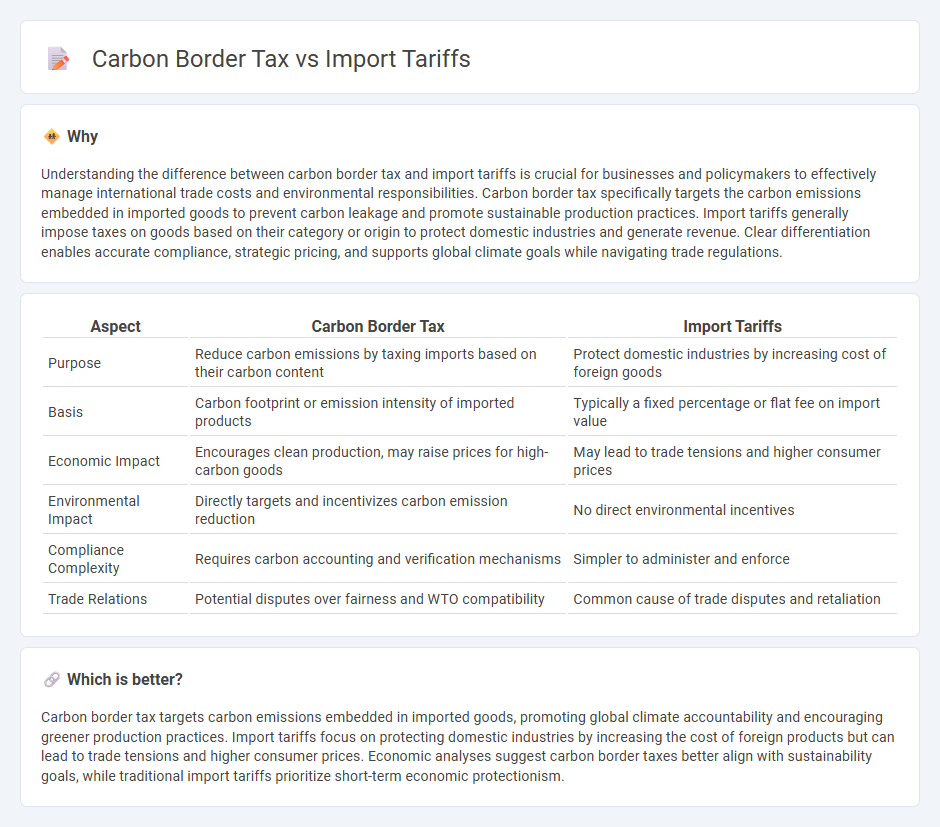

Understanding the difference between carbon border tax and import tariffs is crucial for businesses and policymakers to effectively manage international trade costs and environmental responsibilities. Carbon border tax specifically targets the carbon emissions embedded in imported goods to prevent carbon leakage and promote sustainable production practices. Import tariffs generally impose taxes on goods based on their category or origin to protect domestic industries and generate revenue. Clear differentiation enables accurate compliance, strategic pricing, and supports global climate goals while navigating trade regulations.

Comparison Table

| Aspect | Carbon Border Tax | Import Tariffs |

|---|---|---|

| Purpose | Reduce carbon emissions by taxing imports based on their carbon content | Protect domestic industries by increasing cost of foreign goods |

| Basis | Carbon footprint or emission intensity of imported products | Typically a fixed percentage or flat fee on import value |

| Economic Impact | Encourages clean production, may raise prices for high-carbon goods | May lead to trade tensions and higher consumer prices |

| Environmental Impact | Directly targets and incentivizes carbon emission reduction | No direct environmental incentives |

| Compliance Complexity | Requires carbon accounting and verification mechanisms | Simpler to administer and enforce |

| Trade Relations | Potential disputes over fairness and WTO compatibility | Common cause of trade disputes and retaliation |

Which is better?

Carbon border tax targets carbon emissions embedded in imported goods, promoting global climate accountability and encouraging greener production practices. Import tariffs focus on protecting domestic industries by increasing the cost of foreign products but can lead to trade tensions and higher consumer prices. Economic analyses suggest carbon border taxes better align with sustainability goals, while traditional import tariffs prioritize short-term economic protectionism.

Connection

Carbon border tax and import tariffs both serve as trade policy tools aimed at regulating international commerce by imposing costs on imported goods. Carbon border taxes specifically target the carbon emissions embedded in imported products to encourage environmentally sustainable practices and prevent carbon leakage. Import tariffs broadly levy taxes on goods entering a country to protect domestic industries, control trade deficits, and influence market prices.

Key Terms

Trade barriers

Import tariffs and carbon border taxes serve as trade barriers that protect domestic industries but differ in their objectives and implementation. Import tariffs primarily aim to shield local markets from foreign competition by imposing duties on imported goods, while carbon border taxes target environmental externalities by taxing imports based on their carbon emissions to promote global climate goals. Explore the impact of these trade instruments on international commerce and environmental policy.

Carbon leakage

Import tariffs primarily protect domestic industries from unfair foreign competition, while carbon border taxes specifically target carbon leakage by imposing fees on imported goods based on their carbon emissions. Carbon leakage occurs when companies relocate production to countries with lax carbon regulations, undermining global climate goals. Explore how carbon border taxes can mitigate carbon leakage and drive sustainable international trade.

Competitiveness

Import tariffs directly impact the cost structure of goods entering a market, often leading to higher prices for consumers and potential trade disputes. Carbon border taxes aim to level the playing field by imposing fees based on the carbon emissions associated with imported products, encouraging cleaner production without compromising competitiveness. Explore how integrating carbon border taxes can balance environmental goals with maintaining global market competitiveness.

Source and External Links

Trump Tariffs: The Economic Impact of the Trump Trade War - Trump-era tariffs raised the average U.S. import tariff rate to the highest since 1943, increasing federal tax revenues significantly and impacting consumer costs in 2025.

What Are Tariffs? - Tariffs are taxes on foreign imports paid by importers to their government, often passed to consumers, used to protect domestic industries or retaliate against unfair trade practices.

Regulating Imports with a Reciprocal Tariff to Rectify Trade Practices - The U.S. applies lower average tariffs compared to many trade partners, with significant tariff rate discrepancies on specific products leading to calls for reciprocal tariffs to balance trade.

dowidth.com

dowidth.com